The greenback has made a comeback of sorts, rising from the lows it suffered following the poor Non-Farm Payrolls. However, the jury is still out on whether the trend has resumed. The team at Bank of America Merrill Lynch sees opportunities for USD bulls against the EUR, GBP and the JPY as well as the … “Opportunity Knocks For USD Bulls: Levels & Targets –”

Category: Opinions

EUR/USD: Trading the US Unemployment Claims Apr 2015

US Unemployment Claims is released weekly, and measures the number of people filing for unemployment for the first time. It is considered an important measure of the health and direction of the US economy. A reading which is higher than the market forecast is bullish for the euro. Here are all the details, and 5 … “EUR/USD: Trading the US Unemployment Claims Apr 2015”

USD/CAD: Well-Defined Range, 2 Drivers

The Canadian dollar managed to stage a recovery as the impact of the Iran deal on oil was not too heavy. But what’s next for the loonie? The team at Credit Agricole maps the risks: Here is their view, courtesy of eFXnews: USD/CAD continues to trade in a well-defined range between 1.24 and 1.28. We … “USD/CAD: Well-Defined Range, 2 Drivers”

GBP/USD: Trading the British Services PMI Apr. 2015

The British Services PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the services sector. A reading which is higher than the market forecast is bullish for the pound. Update: UK services PMI jumps to 58.9 points Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at 9:30 GMT. Indicator Background Market … “GBP/USD: Trading the British Services PMI Apr. 2015”

EUR: Should We Still Worry About Greece? – Credit

Headlines from Greece accompanied us in recent weeks, but remained on the sidelines. Will they get back to center stage? The team at Credit Agricole examines the situation using some charts: Here is their view, courtesy of eFXnews: The Eurozone data calendar for next week may offer less excitement with only the German industrial production and … “EUR: Should We Still Worry About Greece? – Credit”

Economic weakness reaches jobs, but what will you buy

The gain of only 126K jobs in March is a bitter disappointment. Coupled with downwards revisions of 69K makes it worse. We are finally seeing the labor market catching up with the dismal economy. Is this enough for a change of course for the US dollar? Or just an extension of the correction? Or in … “Economic weakness reaches jobs, but what will you buy”

EUR/USD: Trading the US NFP April 2 2015

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 13:30 GMT. Indicator Background Job … “EUR/USD: Trading the US NFP April 2 2015”

Party nearly over for USD bulls – HSBC

We have seen some US indicators lifting their heads, while others are still on looking disappointing, including the important ADP NFP. What’s next for the US dollar? The team at HSBC says that the party for the greenback bulls is nearly over: Here is their view, courtesy of eFXnews: The USD bull run feels close to the … “Party nearly over for USD bulls – HSBC”

AUD/USD: Trading the Australian trade March 2015

Australian Trade Balance is closely linked to currency demand and is a key indicator. A reading which is higher than expected is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Australian Trade Balance is measures the difference in the value of imported and … “AUD/USD: Trading the Australian trade March 2015”

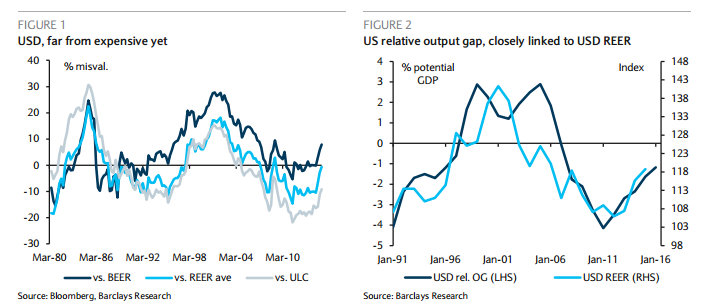

How High Can The USD Go? EUR/USD to 0.98 by

Not only Goldman Sachs sees EUR/USD below parity. The team at Barclays analyzes the value of the US dollar, asking whether the greenback is overvalued and if it can run just a little bit further. Here is their interesting analysis: Here is their view, courtesy of eFXnews: A major questions among market participants right now … “How High Can The USD Go? EUR/USD to 0.98 by”