SGD is the latest currency to register a sharp unexpected drop following action from the Monetary Authority of Singapore to ease monetary policy, which is fast leaving the US and Switzerland as the only two countries not trying to devalue their currencies. The question is – how long will that last for? Many of the … “Oil plunge leaves USD & CHF as the only strong”

Category: Opinions

Fed Preview: USD buy opportunity on “business as usual”?

The US dollar has been on the back foot after the disappointing durable goods orders, that joined other underwhelming figures. There is a growing notion in the markets that a rate hike will not come before September and many already see the Fed refraining from a rate hike this year. But is the Fed really going … “Fed Preview: USD buy opportunity on “business as usual”?”

USD Pullback An Attractive Long-Term Buy – Credit Suisse

The recent setback for the US dollar may be temporary, and just an opportunity to pile up on more USD longs. What do you think? The team at Credit Suisse do not see the Fed making a big enough change to change the course of the greenback: Here is their view, courtesy of eFXnews: “…From a … “USD Pullback An Attractive Long-Term Buy – Credit Suisse”

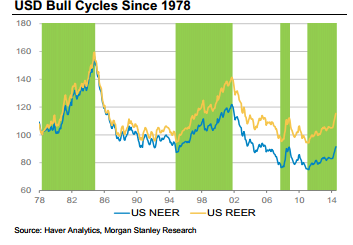

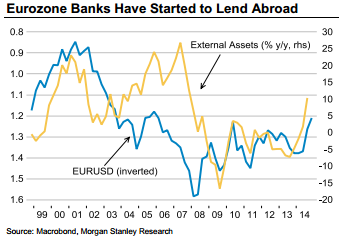

USD Super Cycle Intact; Sell EUR/USD Rebounds targeting 1.09

The US dollar took a hit on the weak durable goods orders numbers, and could not recover on strong numbers from new home sales and consumer confidence. However, the team at Morgan Stanley sees the super cycle of the strengthening dollar intact, and suggests selling rebounds on EUR/USD: Here is their view, courtesy of eFXnews: Past USD … “USD Super Cycle Intact; Sell EUR/USD Rebounds targeting 1.09”

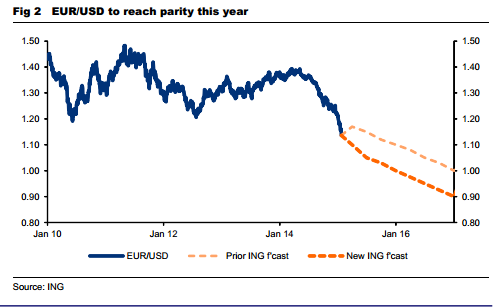

EUR/USD set for parity at year end, 0.90 at end

Euro/dollar enjoyed some stabilization after the big falls. Was the fall exaggerated or is it set to continue? The team at ING explain why the fall is justified and set new targets for the each of the following quarters: Here is their view, courtesy of eFXnews: EUR/USD is currently suffering a discrete adjustment on the larger-than-expected … “EUR/USD set for parity at year end, 0.90 at end”

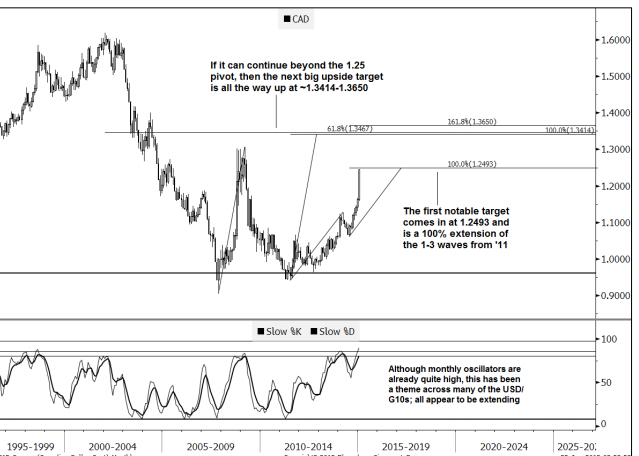

EUR/USD: Momentum Loss?; USD/CAD: 1.25 Breakout? – Goldman Sachs

EUR/USD dropped quite a lot and already reached a first major target. Can it continue lower? It faces significant support. Also the Canadian dollar lost a lot of ground against the greenback. 1.25 could be the floodgate line to the next higher levels on USD/CAD. Here is their view, courtesy of eFXnews: EUR/USD has now … “EUR/USD: Momentum Loss?; USD/CAD: 1.25 Breakout? – Goldman Sachs”

AUD/USD: Trading the Australian CPI Jan 2015

Australian CPI (Consumer Price Index), which is released each quarter, is an inflation index which measures the change in the price of goods and services charged to consumers. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published … “AUD/USD: Trading the Australian CPI Jan 2015”

GBP/USD: Trading the British Preliminary GDP Jan 2015

British Preliminary Gross Domestic Product (GDP) is a key release and is published each quarter. GDP measures production and growth of the economy, and is considered by analysts as one the most important indicators of economic activity. Preliminary GDP is the first version of the indicator and tends to have the most impact. A reading which is … “GBP/USD: Trading the British Preliminary GDP Jan 2015”

ECB QE rundown, SNBomb effect on brokers, surprise cut

ECB QE is here and it’s big: we run down the event and the impact before circling back to the big hint we received for this one week before from the SNB, focusing on the impact on brokers. The moves are of course correlated to the price of oil and we analyze the surprising Canadian cut and also … “ECB QE rundown, SNBomb effect on brokers, surprise cut”

EUR/USD: Selling the rebounds – Morgan Stanley

EUR/USD fell quite a lot after the announcement of massive Quantitative Easing by Mario Draghi, but after the pair reached a trough of 1.113 it made a huge rebound before sliding back down. Forex trading is never a one way street.How can euro/dollar be traded? Morgan Stanley suggests a strategy: Here is their view, courtesy … “EUR/USD: Selling the rebounds – Morgan Stanley”