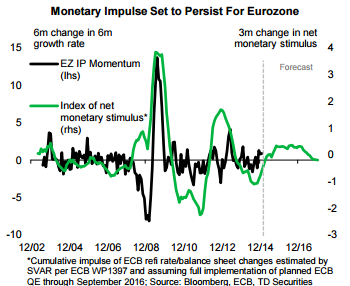

The Draghi show was stolen by a protester that interrupted the press conference. And what about the euro? Has its path been altered? The team at TD weighs in, and sees a downwards trajectory. Here’s why, with a chart: Here is their view, courtesy of eFXnews: At today’s ECB press conference, President Draghi continued to distance … “EUR/USD: Temp Bounce; Parity Call Still Intact For Q3 –”

Category: Opinions

AUD/USD: Trading the Australian jobs Apr 2015

Australian Employment Change, which is released monthly, provides a snapshot of the strength of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 1:30 GMT. Indicator Background Job creation is one of … “AUD/USD: Trading the Australian jobs Apr 2015”

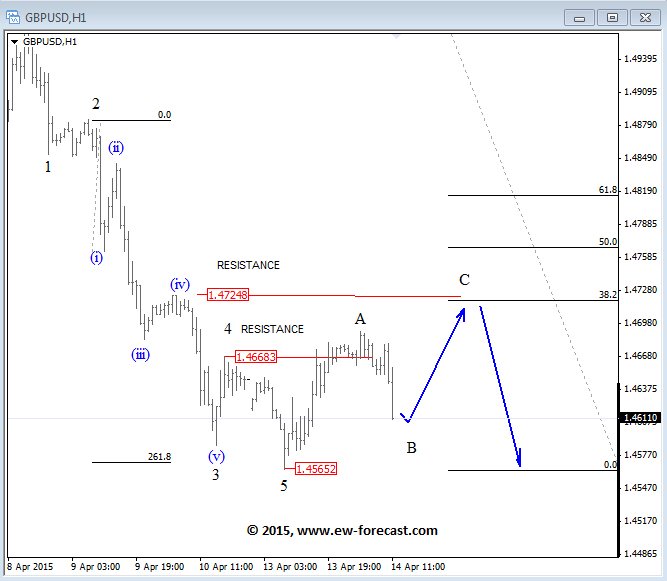

GBP/USD in 3-wave pattern; USD/CAD could fall before rising

The USD is in a bullish mode since last week, but on the short-term charts we noticed that most of the USD pairs are now in correction. On GBPUSD we are looking at a three wave rally after it finished a five wave decline at 1.4565 yesterday, so ideally the price will go to higher … “GBP/USD in 3-wave pattern; USD/CAD could fall before rising”

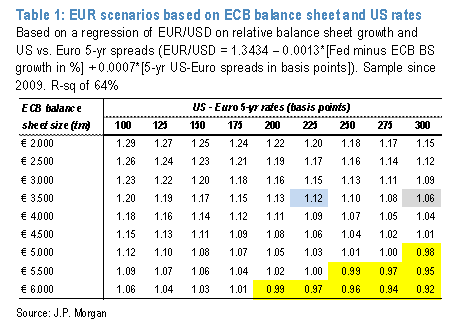

EUR/USD: Towards 1.15 Or Below 1.00 – JP Morgan

EUR/USD is hovering around the lows but is hesitating towards taking the extra step down below the 12 year low of 1.0460. It is also refraining from a meaningful bounce ahead of the ECB meeting. The team at JP Morgan asks what’s next for the common currency and discusses the various factors moving the pair: … “EUR/USD: Towards 1.15 Or Below 1.00 – JP Morgan”

Buy USD/CAD Into BoC – Barclays Trade Of The Week:

The Canadian dollar has been trading in range, in quite a wide one. The next big thing for the loonie is the rate decision? How will it react? Can USD/CAD reach 1.30? Here is the view from Barclays: Here is their view, courtesy of eFXnews: Currency investors should consider staying long USD/CAD and keep buying on … “Buy USD/CAD Into BoC – Barclays Trade Of The Week:”

USDown or greenback comeback? And more – Market Movers

What’s going on in America? Where is the dollar headed? That is the focus of our latest episode as the Easter holidays are behind us and markets are on the move. We also cover slippery oil and the state of the Aussie. You are welcome to listen, subscribe and provide feedback. What’s next for the dollar?: The Non-Farm … “USDown or greenback comeback? And more – Market Movers”

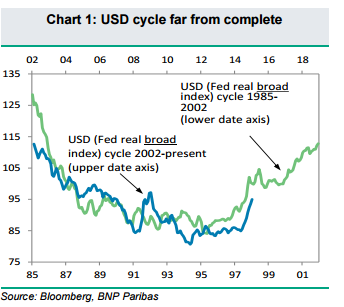

USD: They Think It’s All Over…Far From It – BNPP

The greenback made a comeback of sorts. Is this just a correction or has the long term dollar trend have room to improve? The team at BNP Paribas sees more to come and explains: Here is their view, courtesy of eFXnews: “…Some market participants are revisiting their bullish USD views, arguing that the rally is nearing an … “USD: They Think It’s All Over…Far From It – BNPP”

GBP/USD: Trading the British CPI Apr 2015

British CPI, released each month, is the primary gauge of consumer inflation. A reading which is higher than the market forecast is bullish for the pound. Update: UK inflation remains at 0% – GBP/USD slides Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at 9:30 GMT. Indicator Background Analysts consider CPI one … “GBP/USD: Trading the British CPI Apr 2015”

GBP/USD: More drops ahead; USD/CAD: Consolidation – SocGen

Currencies have moved quite a bit after the Easter holiday. GBP/USD reached new lows and USD/CAD fluctuated quite a lot. The team at SocGen analyzes the technical charts and provides interesting analysis: Here is their view, courtesy of eFXnews: GBP/USD violated the multi-year upward channel last month, confirming the possibility of an extension in the downtrend, … “GBP/USD: More drops ahead; USD/CAD: Consolidation – SocGen”

USD/CAD: Trading the Canadian Apr 2015

Canadian Employment Change is one of the most important economic indicators. Traders and analysts carefully scrutinize employment figures, and a reading higher than forecast is bullish for the loonie. Here are the details and 5 possible outcomes for USD/CAD. Update: Canada gains 28.7K jobs – USD/CAD slides Published on Friday at 13:30 GMT. Indicator Background Job creation is one … “USD/CAD: Trading the Canadian Apr 2015”