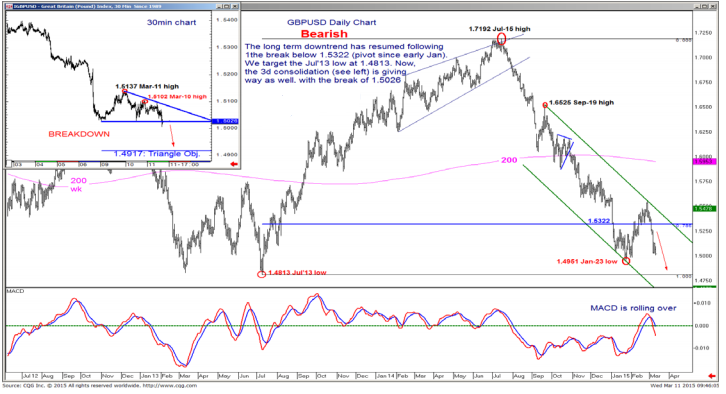

GBP/USD lost the very round 1.50 but is certainly giving a fight and battling over this level. What’s next for cable? The team at Bank of America Merrill Lynch examine the technical levels for pound/dollar. Here is their view, courtesy of eFXnews: With the USD bull trend intact, attention turns to the ongoing breakout in GBP/USD. … “GBP/USD Breakout: Levels & Targets – BofA, Goldman”

Category: Opinions

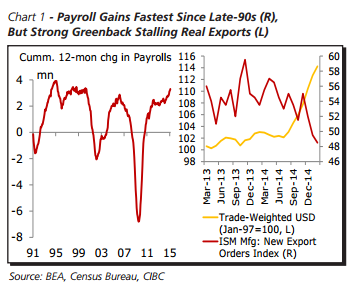

The Last Leg Of USD Strength Set To Start Next

The US dollar enjoyed yet another strong surge, sweeping also currencies that had showed resilience beforehand. Is it over? Not so fast. The team at CIBC explains the motives and the timing for the next leg up in the greenback, that may be the last for this cycle. Here is their view, courtesy of eFXnews: All good … “The Last Leg Of USD Strength Set To Start Next”

AUD/USD: Trading the Australian jobs Mar 2015

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian jobs Mar 2015”

GBP/EUR crosses 1.40 – Good news for UK expats, Spanish

The weakness of the euro, which is most evident against the dollar with near 12 year lows, is also having an impact on the cross-channel currency pair. At the time of writing, EUR/GBP is trading at 0.7134, extending its falls. If we look at the cross the other way around, GBP/EUR is trading above the … “GBP/EUR crosses 1.40 – Good news for UK expats, Spanish”

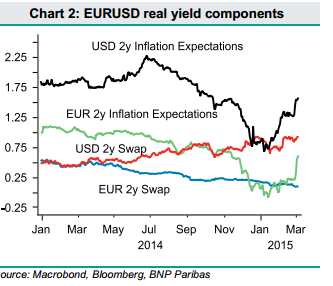

Here Is The ‘Prescribed Cocktail’ For Weaker EUR/USD –

EUR/USD is falling relentlessly breaking low support and still not finding a bottom. We are aware of the forces moving the pair on the headlines front. But what’s going on behind the scenes? The team at BNP Paribas explains: Here is their view, courtesy of eFXnews: BNP Paribas Global Head of Rates Strategy is drawing attention … “Here Is The ‘Prescribed Cocktail’ For Weaker EUR/USD –”

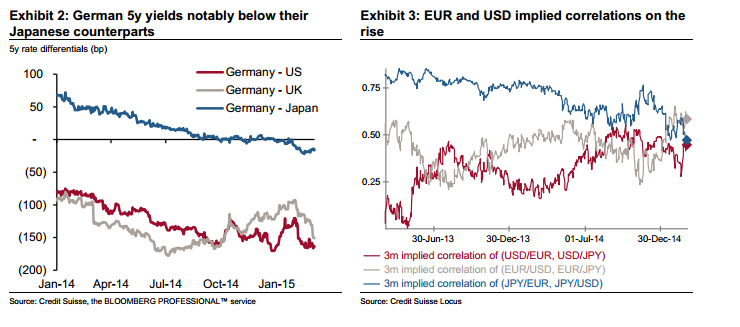

EUR/USD targets down to 1.05 in 3m, 0.98 in 12m – CS

Euro/dollar continues falling, with 1.08 already seen from above. On this background, the team at Credit Suisse revises down its targets. Here is their explanation as why the meltdown is far from over in the pair: Here is their view, courtesy of eFXnews: For the second time this year, Credit Suisse has revised down its EUR/USD … “EUR/USD targets down to 1.05 in 3m, 0.98 in 12m – CS”

RBA to move on rates in April

The RBA, in a shock decision last week decided to keep interest rates on hold in Australia at a record low of 2,25%, brushing off fears of weak unemployment and poor capital expenditure figures. Before the Announcement, 58% of analysts polled expected the central bank to cut rates to 2.25% Guest Post by Andrew Masters … “RBA to move on rates in April”

How Much Of A USD Strength Into Upcoming FOMC? – Goldman

After another strong jobs report from the US expectations have risen for a removal of forward guidance: no more patience from the Fed regarding rates. But how can that affect the dollar? Robin Brooks, George Cole and Michael Cahill analyze, and see room for more: Here is their view, courtesy of eFXnews: “One reason we adopted … “How Much Of A USD Strength Into Upcoming FOMC? – Goldman”

USD/JPY: Trading the JOLTS Job Openings

JOLTS Job Openings measures the number of employment openings each month, excluding the farm industry. A reading which is higher than the market forecast is bullish for the dollar. Update: US JOLTs 4998K – just below predictions Here are the details and 5 possible outcomes for USD/JPYUSD/JPY Published on Tuesday at 14:00 GMT. Indicator Background Job creation is … “USD/JPY: Trading the JOLTS Job Openings”

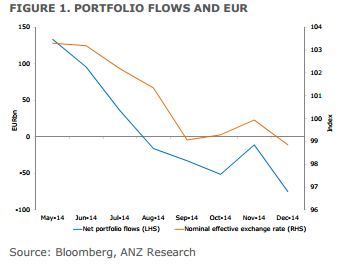

EUR/USD: 1.05 Next Target En-Route To Parity; Downtrend Firmly

EUR/USD crashed quite sharply following the one two punch from Draghi and the NFP, closing at 1.0846. This may not be the end. Brian Martin & Dylan Eades of ANZ foresee the next levels down the road, and explain with a chart: Here is their view, courtesy of eFXnews: “Price action has confirmed that the euro is … “EUR/USD: 1.05 Next Target En-Route To Parity; Downtrend Firmly”