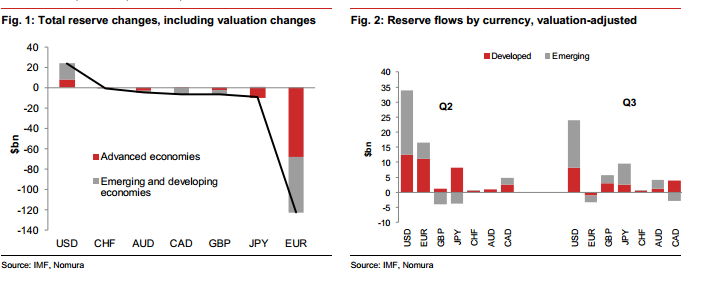

EUR/USD began 2015 with a storm and already reached the lowest levels since 2010. Comments by Draghi are one reason, but not the only one. The tam at Nomura provides a much bigger issue for the single currency: Here is their view, courtesy of eFXnews: Every quarter the IMF puts out a snapshot of global central … “This Could Be A ‘Big Deal’ For Faster EUR Decline”

Category: Opinions

4 reasons why EUR downside could accelerate because of

Greece is back to the headlines after PM Samaras’ presidential bid failed and the country is heading to parliamentary elections. This has already weighed on the euro, but is there more? The team at Nomura provides 4 reasons why the euro’s downfall could accelerate in early January: Here is their view, courtesy of eFXnews: With … “4 reasons why EUR downside could accelerate because of”

Trading the EUR/CHF peg at 1.2000

If someone says he has a 100% trade setup in the Forex Market, you have to be very skeptical about the person. Do not forget something: there is no 100% trade setup in this business. You have to be always prepared for the unexpected. You need different strategy for different pairs as many pairs have … “Trading the EUR/CHF peg at 1.2000”

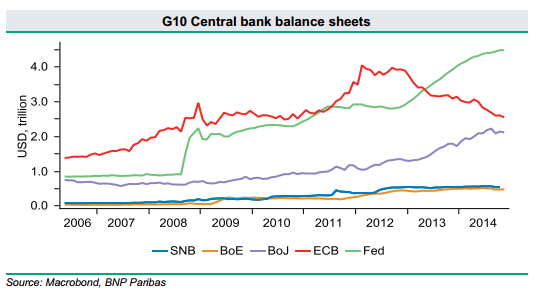

EUR/USD To Start Its Descent To 1.15; We Stay Short

After all the falls in EUR/USD, is there still time for a short? All those 2015 predictions are getting closer as 2014 draws to an end. The team at BNPP sees the descent to 1.15 starting soon, explains and provides a chart: Here is their view, courtesy of eFXnews: Policymakers will continue to dominate the … “EUR/USD To Start Its Descent To 1.15; We Stay Short”

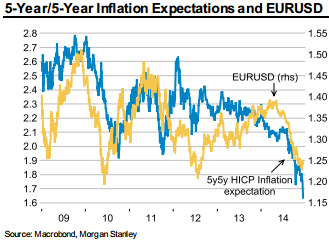

EUR/USD To Fall To 1.12 Without QE Or 1.05 With

While many see downside risks for EUR/USD, few are as bold as to set the following targets: 1.12 or 1.05 in case of QE, very close to parity. The team at Morgan Stanley explain: Here is their view, courtesy of eFXnews: EUR is the most extreme short-positioned currency in the G10, notes Morgan Stanley. “However, … “EUR/USD To Fall To 1.12 Without QE Or 1.05 With”

5 EUR/USD Downside Drivers & Targets – Nomura

The euro remains pressured to the downside and it may not be all over. The team at Nomura present 5 downside drivers for EUR/USD and describe the lower targets: Here is their view, courtesy of eFXnews: It took fairly severe risk aversion to see a squeeze in EURUSD up to above 1.25 earlier this week; and … “5 EUR/USD Downside Drivers & Targets – Nomura”

Divergence, Deflation and the Dollar – 2014 in Forex

For the forex markets 2014 can be largely summed up in just two words: Divergence and Deflation. It was also the year of the USD, which enjoyed a spectacular rally. The USD index was around 80 at the end of December 2014 and by the end of December 2015 it was 89.60 with it really … “Divergence, Deflation and the Dollar – 2014 in Forex”

EUR/USD: Trading the US Unemployment Claims Dec 2014

US Unemployment Claims is released weekly, and measures the number of people filing for unemployment for the first time. It is considered an important measure of the health and direction of the US economy. A reading which is higher than the market forecast is bullish for the euro. The indicator is usually released on Thursdays, … “EUR/USD: Trading the US Unemployment Claims Dec 2014”

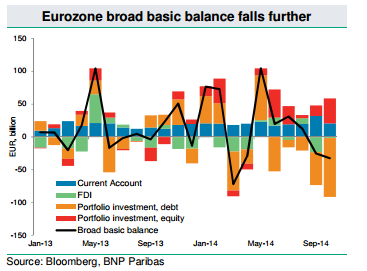

We Stay Short EUR/USD; More Reasons To Be Short EUR

If you needed more reasons to understand the euro’s move south and EUR/USD grind lower, the team at BNP Paribas provides explanations. And, they also have a trade setup for EUR/USD: Here is their view, courtesy of eFXnews: October’s balance of payments data continues to suggest real flow support for the EUR is waning, notes … “We Stay Short EUR/USD; More Reasons To Be Short EUR”

Is the New Zealand Dollar ready for a rise?

The answer might be found in the COT Report. The Commitment of Traders Report (COT Report) measures the net long and short positions of the market players. These players are the Commercials, Non-Commercials and Retail traders. A net position extreme reading suggests that a trend reversal is in the play. Before getting too excited about … “Is the New Zealand Dollar ready for a rise?”