The British Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Update: UK Manufacturing PMI hits 54.4 – within expectations – GBPUSD … “GBP/USD Trading the British Manufacturing PMI”

Category: Opinions

Euro Will Fall In A Cyclical Upswing: Why & Where

EUR-USD begins slipping out of range and is trading at the 1.07 handle. The team at Goldman Sachs has already lowered forecasts, and now focuses on targets for the shorter term: Here is their view, courtesy of eFXnews: The recent revision higher of Euro area growth and inflation forecasts by both policy makers and private … “Euro Will Fall In A Cyclical Upswing: Why & Where”

ECB QE continues full steam – EUR/USD set to fall?

The bond buying program of the European Central Bank is entering its fourth week. Towards the launch of the program and during the first week, there were fears that the ECB would not have enough bonds to buy, that its goal of 60 billion per month was somewhat too ambitious. Well, the latest weekly release shows that … “ECB QE continues full steam – EUR/USD set to fall?”

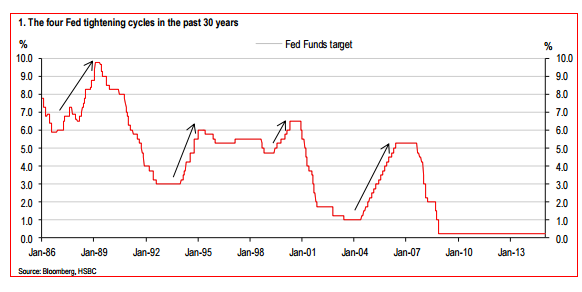

What Will Happen To USD When The Fed Pulls The

The US dollar has strengthened quite a lot in anticipation of a rate hike, and also due to convergence with other central banks that took the other path. What will happen in the day after? The team at HSBC observe the situation and reach a clear conclusion: Here is their view, courtesy of eFXnews: “The overall … “What Will Happen To USD When The Fed Pulls The”

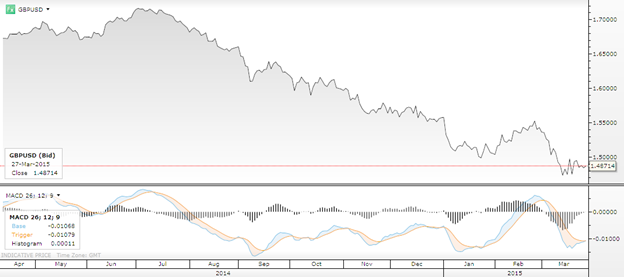

Will The British Pound Start to Reverse?

The British Pound has been one of the most heavily sold currencies in 2015, and forex traders are still waiting for an indication that these bearish trends have run their course. But when we look at the British economy from a broader perspective, there is a clear case that can be made for further weakness … “Will The British Pound Start to Reverse?”

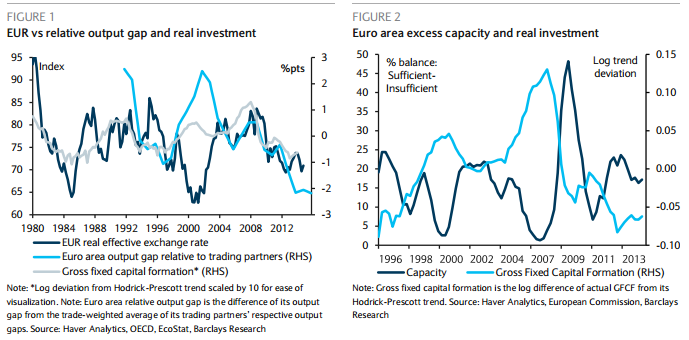

EUR/USD to parity by Q3 and to 0.95 by end

EUR/USD seemed to have found a range between 1.05 and 1.10. But, can it maintain it? The team at Barclays sees ambitious low targets for euro/dollar and explain the drivers. Here is their view, courtesy of eFXnews: How much lower can the EUR fall? “By our soundings, a lot”, answers Barclays in its quarterly note to … “EUR/USD to parity by Q3 and to 0.95 by end”

Canadian dollar: What’s next? 4 Issues from Nomura and

The Canadian dollar managed to improve its position recently, with USD/CAD retreating from the highs that got it close to 1.30. The rising oil prices following the crisis in Yemen helped, but did not last too long. So what’s next for the loonie? Here are views from Nomura and Morgan Stanley: Here is their view, courtesy … “Canadian dollar: What’s next? 4 Issues from Nomura and”

Rising chances of BOJ action in April following weak

Japan reported its inflation numbers, and they were disappointing. The numbers are still skewed by the sales tax hike that sent the country into recession in April 2014, but if you exclude them, it is impossible to say that the Bank of Japan is nearing its 2% inflation goal. With USD/JPY basically stuck in a range around … “Rising chances of BOJ action in April following weak”

Resell EUR/USD to 1.04 – BNPP

The US dollar is on the rise again and the euro begins to feel the heat. Is there more room to go? The team at BNP Paribas certainly thinks so and sets a low target: Here is their view, courtesy of eFXnews: The USD has relatively retreated in the aftermath of the 18 March FOMC statement. … “Resell EUR/USD to 1.04 – BNPP”

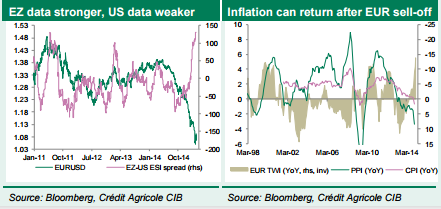

EUR/USD: Is This A Turning Point? – Credit Agricole

EUR/USD has fallen off the highs thanks to the dollar’s weakness (here are 3 reasons). However, it is still trading high – not too far from 1.10. The team at Credit Agricole examines whether euro/dollar is at a turning point. Here is their view, courtesy of eFXnews: The Eurozone economic outlook is improving and portfolio … “EUR/USD: Is This A Turning Point? – Credit Agricole”