The US-Sino trade spat is raising market volatility. Five significant developments are indicating President Trump is losing. The US dollar has yet to react to developments. “Trade wars are good and easy to win” – said US President Donald Trump on March 2018. Nearly a year and a half later, Chinese industrial output growth has … “5 signs Trump is losing the trade war”

Category: Opinions

UK inflation may fall and take GBP/USD with it

GBP/USD has been leaning lower amid ongoing Brexit and trade concerns. The UK jobs report has shown an unexpected rise in the jobless rate but rising wages. Tuesday’s four-hour chart is pointing to further falls. Brexit has been out of the spotlight – but sterling is struggling anyway. UK unemployment has risen to 3.9% in June … “UK inflation may fall and take GBP/USD with it”

GBP/USD may struggle with high wage expectations

The UK is expected to report a low unemployment rate and a robust increase in wages. High expectations may result in a disappointment, lowering expectations for a rate hike. GBP/USD – already struggling with Brexit – has room to fall. Unemployment at 3.8% and annual wage growth matching that rate – such headlines may fuel … “GBP/USD may struggle with high wage expectations”

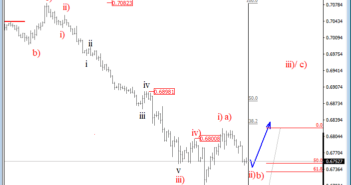

Are Bulls Back in Business on AUDUSD and NZDUSD? – Elliott wave Analysis

Bigger, bearish, impulsive structure (meaning with five legs) on Aussie can be completed, as we see a sharp recovery from the 0.668 regions, which can already be part of a three-wave reversal. The current three-wave move can take price towards 0.6898 minimum target region, however once minor wave b)/ii) correction fully develops. AUDUSD, 4h NZDUSD … “Are Bulls Back in Business on AUDUSD and NZDUSD? – Elliott wave Analysis”

USD/JPY has more room to fall on trade wars

USD/JPY has been extending its slump amid intensifying trade wars. Tensions between the US and China and the US consumer are set to dominate. Mid-August’s technical daily chart is pointing to further falls. When the going gets tough, the tough get going. As the US-Sino trade war turned into a currency war, the Japanese currency … “USD/JPY has more room to fall on trade wars”

EUR/USD enjoyed the trade wars and that may come to an end

EUR/USD has recovered thanks to the dollar’s weakness. Updated euro-zone GDP, the US consumer, and trade are eyed. Mid-August’s daily chart is pointing to fresh falls for the pair. “When two are fighting, the third wins” – goes the saying. The euro has benefited from the intensifying US-Sino trade spat. China has devalued its yuan … “EUR/USD enjoyed the trade wars and that may come to an end”

GBP/USD has yet to see the bottom as Boris’s Brexit weighs heavily

GBP/USD has managed to halt its decline but failed to recover amid the US-Sino trade war. Concerns about a hard Brexit and three top-tier British figures stand out this week. Mid-August’s daily chart is pointing to further losses. Brexiteers build on a robust trade agreement with America after the UK leaves the EU – and … “GBP/USD has yet to see the bottom as Boris’s Brexit weighs heavily”

AUD/USD may extend losses even if the RBA leaves rates unchanged

The Reserve Bank of Australia is set to leave rates unchanged in its August meeting. The RBA weighs global risks against recent upbeat figures in Australia. AUD/USD has more chances to drop than to rise in response to the event. When the US Federal Reserve cuts interest rates – others follow. However, in the Reserve … “AUD/USD may extend losses even if the RBA leaves rates unchanged”

Surprise index points to a downside surprise in the ISM Non-Manufacturing PMI

The US ISM Non-Manufacturing PMI is a critical leading indicator. FXStreet’s Surprise Index points to a downside surprise. The US dollar may lose ground on the news. Will the Federal Reserve cut interest rates in September? That is the main question currency traders are asking and the answer – as the Fed puts it – depends on the data. … “Surprise index points to a downside surprise in the ISM Non-Manufacturing PMI”

NFP Preview: 5 scenarios for EUR/USD, mostly downbeat

US Non-Farm Payrolls are set to provide a fresh direction after markets digested the Fed decision. Low expectations may lead to a positive surprise. The US dollar is well-positioned into the release. The historic rate cut by the Federal Reserve – which turned out to be hawkish and dollar-positive – may be behind us. However, the next … “NFP Preview: 5 scenarios for EUR/USD, mostly downbeat”