Chinese Gross Domestic Product (GDP) is a measurement of the production and growth of the economy, and analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published … “AUD/USD: Trading the Chinese GDP Jul 2015”

Category: Opinions

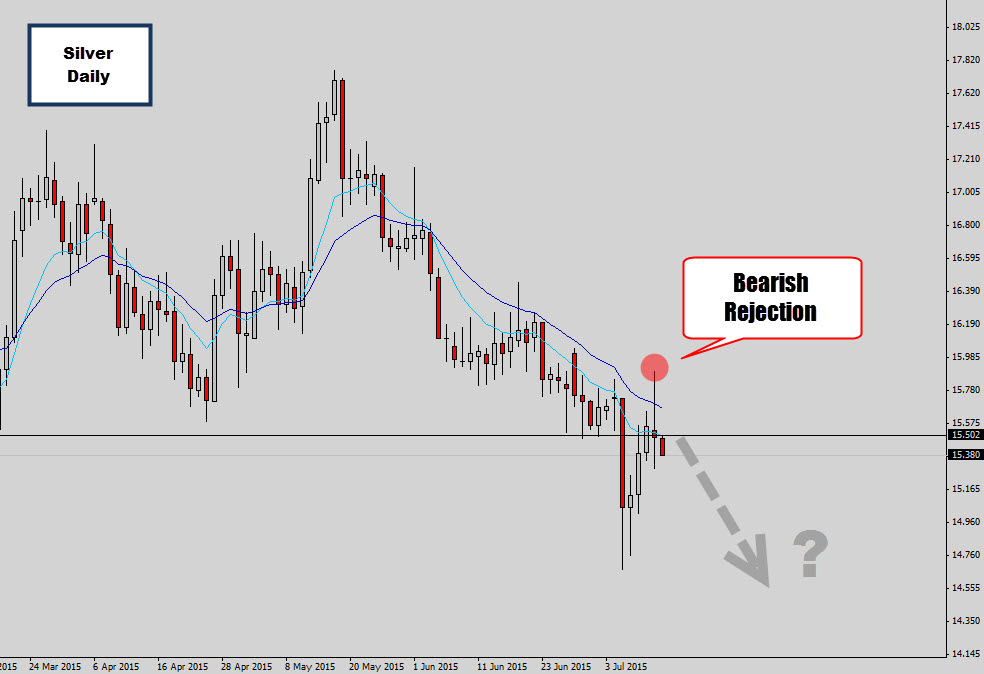

Silver Knocks Back Higher Prices – Bearish Reversal Signal

The Silver market had an active day to start off this week. Prices rallied up higher past the mean value and were quickly rejected. The rejection of higher prices was sharp, creating a long wicked 4 hour bearish rejection candle which eventually lead to a bearish rejection candle being printed on the daily chart at the … “Silver Knocks Back Higher Prices – Bearish Reversal Signal”

GBP/USD: Trading the UK CPI July 2015

British CPI, released each month, is the primary gauge of consumer inflation and is keenly anticipated by the markets. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at 8:30 GMT. Indicator Background Analysts consider CPI one of … “GBP/USD: Trading the UK CPI July 2015”

Case For EUR/USD Downside Is Strong With Or Without

Despite the Greek approval of the austerity proposals, it is not 100% that we will get a deal. In any scenario, the team at Goldman Sachs explains why there is a strong case on the downside for EUR/USD: Here is their view, courtesy of eFXnews: The uncertainty around the negotiations between Greece and its creditors … “Case For EUR/USD Downside Is Strong With Or Without”

Here Is How To Trade Greece’s End-Game In FX – BNPP

We have heard about the wide Greek proposals, that open the way for a deal with creditors. However, nothing is 100% certain. Here is how to trade the EU Summit, which has turned into a binary event, according to BNP Paribas: Here is their view, courtesy of eFXnews: In its last week’s FX note to clients, BNP … “Here Is How To Trade Greece’s End-Game In FX – BNPP”

EUR/USD to 1.05 in 3 months, 0.98 in 12 months

Greece has submitted its proposal, which is one that the creditors will find hard to reject. Nevertheless, there are good reasons to see the euro falling. Here are 4 reasons from the team at Credit Suisse: Here is their view, courtesy of eFXnews: While Greece has so far not proven a powerful negative for the … “EUR/USD to 1.05 in 3 months, 0.98 in 12 months”

USD/CAD: Trading the Canadian Jobs Jul 2015

Canadian employment change is one of the most important Canadian indicators, which often has a significant impact on the markets. Traders and analysts carefully scrutinize employment figures, and a reading higher than forecast is bullish for the loonie. Update: Canadian employment falls only 6.4K, unemployment rate 6.8% – USD/CAD down Here are the details and 5 possible outcomes for USD/CAD. … “USD/CAD: Trading the Canadian Jobs Jul 2015”

Grexit Or Not, Sell EUR/USD targeting 1.02 – Danske

The Greek crisis seems to be heading to a showdown on Sunday’s EU Summit. But regardless of the results, the team at Danske see a sell opportunity: Here is their view, courtesy of eFXnews: The Greek ‘No’ sent EUR crosses lower but the initial move has already partly reversed. We see two main reasons for the limited … “Grexit Or Not, Sell EUR/USD targeting 1.02 – Danske”

AUD/USD: Trading the Australian jobs Jul 2015

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 1:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian jobs Jul 2015”

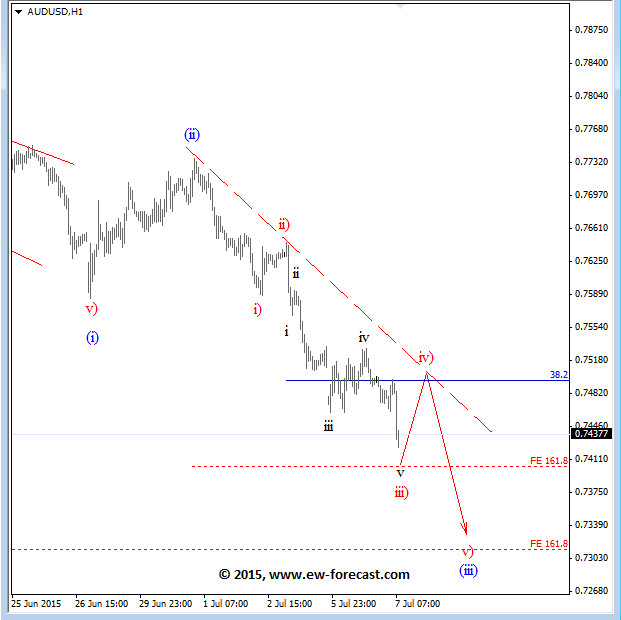

USD May Pause For Correction – Looking At AUDUSD &

AUDUSD keep its downward direction now close to the 1.618 projection of the 3 wave in the 3 wave of the larger degree. According to the count we see a possible pullback soon but just a corrective one in its nature before we resume lower levels. Comments from the RBA from last night imply they … “USD May Pause For Correction – Looking At AUDUSD &”