Over the past year Polish voters have twice rejected centralist Civic Party incumbents in favor of populist Law and Justice Candidates. The change in government isn’t because of the economy. Poland’s 3.4% 2014 GDP growth was well ahead of 1.3% GDP growth of its fellow EU members. In spite of the economic problems of the … “EUR/PLN: Standing Tall”

Category: Opinions

What Risk Resilience Implies For Grexit & The EUR –

Where is the euro headed after markets have digested the big NO in the Greferendum and the resignation of Varoufakis? The team at Deutsche Bank analyzes: Here is their view, courtesy of eFXnews: For the second weekend in a row, EUR and risk appetite resilience in the face of Greece has been surprising. So what is … “What Risk Resilience Implies For Grexit & The EUR –”

EUR/USD July 2015 Trading US JOLTS Job Openings

US JOLTS Job Openings measures the change in the number of employment openings, excluding the farm industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible JOLTS outcomes for EUR/USD. Published on Tuesday at 14:00 GMT. Indicator Background Job creation is one of … “EUR/USD July 2015 Trading US JOLTS Job Openings”

EUR/USD Could Easily Catch Traders Wrong-Footed – Credit Agricole

The results of the Greferendum are awaited with high anticipation. But what does it mean for EUR/USD? We have already seen some strange reactions in the world’s most popular pair. Credit Agricole explains: Here is their view, courtesy of eFXnews: As Greece prepares for its historic referendum markets are becoming even more nervous about Greek exit from … “EUR/USD Could Easily Catch Traders Wrong-Footed – Credit Agricole”

Greferendum: Here Is The Best EUR Play To Trade – BNPP

The markets will open to the results of the Greek referendum, aka #Greferendum. How will the euro react? The team at BNP Paribas finds the best trade: Here is their view, courtesy of eFXnews: In its weekly note to clients today, BNP Paribas assess the FX response to this weekend’s Greek referendum, outlining the potential EUR response to … “Greferendum: Here Is The Best EUR Play To Trade – BNPP”

Greek Referendum and what it means – Deutsche Bank &

Greeks will go to the polls and decide on whether or not to accept the creditors’ proposal. Some see it as a vote on the euro or on the drachma and it’s clear that it will affect the political career of the current government. Here are two angles on the story, from Deutsche Bank and Credit Agricole: … “Greek Referendum and what it means – Deutsche Bank &”

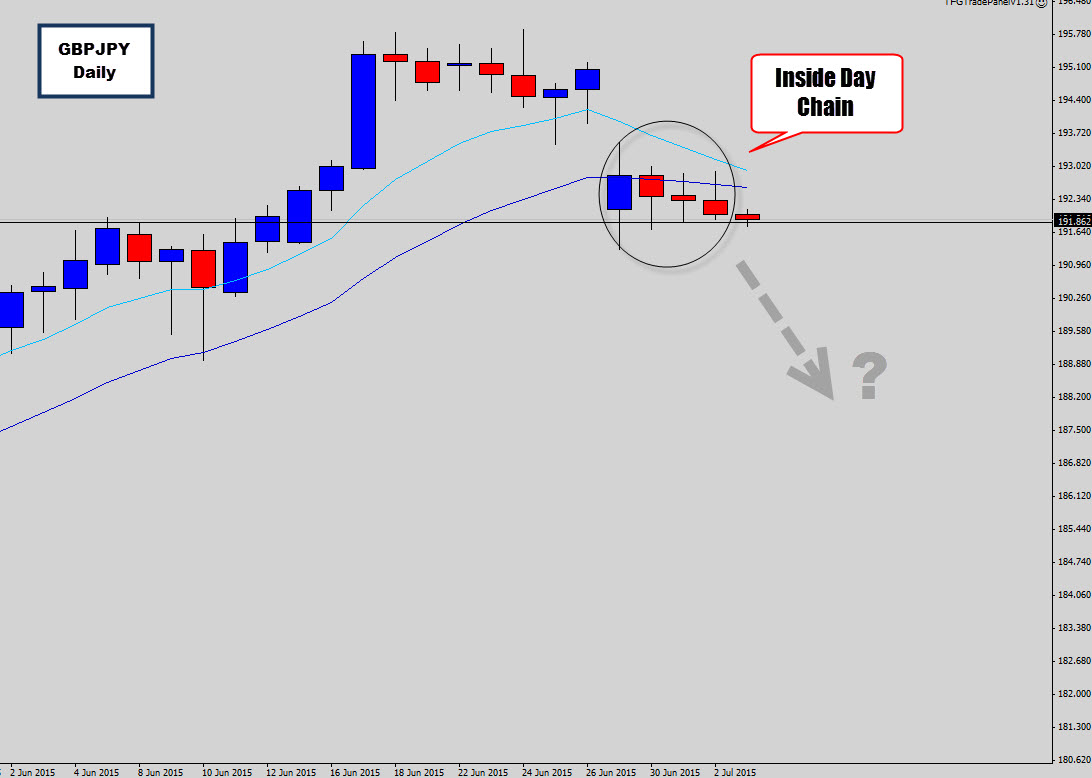

GBPJPY Tripple Inside Day Combo – Waiting for a Breakout

Non Farm Payroll was released last session, 1 day earlier than normal to accommodate for the July 4th holiday for the USA. The impact of NFP was mild on some pairs, but no impact here on the GBPJPY daily chart. As a result of the indecision, this market has dropped it’s third Inside Day. A … “GBPJPY Tripple Inside Day Combo – Waiting for a Breakout”

Analysis: NFP risks second rate hike, not the first in

The Non Farm Payrolls disappointed with a weak headline number, negative revisions and mostly painfully no monthly change in wages. This puts the y/y change at only 2% after the breakout we had last time. With no wage inflation, there is no real rise in core inflation which the Fed cares about. Nevertheless, and assuming … “Analysis: NFP risks second rate hike, not the first in”

GBP/USD: Trading the British Services PMI Jul. 2015

The British Services PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the services sector. Of the three British PMI reports, Services PMI is considered the most important. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Friday … “GBP/USD: Trading the British Services PMI Jul. 2015”

O’ Canada, US Dollar Going Up Up and Away!

With Canada in celebration mode, the US dollar is going up up and away. The US dollar has gained a lot of momentum driven by the Greece powder keg, while the Canadian dollar is pressured by falling oil prices today. The uncertainty over Greece, lackluster Canadian GDP, falling oil prices, has all created a perfect … “O’ Canada, US Dollar Going Up Up and Away!”