The German Preliminary GDP measures growth in the economy. GDP measures production and growth of the economy. A reading which is higher than the market forecast is bullish for the euro. Update: German GDP grew 0.7% in Q4 – much better than expected Here are all the details, and 5 possible outcomes for EUR/USD. Published on Friday at 7:00 … “EUR/USD: Trading the Preliminary German GDP February 2015”

Category: Opinions

Greek crisis: Hamburg elections part of Germany’s hard line

Some say that all politics are internal ones, and that that influences external decisions. This may be the case in the current intensive negotiations between Greece and its European creditors led by Germany. German finance minister Wolfgang Schäuble is leading the tough stance, basically rejecting in public any proposal that is different from the terms agreed upon … “Greek crisis: Hamburg elections part of Germany’s hard line”

AUD/USD: Trading the Australian jobs Feb 2015

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian jobs Feb 2015”

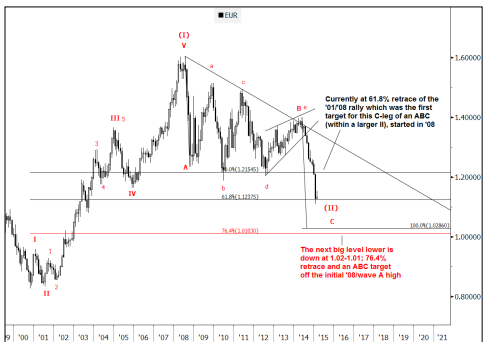

EUR/USD: A-B-C Pattern; The Next Big Level – Goldman

EUR/USD is somewhat stuck in narrower ranges, especially when comparing to recent volatility. What’s next for the pair? The team at Goldman Sachs examines the charts from an Elliott Wave Perspective: Here is their view, courtesy of eFXnews: EUR/USD price-action from the Jan. 26th low looks like a complete ABC pattern which is characteristically corrective, … “EUR/USD: A-B-C Pattern; The Next Big Level – Goldman”

GBP/USD: Trading the British Manufacturing Feb 2015

British Manufacturing Production, a key indicator, provides analysts and traders with a snapshot of the health of the UK manufacturing sector. A reading which is higher than the market forecast is bullish for the pound. Update: UK manufacturing output beats expectations Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at … “GBP/USD: Trading the British Manufacturing Feb 2015”

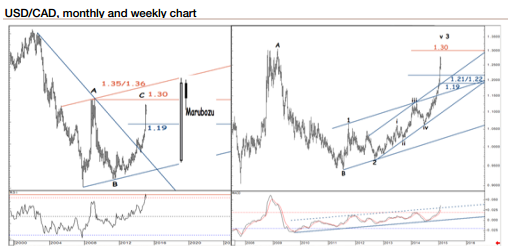

USD/CAD: Still En-Route To 1.30; AUD/USD: H&S Confirmed –

Both AUD and CAD managed to overcome recent blows and stage recoveries. Is this sustainable? Not so fast. The team at SocGen sees both commodity currencies weakening, and sets targets: Here is their view, courtesy of eFXnews: USD/CAD in resuming its move higher and still en-route to test March 2009 highs of 1.30, notes SocGen. “Monthly RSI is … “USD/CAD: Still En-Route To 1.30; AUD/USD: H&S Confirmed –”

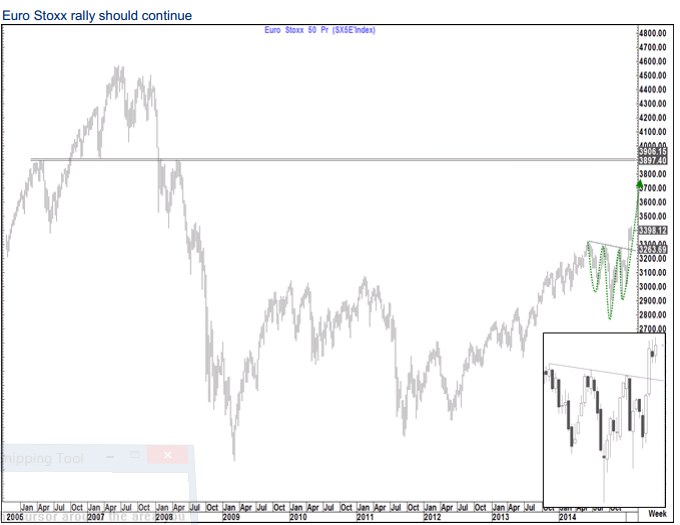

EUR/USD En-Route To Parity As European Equity Markets Set

Quantitative Easing has already been announced in the euro-zone and will come into effect in March. This is set to have a wide impact on all markets. Tom Fitzpatrick at CitiFX sees the euro weakening all the way to parity with the USD and explains: Here is their view, courtesy of eFXnews: “A number of European … “EUR/USD En-Route To Parity As European Equity Markets Set”

NFP Preview, Aussie Analysis, Greek Grindings and Oil Optimism

The NFP is eyed with worries after recent US data. And what about wages? The RBA cut rates: a one off or just the beginning? The ECB’s late night move against Greece only temporarily hurt the euro. How will this evolve? And oil is finally recovering, but is this only a correction? Welcome to a new … “NFP Preview, Aussie Analysis, Greek Grindings and Oil Optimism”

EUR/USD: Trading the US NFP Feb 2016

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Update: Non-Farm Payrolls +257K – above expectations – USD … “EUR/USD: Trading the US NFP Feb 2016”

Grexit Probability Higher Than In 2012; ECB Puts Pressure

The ECB surprised markets at a late hour and announced that Greek government bonds will no longer satisfy as collateral. This hurt EUR/USD. And what are the implications? The team at Barclays, that already talked about a 15 big figure fall for EUR/USD, now says that the chances of a Greek exit are now probably … “Grexit Probability Higher Than In 2012; ECB Puts Pressure”