British CPI, released each month, is the primary gauge of consumer inflation. A reading which is higher than the market forecast is bullish for the pound. Update: UK inflation plunges to 0.5% – GBP/USD follows Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at 9:30 GMT. Indicator Background Analysts consider CPI one … “GBP/USD: Trading the British CPI Jan 2015”

Category: Opinions

Tough times ahead for the Australian economy

The Australian economy took a hit last week as retail sales came in well below expectations fuelling speculation again that the Reserve Bank of Australia will need to lower interest rates in order to kick start the economy. Retail sales in Australia rose by 0.1% in November lower than analyst’s expectations of a 0.2% rise … “Tough times ahead for the Australian economy”

What is behind the strength of the NZD?

If you look at the NZD daily charts against any of the 7 major forex currencies, you will see that NZD is making a very strong progress against all of them. How is this possible for a commodity currency when most commodity prices have recently been falling? Here are 4 reasons which help to explain … “What is behind the strength of the NZD?”

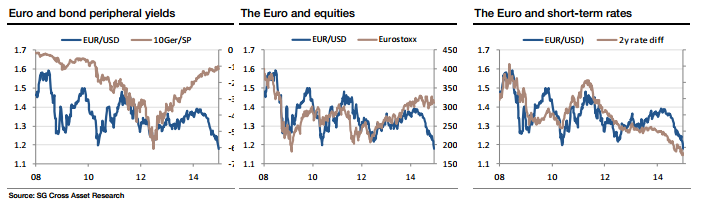

EUR/USD: Is Market Ahead Of Itself? – SocGen

The fall of EUR/USD has been quite spectacular in the last days of 2014 and the early days of 2015 – falls which sent the pair to the lowest levels since 2006. Is this all too soon? Did the market get ahead of itself? Kit Juckes of Societe Generale answers: Here is their view, courtesy of eFXnews: … “EUR/USD: Is Market Ahead Of Itself? – SocGen”

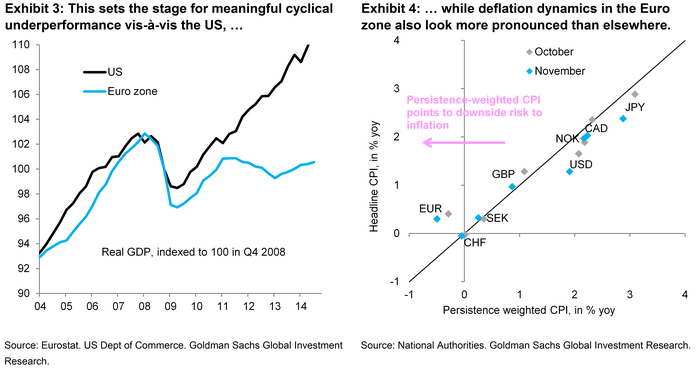

EUR/USD at 0.90 by end 2017 – Goldman Sachs updated

While EUR/USD managed to bottom out after the mixed Non-Farm Payrolls report, this is not necessarily a long lasting bounce. Euro/dollar parity is no longer ruled out in the longer term, and the bank provides targets for the shorter term as well as explanations for the downgrade of forecasts: Here is their view, courtesy of eFXnews: The … “EUR/USD at 0.90 by end 2017 – Goldman Sachs updated”

Has EUR/USD bottomed out? This pattern looks familiar

EUR/USD is trading at 1.1830: these are very low levels when looking back just one week and especially if we look back at the pre-holiday levels, but it has already seen lower levels this week. Looking at NFP reactions from October, November and December, we see a significant bounce of the pair. So, has EUR/USD reached a low … “Has EUR/USD bottomed out? This pattern looks familiar”

3 reasons why US wages are set for a big

The US enjoyed another strong month of job gains in December, but a big disappointment came from the drop in wages: 0.2% m/m and a slide to a gain of only 1.7% y/y. This casts a lot of doubts whether the Federal Reserve will be able to raise rates in 2015. However, here are 3 reasons to expect a … “3 reasons why US wages are set for a big”

EUR/USD crash explained, FOMC minutes rundown, US jobs and

EUR/USD had a spectacular crash in the wake of 2015. We explain what’s behind it, what is already priced in and what isn’t. The Fed is seems to be smooth sailing towards hiking, but there are bumps on the road and data dependency: yes the NFP. And, we examine another effect of falling oil: the Caribbean country of … “EUR/USD crash explained, FOMC minutes rundown, US jobs and”

EUR/USD: Trading the US NFP Jan 2015

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Update: Non-Farm Payrolls +252K, unemployment, unemployment 5.6% Published on Friday … “EUR/USD: Trading the US NFP Jan 2015”

2015 Preview for currencies & commodities: the Fed hike,

An exciting 2014 has ended and we have a packed show previewing the currencies and commodities in 2015: when will the Fed hike and how will the dollar react? How low can the euro go? Can it bounce back? And the same question goes for oil? For the pound, politics play a particularly important part, and for … “2015 Preview for currencies & commodities: the Fed hike,”