The Fed said its word and stirred markets. But what exactly was in there? We dissect the carefully crafted words from the world’s most important central banks, the underlying state of the US economy, market reactions now and looking forward regarding currencies, commodities, stocks and bonds, and lots more. Welcome to a new episode of Market Movers, presented by … “The Fed and the road ahead – all you need”

Category: Opinions

The Fed is more dovish, but USD is still king

The dollar got a big blow from the more dovish tone heard from Yellen and her colleagues, with the dot chart standing out as a sign that rate hikes will be delayed, or at least sporadic rather than systematic. But in the morning after, other currencies had a serious hangover. Why? They cannot really stand on their … “The Fed is more dovish, but USD is still king”

Fed’s Patient In Deed, If Not Word; USD On Their

The Federal Reserve removed the “patience” wording but more than balanced this with dovish wording, The Federal Reserve removed the “patience” wording. And how exactly does the Fed see the greenback? The team at Bank of America Merrill Lynch explains: Here is their view, courtesy of eFXnews: The following is Bank of America Merrill Lynch’s reaction … “Fed’s Patient In Deed, If Not Word; USD On Their”

4 reasons why the dollar is down on the Fed

The Fed said its word: removed patience, but also said a lot of other things. The USD is selling off heavily after a statement that saw the removal of forward guidance: the move that paves a rate hike. Why? Here are 4 quick reasons: Confidence needed on inflation: Beforehand they seemed more confident. Yellen still sees oil … “4 reasons why the dollar is down on the Fed”

USD/CAD: Trading the Canadian Wholesale Sales

Canadian Wholesale Sales is an important indicator of consumer spending. A reading which is better than the market forecast is bullish for the Canadian dollar. Update: Canadian wholesale sales plunge 3.1% Here are all the details, and 5 possible outcomes for USD/CAD. Published on Wednesday at 12:30 GMT. Indicator Background Canadian Wholesale Sales measures the total amount of … “USD/CAD: Trading the Canadian Wholesale Sales”

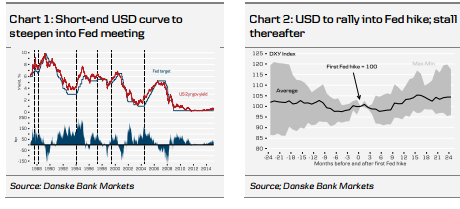

How To Prepare For A Less ‘Patient’ Fed? – BNPP

The US dollar enjoyed a nice rally against many currencies in anticipation of Fed tightening. We will probably get a change in wording this week. How can we prepare for it? Which currency pair is likely to move most? Vassili Serebriakov from BNP Paribas answers: Here is their view, courtesy of eFXnews: “The FOMC policy announcement on … “How To Prepare For A Less ‘Patient’ Fed? – BNPP”

EUR/USD: Trading The German ZEW Mar 2015

German ZEW Economic Sentiment is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Update: German ZEW Economic Sentiment at 54.8 points; Core CPI up to 0.7% Here are all the details, and 5 … “EUR/USD: Trading The German ZEW Mar 2015”

EUR/USD; Further Loses Ahead; Positioning Not A Hinder –

So, the euro is recovering, isn’t it? Well, perhaps not for too long. The general downtrend seems to be intact. The team at Dankse explain why more losses are awaiting EUR/USD: Here is their view, courtesy of eFXnews: “We have been forecasting EUR/USD to fall in H1 and bounce in H2. That is still our … “EUR/USD; Further Loses Ahead; Positioning Not A Hinder –”

QE: Who got it right, Krugman or the Gold bugs?

This episode of Market movers is dedicated to Quantitative Easing (QE). This happens as the “QE baton” is passed from the Federeal Reserve to the ECB. These banks are not alone. We define and explain it, review the main uses, the benefits and the secondary effects. Does it really work? Will central banks know how to unwind … “QE: Who got it right, Krugman or the Gold bugs?”

EUR/USD: UOM Consumer Sentiment March 2015

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Update: US consumer confidence slides to 91.2 – USD pauses (for now Here are all the details, … “EUR/USD: UOM Consumer Sentiment March 2015”