Quantitative easing has been around some seven years in its current form, but now another monetary policy tool is gaining momentum called negative interest rates. This is likely to become a weapon of choice in the currency wars and a key driver of exchange rates. Since the oil price plunge late last year (though it … “Negative interest rates: The new weapon in the forex”

Category: Opinions

AUD/USD: Trading the Australian Retail Sales February 2015

Australian Retail Sales is considered the primary gauge of consumer spending. The indicator provides analysts and traders with an early look at consumer spending. A reading that is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Consumer spending is … “AUD/USD: Trading the Australian Retail Sales February 2015”

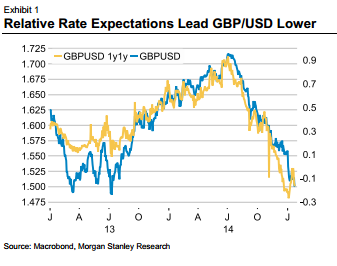

GBP/USD: 1.38 is the new target; staying short – Morgan

Cable continues battling the 1.50 line amid speculation about the timing of the next move by the Bank of England. Mark Carney and co. are meeting soon, but no change is expected anytime soon. The team at Morgan Stanley stays short and revises the target down to 1.38: Here is their view, courtesy of eFXnews: Morgan Stanley’s … “GBP/USD: 1.38 is the new target; staying short – Morgan”

GBP/USD: Trading the UK Construction PMI February 2 2015

The British Construction PMI Index is based on a survey of Purchasing Managers in the construction industry. The survey includes about 170 respondents, who are surveyed for their view of a wide range of business conditions, including employment, new orders, prices and inventories. A reading which is higher than the market forecast is bullish for … “GBP/USD: Trading the UK Construction PMI February 2 2015”

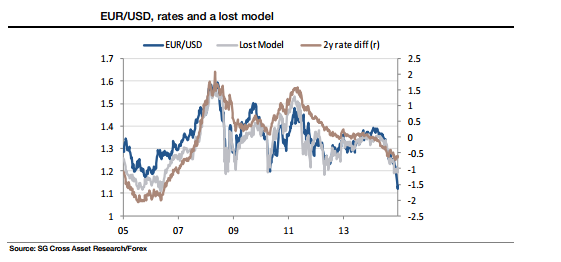

EUR/USD: Quieter Times Ahead?; Important Levels To Watch –

EUR/USD managed to stabilize after the big falls and is trading in a wedge. Does this imply quieter times? What levels should be watched? The team at SocGen discusses: Here is their view, courtesy of eFXnews: “…At the risk of using an out-of-date analytical tool to draw spurious conclusions, I would observe that the euro is about 6 ½ … “EUR/USD: Quieter Times Ahead?; Important Levels To Watch –”

Bleak outlook expected from RBA

More and more analysts are now predicting that the RBA is set to cut rates with 40% predicting that the first for the year may come as early tomorrow when the Central Bank announces their first interest rate decision for the year. One of the biggest names advocating for a rate cut is renowned business … “Bleak outlook expected from RBA”

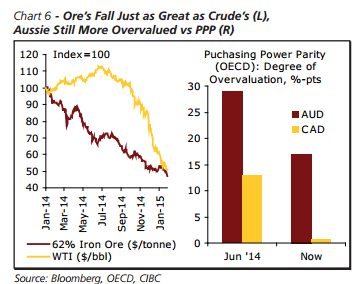

AUD: Will Stevens Borrow Poloz’s Clippers? – CIBC

The moment of truth is approaching for the Reserve Bank of Australia. After two months, the central bank convenes again. Will Stevens cut the interest rate? Where is AUD/USD headed to? Here is their view, courtesy of eFXnews: The AUD has been another currency succumbing to a resurgent USD over the last six months, depreciating by almost … “AUD: Will Stevens Borrow Poloz’s Clippers? – CIBC”

Fed rundown, GDP outlook, Greek elections analysis and AUD

The US returns to the limelight with the Fed decision and the first release of US GDP. What are the implications for the dollar? Before diving into this, we analyze the impact of the Greek elections for the euro in the short and long terms. And AUD is also on the agenda with a possible rate cut … “Fed rundown, GDP outlook, Greek elections analysis and AUD”

Did the Fed hint about a strong GDP report?

Recent indicators about the US economy were not too good. Most recently, durable goods orders for December badly disappointed and included downwards revisions for November. However, the FOMC statement did see a solid economy and even a strong jobs market. No word about falling wages – a figure combining both the Fed’s mandates for jobs and inflation. … “Did the Fed hint about a strong GDP report?”

EUR/USD: Trading the Advance US GDP

US Advance GDP is a measurement of the production and growth of the economy. Analysts consider GDP one of the most important indicators of economic activity. So, the Advance GDP release could have a significant impact on the movement of EUR/USD. A reading which is better than the market forecast is bullish for the dollar. Update: US … “EUR/USD: Trading the Advance US GDP”