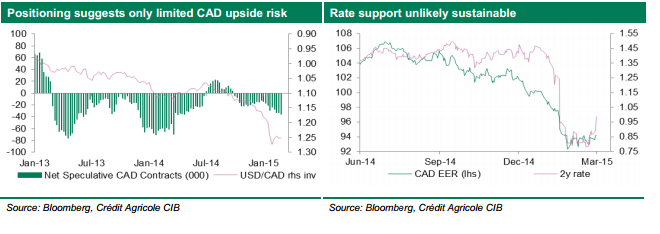

All commodity currencies were crushed under the strength of the greenback following the excellent NFP. But not all commodities are equal. The team at Credit Agricole explains the different situations in both CAD and NZD: Here is their view, courtesy of eFXnews: Both the Bank of Canada’s less dovish monetary policy stance and stabilising commodity price developments … “CAD: Staying Short; NZD: Sell-Off An Over-Reaction – Credit”

Category: Opinions

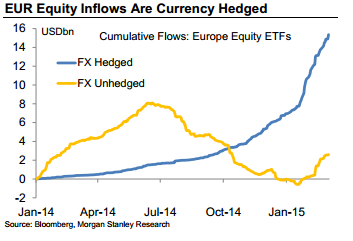

Rally in EUR? Here is why it is difficult –

We have already seen how good euro-zone data does NOT help the euro, and the spectacular crash following the US NFP. Why does this happen to the common currency? The team at Morgan Stanley explains: Here is their view, courtesy of eFXnews: Over the past couple of weeks, economic data in Europe have improved noticeably, led … “Rally in EUR? Here is why it is difficult –”

NFP cements removal of “patience” – June hike looks real

The solid Non-Farm Payrolls report completes the picture for the Fed move. Janet Yellen already prepared us for a removal of forward guidance in March during her battled testimony on Capitol Hill. She also repeated the mantra that everything is data dependent. This report is good enough to cement the removal of patience. Without “patience” … “NFP cements removal of “patience” – June hike looks real”

AUD/USD what’s next after the RBA “no cut”? – Market

The Non-Farm Payrolls report is critical for the US dollar – we explain why and what to expected. In addition, our packed show features a debate on false breaks, the Australian and Canadian rate decisions, a potential easing in Japan, the widening gap within oil prices and an update on forex brokers after the SNBomb. … “AUD/USD what’s next after the RBA “no cut”? – Market”

EUR/USD: Trading the US NFP Mar 2015

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Update: Non-Farm Payrolls + 295K – excellent news – … “EUR/USD: Trading the US NFP Mar 2015”

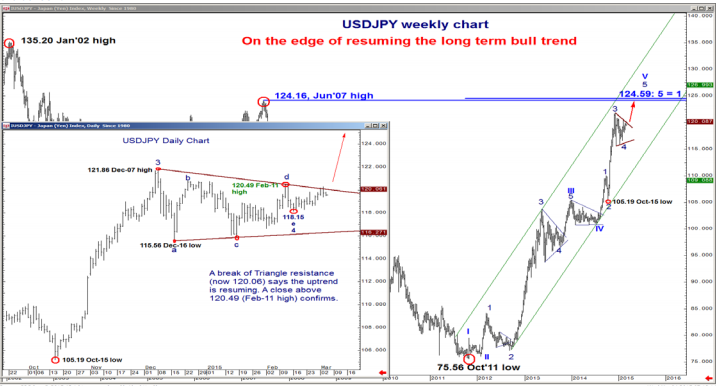

USD/JPY, USD/CAD: Bullish Setup; EUR/USD: Breakout – BofA Merrill

What’s next for the US dollar against the yen, Canadian dollar and the euro? Here are some technical setups from Bank of America Merrill Lynch: Here is their view, courtesy of eFXnews: USD/JPY is on the verge of completing its 3m range trade and resuming its long term bull trend for 120.49, notes Bank of America … “USD/JPY, USD/CAD: Bullish Setup; EUR/USD: Breakout – BofA Merrill”

Eurozone fundamentals improving, eventually EUR should follow

Cheaper oil, low interest rates and strong US growth may be starting to work their magic on the flagging Eurozone economy – if so a recovery of the EUR should follow in due course. For now the EUR remains under pressure, not least with the European Central Bank launching its EUR 1.1 trillion quantitative easing … “Eurozone fundamentals improving, eventually EUR should follow”

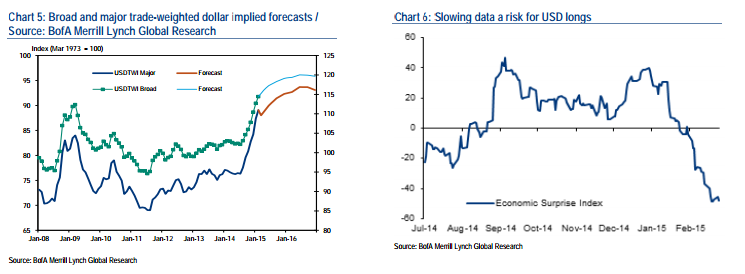

USD Consolidates Then Moves Up: Themes, Forecasts, Risks –

After some range trading for the US dollar during February, what’s next for the greenback? Here are views on the themes that are set to rock the US dollar and forecasts for a few pairs: Here is their view, courtesy of eFXnews: The following is Bank of America Merrill Lynch’s comprehensive outlook for the USD including … “USD Consolidates Then Moves Up: Themes, Forecasts, Risks –”

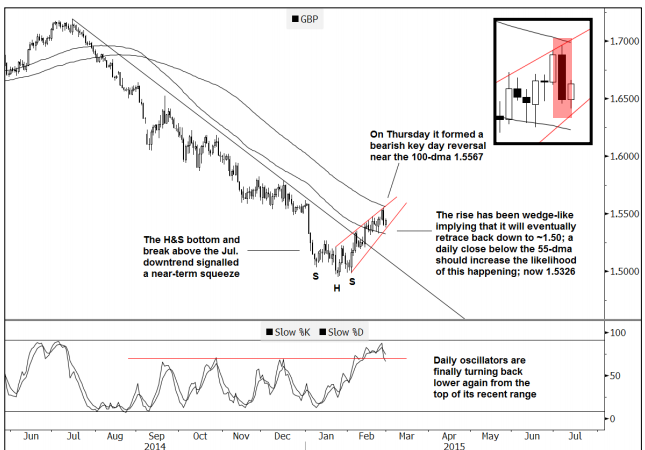

GBP/USD: False Break But Still Wedge-Like – Goldman Sachs

Cable advanced quite nicely but hit a high and began retreating, mostly due to the strength of the pound. What’s next for cable? The team at Goldman Sachs provides a technical analysis for GBP/USD: Here is their view, courtesy of eFXnews: GBP/USD had a false break lower into the end of last week but ultimately still … “GBP/USD: False Break But Still Wedge-Like – Goldman Sachs”

Why euro-zone positive surprises will NOT lift EUR/USD yet

Indicator after indicator, the data flowing out of the euro-zone continues beating expectations. After so many months of gloom, the economic situation could have reached a point where it just couldn’t get worse. And, the weaker euro seen in recent months also played a role and is beginning to being felt. Is this enough to … “Why euro-zone positive surprises will NOT lift EUR/USD yet”