A predictable currency pair loses slows down when it approaches a clear technical resistance or support level, eventually reversing back within the range. If this currency pair has strong momentum, it makes a distinct break, piercing through the line and more importantly: not looking back. Yet not all currency pairs are born equal: the less predictable … “5 Most Predictable Currency Pairs – Q3 2015”

Category: Opinions

Video: Greece, Euro Parity, & The Biggest Trades For H2

The first half of the year was certainly turbulent. Was does the second half entail? The team at Bank of America Merrill Lynch lay out their thoughts in the video below, which includes the option of EUR/USD parity: Here is their view, courtesy of eFXnews: In its mid-year press conference in New York today, Bank … “Video: Greece, Euro Parity, & The Biggest Trades For H2”

EUR/USD: Trading the US GDP June 2015

US Final GDP is a key release and is published each quarter. GDP reports measure production and growth of the economy, and are considered by analysts as one the most important indicators of economic activity. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and 5 possible outcomes for … “EUR/USD: Trading the US GDP June 2015”

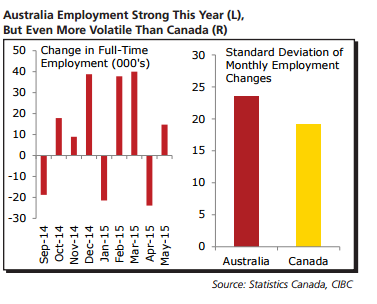

Not So Dotty On The USD; CAD To Top Higher

Commodity currencies often run in tandem with each other and sometimes in a different manner to the major currencies. What’s going on in AUD and CAD? The team at CIBC weighs in: Here is their view, courtesy of eFXnews: The following are CIBC’s weekly outlook for the USD, CAD, and AUD. Not So Dotty On the US$. … “Not So Dotty On The USD; CAD To Top Higher”

Digesting the Dollar Dove Dive -MM #55

No surprise is also a surprise when it’s a Fed decision. We run down the FOMC meeting, update on the ever-escalating Greek crisis and discuss next week’s important events. You are welcome to listen, subscribe and provide feedback. FOMC rundown: This is what happens when the doves don’t cry: we break down the various elements of the Fed … “Digesting the Dollar Dove Dive -MM #55”

EUR/USD: Fade Rally On Any Greek Resolution – BNPP

Reports over the weekend suggest that there is some progress around the Greek crisis. Will we see a deal soon? If so, the team at BNP Paribas suggests fading any Greek related rally. Here is their rationale: Here is their view, courtesy of eFXnews: “Despite a dovish market reaction to this week’s FOMC statement, the … “EUR/USD: Fade Rally On Any Greek Resolution – BNPP”

AUD/USD: Trading the HSBC Chinese Flash PMI Jun 2015

HSBC Chinese Flash Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in China. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 … “AUD/USD: Trading the HSBC Chinese Flash PMI Jun 2015”

EUR/USD: Ignore The Noise; Stick To Fundamentals: 0.95 in

The Greek crisis, with all its ups and down is certainly moving markets, as we have seen with the recent spikes. Nevertheless, the team at Goldman Sachs says we should follow the fundamentals and not the noise, and this implies a strong movement downwards. Here is their view, courtesy of eFXnews: Following yesterday’s FOMC meeting, Goldman … “EUR/USD: Ignore The Noise; Stick To Fundamentals: 0.95 in”

What’s Wrong With The US Dollar? – CIBC

The US dollar is struggling with negative data and does not really rally on positive data. What’s going on? And will this change? The team at CIBC weighs in: Here is their view, courtesy of eFXnews: Economic data has been solid over the past month and the US recovery looks like it’s back on track but … “What’s Wrong With The US Dollar? – CIBC”

EUR/USD Risk-Reward: Market In 2-Minds – Credit Suisse

So, we had the Fed and the Greek crisis is still going on. EUR/USD did move up to the higher end of the range but still respects the double top. So what’s next for euro/dollar and all its moving parts? The team at Credit Suisse lays it out: Here is their view, courtesy of eFXnews: In … “EUR/USD Risk-Reward: Market In 2-Minds – Credit Suisse”