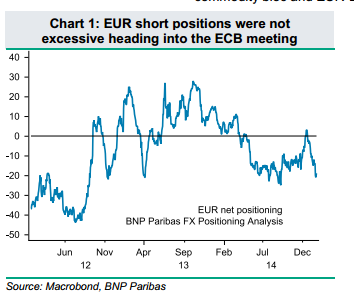

Draghi delivered a massive QE program and sent the euro sinking across the board. Before we have too much time to rest, the central bank on the other side of the Atlantic makes its decision. What will Yellen do? The team at BNP Paribas analyzes EUR/USD and reaches a conclusion: Here is their view, courtesy … “EUR/USD: After ECB And Ahead Of FOMC – room for”

Category: Opinions

5 points on why Draghi more than delivered and EUR/USD

The ECB announced QE. Buying sovereign bonds in a Quantitative Easing program finally happened, and it happened big time. Draghi seemed determined and rightfully so. The initial market reaction was somewhat hesitant but the euro began it’s slide. Is that all? Probably not. Here are 5 points about why the move is huge and why … “5 points on why Draghi more than delivered and EUR/USD”

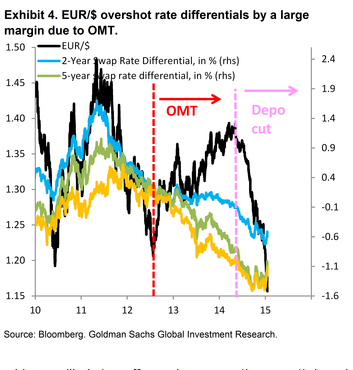

ECB Meeting A Catalyst For EUR/USD Lower – Goldman Sachs

Will the size of the ECB’s QE be big big enough to push the euro even lower? It does not have to be that extreme: Draghi could find a way to surprise the markets and weigh on the common currency. The team at Goldman Sachs explains: Here is their view, courtesy of eFXnews: Goldman Sachs … “ECB Meeting A Catalyst For EUR/USD Lower – Goldman Sachs”

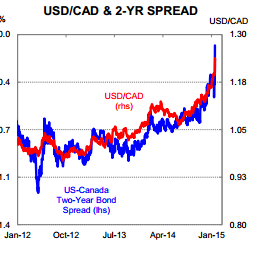

USD/CAD: Running Away; Buy Dips targeting 1.30 – CBA

The Bank of Canada shocked markets with the first rate move in over 4 years, and it was to the downside: the cut of the rate to 0.75% sent the Canadian dollar down. Is this a first move out of many or just a one-off event? And what will happen to the Canadian dollar? The team … “USD/CAD: Running Away; Buy Dips targeting 1.30 – CBA”

AUD/USD: Trading the HSBC Chinese Flash PMI Jan 2015

The HSBC Chinese Flash Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in China. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and … “AUD/USD: Trading the HSBC Chinese Flash PMI Jan 2015”

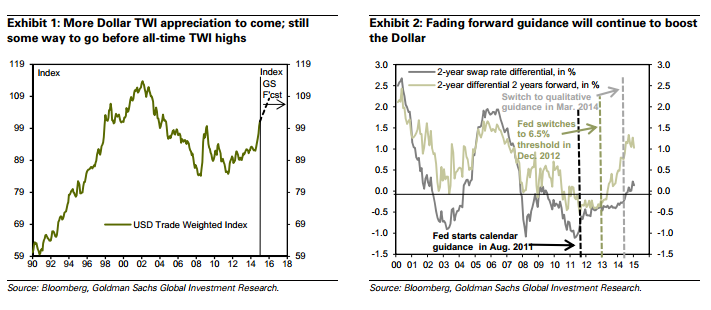

Dollar Strength To Continue With Shift In Drivers –

The US dollar gained quite a lot in late 2014 and in the early days of 2015. Can this strength continue? There is potential, and the move could come from other sources. Fiona Lake, Robin Brooks and Michael Cahill from Goldman Sachs explain: Here is their view, courtesy of eFXnews: “We expect USD strength across … “Dollar Strength To Continue With Shift In Drivers –”

Perceptions of ECB independence hang in the balance

This Thursday’s ECB press conference will be a show stopper for the forex markets and could deliver another market moving shocker following closely on the Swiss National Bank’s surprise decision to unpeg CHF from the EUR last week. The ECB is widely expected to announce the launch of a long waited and much anticipated quantitative … “Perceptions of ECB independence hang in the balance”

Staying Bearish EUR/USD Outright: Levels & Targets – Credit

The sentiment in the markets is still bearish on EUR/USD despite teh recent falls and ahead of the expected decision on QE from the ECB. What levels should be watched? The team at Credit Suisse answers and provides a chart: Here is their view, courtesy of eFXnews: EUR/USD still trading in retreat hovering around a … “Staying Bearish EUR/USD Outright: Levels & Targets – Credit”

7 Scenarios for the ECB decision

An announcement on QE in the euro-zone seems imminent in the euro-zone. The shocking move by the SNB with its accompanying hints and recent comments from ECB officials have paved the way for a very significant announcement. The reaction for EUR/USD depends on the size of the program. But, Draghi and co. will not necessarily … “7 Scenarios for the ECB decision”

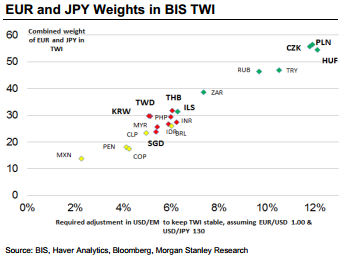

Trading The ECB – Morgan Stanley

What type of QE will the ECB announce? Will it actually delay the decision to March? What is and what isn’t priced in? The team at Morgan Stanley provide a guide map to trading the ECB decision on Thursday: Here is their view, courtesy of eFXnews: While the precipitous decline in crude prices has continued to capture … “Trading The ECB – Morgan Stanley”