PM May will present a new Brexit deal her cabinet has discussed. Sterling jumped on hopes that this time it can pass. The past shows that parliament is not keen on approving an accord. GBP/USD seemed to have ended its losing streak. After hitting a new four-month low at 1.2685, cable is currently trading closer to … “May’s deal may not be enough and GBP/USD could fall back down”

Category: Opinions

USD/CAD: Reversion & Seasonals Point To USD/CAD Upside Risk Through 1.36 – BofAML

USD/CAD has mixed forces pulling it to all directions. What are the levels to watch? Here is their view, courtesy of eFXdata: Bank of America Merrill Lynch Global Research discusses USD/CAD outlook and maintains a bullish bias, on the back of unsustainable Fed vs. BoC policy pricing and bullish seasonals. “Since early last year, there have … “USD/CAD: Reversion & Seasonals Point To USD/CAD Upside Risk Through 1.36 – BofAML”

USD/JPY recovery capped as trade wars escalate

USD/JPY has managed to stabilize despite further blows in the trade war. The Fed meeting minutes, durable goods orders will join the trade concerns in moving markets. The technical outlook remains bearish for the currency pair and experts are bearish in the short term. What just happened: Chinese retaliation, Huawei Another week, another escalation in … “USD/JPY recovery capped as trade wars escalate”

GBP/USD may extend its falls as PM Johnson is feared

GBP/USD dropped sharply as PM May is getting closer to leaving. Apart from Brexit, US-Sino trade relations, and UK inflation stand out. The technical outlook is now fully bearish for the currency pair. Experts are mostly bullish after the fall. What just happened: The beginning of June is the end of May UK PM Theresa … “GBP/USD may extend its falls as PM Johnson is feared”

Boris Johnson may do a De-Gaulle on Brexit

UK PM May is set to step down and Boris Johnson is the leading candidate to replace her. The erratic former Foreign Secretary may increase GBP/USD volatility. Despite his Brexit credentials, he could still lift the pound. After a tear-provoking meeting with her backbenchers, UK PM Theresa May pledged to set a date for her … “Boris Johnson may do a De-Gaulle on Brexit”

Could the FED Change Interest Rates in 2019?

On March 20th, the FOMC (Federal Open Market Committee) decided to keep the key interest at the same 2.25-2.5% levels. The move was in line with the market’s expectations, and the US central bank also announced that there won’t be any additional rate hikes this year, due to weakening economic conditions. QT ending in September … “Could the FED Change Interest Rates in 2019?”

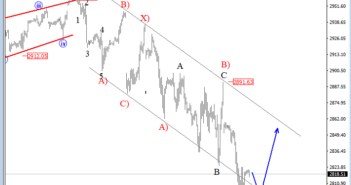

Elliott wave Analysis: DAX, The S&P500 and XXX/JPY Pairs Having a Great Connection; A Bullish Reversal in View

Stocks are lower, still in search of support. We see German Dax reaching a very interesting area around 11800 where bears may slow down as second zigzag seems very similar in a distance of the first zigzag. Ideally, there will be a strong bounce from that area, but it should be in impulsive fashion to … “Elliott wave Analysis: DAX, The S&P500 and XXX/JPY Pairs Having a Great Connection; A Bullish Reversal in View”

3 reasons for the dollar’s fall on China’s retaliation

China is retaliating with tariffs and threats of taking further measures The greenback is falling sharply against majors. There are three reasons for the fall of the USD. The US Dollar has sunk after China announced launched its torpedo countermeasures in retaliation to the new US tariffs. So far, the ongoing negotiations provided hopes that it … “3 reasons for the dollar’s fall on China’s retaliation”

UK wages and unemployment are unlikely to rock the pound

GBP/USD struggles with 1.3000, not going anywhere fast. Brexit continues tearing Britain’s main parties apart and talks are closer to breaking up. The technical outlook leans to the downside for the currency pair. Nigel Farage’s new Brexit party will receive more votes than the Conservatives and Labour combined in the upcoming European elections, according to a weekend … “UK wages and unemployment are unlikely to rock the pound”

Cryptos: What’s next after the Sunday surge?

Cryptocurrencies have shot higher over the weekend as more money pours in. Bitcoin jumped by around $1,000 and the others also pushed higher. Here are the levels to watch according to the Confluence Detector. The Tether scandal may belong to the past, at least according to recent price action. Digital coins are not constrained by … “Cryptos: What’s next after the Sunday surge?”