Towards the ECB meeting on January 22nd, there could be more room for the euro to the downside against both the dollar and the pound. The team at Barclays explains the rationale and levels on the charts: Here is their view, courtesy of eFXnews: Currency investors should consider starting short EUR/USD and EUR/GBP into this … “Stay Short EUR/USD, EUR/GBP – Barclays Trade Of The Week”

Category: Opinions

EUR/USD: Trading the German ZEW Jan 2015

German ZEW Economic Sentiment is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Tuesday at 10:00 GMT. Indicator Background … “EUR/USD: Trading the German ZEW Jan 2015”

ECB QE could theoretically surpass €2 trillion according to

In the past week, we have received quite a few fat hints from Draghi and his colleagues.Also the SNB’s shock move included 3 ECB QE hints. And if fat hints weren’t enough, Dutch ECB member Klaas Knot spills the beans on QE, or if you wish, ties the knot. Here are the recent details emerging from the ECB, calculations … “ECB QE could theoretically surpass €2 trillion according to”

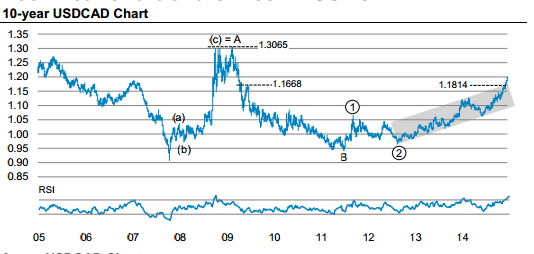

Buying USD/CAD – Morgan Stanley Chart Of The Week

The Canadian dollar had quite a few volatile days, with ranges of over 200 pips. What’s next for the loonie? The team at Morgan Stanley selects Dollar/CAD on 3 technical charts and points to the upside: Here is their view, courtesy of eFXnews: Morgan Stanley picks USD/CAD as its technical FX chart of the week, where … “Buying USD/CAD – Morgan Stanley Chart Of The Week”

EUR/USD: Staying Bearish With A Wide Range Into ECB –

Is the ECB QE priced in or not priced in? That remains an open question in markets, also after the shocking SNB decision to remove the EUR/CHF peg. The team at BTMU explain their positioning, taking the SNB move into consideration, and offer a bearish bias: Here is their view, courtesy of eFXnews: The following … “EUR/USD: Staying Bearish With A Wide Range Into ECB –”

ECB QE Base Scenario: €500-€750 billion – Credit Suisse

An announcement on Quantitative Easing by the ECB seems imminent after recent comments from the Bank’s chiefs, including Draghi, and after the removal of the Swiss peg. The team at Credit Suisse provides an in-depth analysis and various scenarios for the big event on January 22nd: Here is their view, courtesy of eFXnews: In the run-up … “ECB QE Base Scenario: €500-€750 billion – Credit Suisse”

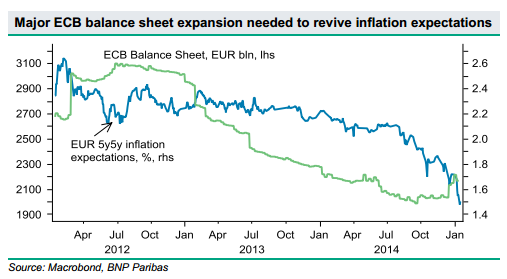

The ECB’s time to shine: how to position with EUR?

A lot of details are pouring in regarding the size and the details of the ECB’s QE program, which is set to be announced on Thursday, January 22nd. But is such an announcement already baked into the price of the euro? Not necessarily so. The team at BNP Paribas explain why they remain EUR bears: … “The ECB’s time to shine: how to position with EUR?”

SNBomb, ECB Preview, US wages, Saudi costs and the

Our weekly podcast came just in time after the shocking removal of the EUR/CHF floor. We begin with this and move on the very correlated upcoming event: the upcoming ECB meeting in which QE is on the cards. We then look at the state of the states, especially wages, before questioning how cheap Saudi oil really … “SNBomb, ECB Preview, US wages, Saudi costs and the”

EUR/USD: Trading the UOM January 2015

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Update: US Consumer Sentiment jumps to 98.2 – better than expected Here are all the details, and 5 possible … “EUR/USD: Trading the UOM January 2015”

Bearish EUR; Bullish Gold – Levels & Targets – BofA

Gold managed to emerge as one of the winners from the recent market turmoil. On the other side of the equation, the euro suffered from the removal of the Swiss bid. The team at Bank of America Merrill Lynch analyzes the charts and sets targets: Here is their view, courtesy of eFXnews: Gold in Euros ( XAU/EUR) … “Bearish EUR; Bullish Gold – Levels & Targets – BofA”