Is the sell off of the USD finally over? It may be the case. The team at Credit Agricole see the greenback at a turning point and a short opportunity for EUR/USD: Here is their view, courtesy of eFXnews: The USD kicked off the week on a strong note, rising against all major currencies. The EUR … “USD Turning Point: Stay Short EUR/USD For 1.08 – Credit”

Category: Opinions

GBP/USD: Trading the British Retail Sales May 2015

British Retail Sales is considered one of the most important economic indicators. A reading that is higher than the market forecast is bullish for the British pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Thursday at 8:30 GMT. Indicator Background Retail Sales is the primary gauge of consumer spending, a critical component of economic … “GBP/USD: Trading the British Retail Sales May 2015”

USD/JPY: Trading the Japanese GDP May 2015

Japanese Preliminary GDP measures production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity, and a reading which is better than the market forecast is bullish for the Japanese yen. Here are all the details, and 5 possible outcomes for USD/JPY. Published on Wednesday at 23:50 GMT. Indicator Background … “USD/JPY: Trading the Japanese GDP May 2015”

USD: Glass half full or half empty? – Market Movers #50

Lots of ins and out in the US labor market situation. When will the rate hike come? We offer both sides of the argument, talk about the implications of the UK election results, the situation of oil prices and preview the next week’s events in a volatile market. You are welcome to listen, subscribe and provide feedback. UK … “USD: Glass half full or half empty? – Market Movers #50”

USD/CAD Probes Support; EUR/USD Back To The Drawing Board

Dollar/CAD and also EUR/USD experienced interesting technical moves in the past week. What does the road ahead have for them? The team at Bank of America Merrill Lynch provides some insight: Here is their view, courtesy of eFXnews: USD/CAD is testing pivotal long-term support at the 1.1909/1.1915 area, notes Bank of America Merrill Lynch. “While … “USD/CAD Probes Support; EUR/USD Back To The Drawing Board”

GBP: The Calm After The Storm; How To Position? – BNPP

The pound has certainly moved higher, continuing its post-election rally, despite mixed events. Could it be entering a period of calm? The team at BNP Paribas explains: Here is their view, courtesy of eFXnews: With the outcome of the UK election much ‘cleaner’ than expected, BNP Paribas believes a return to fundamentals warrants a more positive view … “GBP: The Calm After The Storm; How To Position? – BNPP”

EUR/USD: Trading the UoM Consumer Sentiment Index – May

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Update: US consumer Confidence falls to 88.6 – USD lower Here are all the details, and 5 possible … “EUR/USD: Trading the UoM Consumer Sentiment Index – May”

EUR/USD: An Early Warning Signal – Danske

EUR/USD rallied hard on the poor US retail sales report. What’s next for the pair? The team at Danske explain the current situation and provide forecasts for 1m, 3m, 6m and 12 months. Here is their view, courtesy of eFXnews: Deflation deceleration warns of EUR/USD upside later… − Stretched positioning in terms of ‘long USD’ made … “EUR/USD: An Early Warning Signal – Danske”

3 Reasons To Stay Long GBP – Deutsche Bank

The pound has certainly had its share of action, with significant intra-day drops and rises. What’s next for sterling? The team at Deutsche Bank lists 3 reasons to remain long: Here is their view, courtesy of eFXnews: In a special note today, Deutsche Bank advises clients to stay long GBP, arguing that there is still value … “3 Reasons To Stay Long GBP – Deutsche Bank”

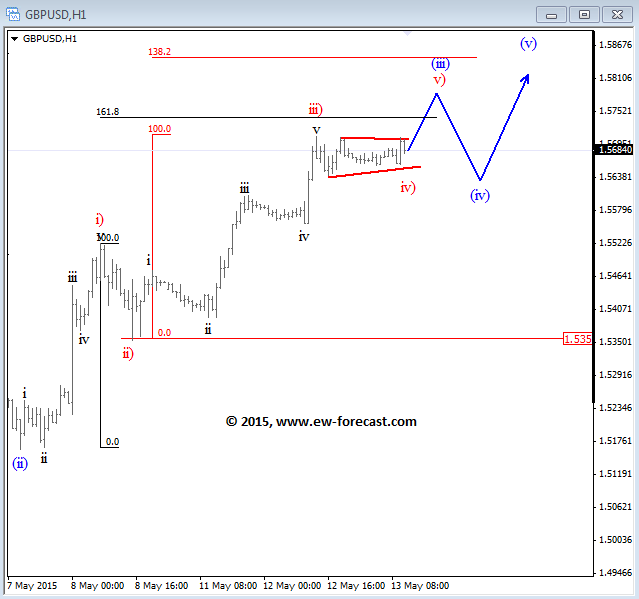

GBPUSD could halt at 1.58; USDCHF Looks For Support –

GBPUSD keeps trading higher, so we adjusted the wave count. We are now looking at an impulsive recovery, currently with subwave (iii) in progress, but it may be trading now into the final stages with its five subwaves. That said, an upside move can be limited near 1.5800. GBPUSD 1h Elliott Wave Analysis USDCHF price … “GBPUSD could halt at 1.58; USDCHF Looks For Support –”