The Australian government faced a stark warning last week that unless it reigns in the finances it’s at risk of losing it AAA rating from ratings agency Standard and Poor’s. Although there is no immediate threat of a downgrade from the AAA rating the ratings agency told the Wall Street Journal that the government needs … “Australian economy faces the crossroads”

Category: Opinions

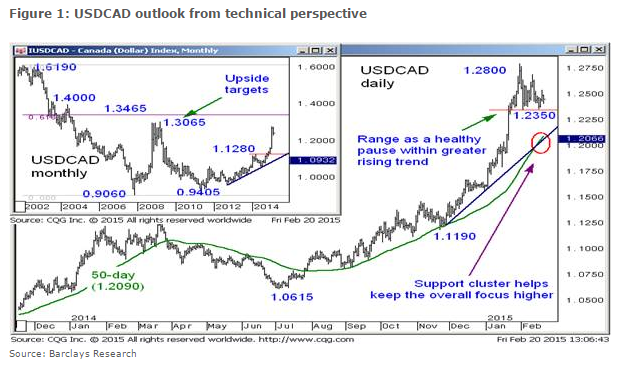

Buy USD/CAD – Barclays Trade of the Week

The Canadian dollar suffered from falling oil prices and also from the disappointing retail sales numbers. The team at Barclays says there is more room for weakness in the C$ – a rise in USD/CAD. Here is the rationale and the charts: Here is their view, courtesy of eFXnews: Currency investors should consider buying USD/CAD … “Buy USD/CAD – Barclays Trade of the Week”

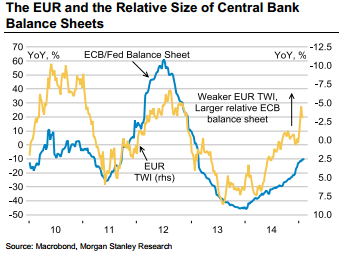

What will happen to EUR if ECB Fails On Its

The implementation of the ECB’s massive QE program is just around the corner. How will it impact the exchange rate? And what happens if the balance sheet does not rise as expected? The team at Morgan Stanley provides some answers: Here is their view, courtesy of eFXnews: “Rate and yield differentials working against the EUR … “What will happen to EUR if ECB Fails On Its”

Time To Buy The USD Index – BofA Merrill

The US dollar has not exactly continued its winning streak in recent weeks, and has had mixed results. Is it time for a renewal of the uptrend? The team at Bank of America Merrill Lynch thinks so. Here is there rationale, entry points and targets: Here is their view, courtesy of eFXnews: For the past … “Time To Buy The USD Index – BofA Merrill”

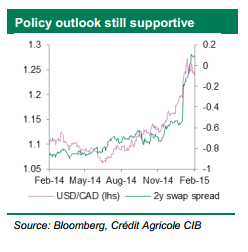

Staying Long USD/CAD For 1.3050; Staying Bearish On CAD

The Canadian dollar flipped up and down on oil prices, still uncertain about the next steps of the Bank of Canada. The team at Credit Agricole sees further depreciation of the C$ and sets a target: Here is their view, courtesy of eFXnews: The CAD has been in demand for most of the last few … “Staying Long USD/CAD For 1.3050; Staying Bearish On CAD”

3 bearish EUR/USD scenarios for 3 Different Greek Outcomes

The plot thickens around the Greek crisis and the clock continues ticking quickly. How will this affect the euro? The team at Goldman Sachs lays out the scenario and see the risk reward tilted firmly to the downside: Here is their view, courtesy of eFXnews: In a note to clients today, Goldman Sachs discusses how EUR/USD … “3 bearish EUR/USD scenarios for 3 Different Greek Outcomes”

Questions for traders, State of Fed, Greek crisis, oil,

A packed show awaits you, our listeners, in which we cover a wide variety of market moving events, covering commodities, the next moves in the dollar, euro and pound as well as a time for pausing and reflecting on trading strategies. Tune in. Welcome to a new episode of Market Movers, presented by Lior Cohen of … “Questions for traders, State of Fed, Greek crisis, oil,”

EUR/USD: Bearish short and long term – Citi

EUR/USD is reacting to every headline regarding Greece and seems to be looking for a direction. The team at Citi examine the charts and see a clear direction: down. Here is the rationale and the targets: Here is their view, courtesy of eFXnews: On long-term charts, EUR/USD remains below the 200 month moving average, which … “EUR/USD: Bearish short and long term – Citi”

GBP/USD: Trading the British Retail Sales Feb 2015

The Retail Sales release is considered one of the most important economic indicators. A reading that is higher than the market forecast is bullish for the British pound. Update: UK retail sales disappoint – GBP/USD already low Here are all the details, and 5 possible outcomes for GBP/USD. Published on Friday at 9:30 GMT. Indicator Background … “GBP/USD: Trading the British Retail Sales Feb 2015”

Is the ECB triggering a Greek Bank Run?

The European Central Bank is in a tight spot between politicians on both sides of the Greek crisis. Greece want looser conditions for its banks in order to have more breathing space for the economy and for negotiations. German politicians would prefer a more prudent approach in order to mitigate risk and put pressure on Greece to … “Is the ECB triggering a Greek Bank Run?”