The British pound is on the back foot against the greenback, trading at the 1.50 handle. Can it break lower, or is it set for a rebound? The team at ANZ sees the recent moves as overdone, and explains: Here is their view, courtesy of eFXnews: Cable’s plunge in early 2015 looks overdone as the … “GBP/USD: Selling Overdone; Buy On Further Dips – ANZ”

Category: Opinions

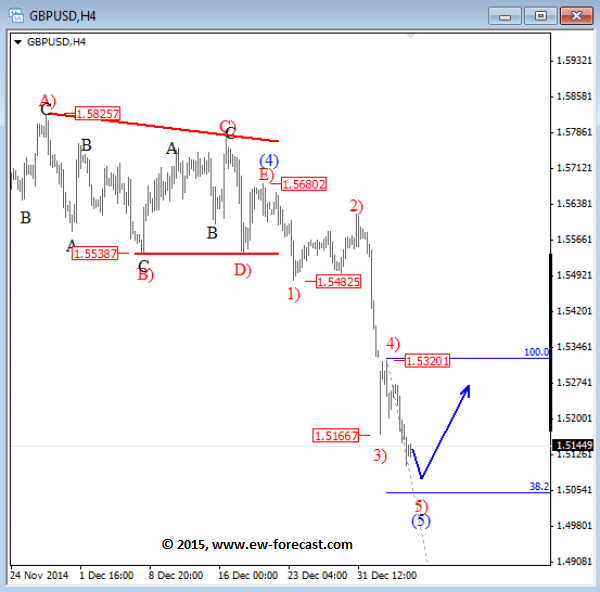

EUR/USD support seen at 1.1750, GBP/USD at 1.5000 –

EURUSD is already at the lows, which means that wave 4) is probably done near 1.1970 so wave 5) is now in play for lower levels. We are looking for a potential weakness to 1.1750 where the market could be looking for some support, especially as we see the price in late stages of an … “EUR/USD support seen at 1.1750, GBP/USD at 1.5000 –”

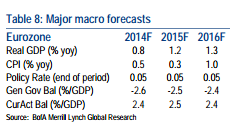

How Far QE Will Go?; Forecasts & Risks for EUR/USD

Quantitative Easing in the euro-zone is probably on the way. How much of it is already priced in? Did the markets get ahead of themselves? The analysts at Bank of America Merrill Lynch weigh in: Here is their view, courtesy of eFXnews: By the end of 2014, the ECB provided strong signals that sovereign QE … “How Far QE Will Go?; Forecasts & Risks for EUR/USD”

EUR/USD: A QE program worth over €500 billion could

Chances for an announcement of QE in the euro-zone seems more than imminent after the zone slipped into deflation. Is the move already priced in? The focus now moves to the size of the program. The team at BTMU explains the critical number for the ECB and EUR/USD and provides price targets: Here is their view, courtesy … “EUR/USD: A QE program worth over €500 billion could”

AUD/USD: Trading the Australian Building Jan 2015

Australian Buildings Approvals measures the change in the number of new building approvals issued. It is one of the most important indicators of the construction sector. A reading that is higher than the market prediction is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Thursday at … “AUD/USD: Trading the Australian Building Jan 2015”

Trading 3 Major Support Zones on the Weekly Chart

Many traders make the mistake of entering trades without looking at the long-term charts. This mistake can influence the outcome of the trade as the daily chart might not show a major support or resistance zone which can only be seen on the weekly or monthly charts. We will look into 3 setups based on … “Trading 3 Major Support Zones on the Weekly Chart”

Doom and gloom for the Australian economy

The Australian dollar has had a horror start to the year falling to its lowest level in in over 5 years with no bottom in sight as weak iron ore prices, a resurgent US economy and a slowdown in China take its toll on the currency and the overall economy. In early trade on Monday … “Doom and gloom for the Australian economy”

GBP/USD Trading the UK Services PMI January 2015

The British Services PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the services sector. Respondents are surveyed for their view of manufacturing conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Update: UK Services PMI falls to 55.8 – new low for GBP/USD Here are all the details, … “GBP/USD Trading the UK Services PMI January 2015”

Forex: 2015 will be year of US interest rate rise

The scene looks set for the US Federal Reserve to start raising interest rates in 2015 – a shift in the monetary cycle, which could unleash more turmoil in currency and other markets, such as equities. It will also highlight increasing divergence between the US and the Eurozone and Japan. The US economy is in … “Forex: 2015 will be year of US interest rate rise”

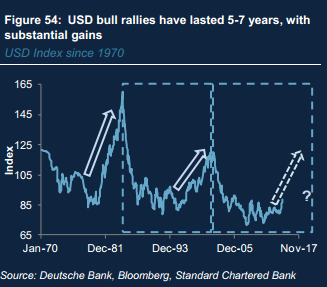

Despite Its Sharp Rally, The USD Is Still Cheap –

Yes, the dollar ran higher and higher, but it probably is not enough. And it is not only a euro story, or weaker China hitting the Australian dollar, oil hitting the loonie and elections weighing on the pound. If this is a historic dollar cycle, there is so much room to run. The team at Standard … “Despite Its Sharp Rally, The USD Is Still Cheap –”