Euro-zone growth is expected to have picked up in Q1. While there are some green shoots, real improvement is unlikely. EUR/USD has room to fall if growth remains sluggish. The euro-zone publishes the preliminary read of Q1 GDP on Tuesday, April 30th, at 9:00 GMT. The old continent markedly slowed down in 2018 after enjoying … “Euro-zone GDP expectations may be too high – watch EUR/USD”

Category: Opinions

GBP/USD is waiting for two hammers to fall

GBP/USD fell sharply on USD strength, Brexit impasse. Brexit partially gives way to the Bank of England’s Super Thursday. The technical picture is bearish for the pair. Experts are bearish in the short term but bullish afterward. This was the week: Succumbing to USD strength Parliament returned, but not much happened in cross-party talks between … “GBP/USD is waiting for two hammers to fall”

4 reasons for the post-GDP USD fall and why it can make a comeback

US GDP grew by an impressive 3.2%, with less impressive components. A rate hike seems less likely after the release. The US Dollar dropped but has room to rise The US economy grew by an annualized rate of 3.2% in Q1 2018 according to the initial release. The figure came out above the official expectations … “4 reasons for the post-GDP USD fall and why it can make a comeback”

EUR/USD: Tactically Bearish For A Retest Of 1.10 & 1.09 Near-Term – MUFG

EUR/USD is trying to recover after falling to the lowest levels since June 2017. But it still remains under pressure. Here is their view, courtesy of eFXdata: MUFG Research discusses EUR/USD outlook and adopts a tactical bearish bias, expecting the pair to trade with a downward direction in 1.1300-1.0900 range in the near-term. “The euro has … “EUR/USD: Tactically Bearish For A Retest Of 1.10 & 1.09 Near-Term – MUFG”

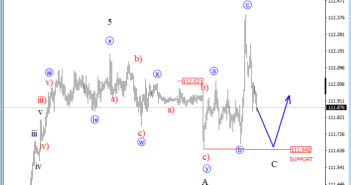

Elliott wave Analysis: S&P500 and USDJPY Intra-day View

Good morning traders, Stocks are coming down a little, but not much, so we see the SP500 in sub-wave four which may see support at the recent swing high, so ideally there is going to be another push higher up to 2960. Only a decline below 2900 May suggests that a temporary top is already … “Elliott wave Analysis: S&P500 and USDJPY Intra-day View”

5 scenarios for Spain’s elections

Spaniards go to the polls on Sunday and polls show a divided country. The various political scenarios may take time to materialize. EUR/USD may enjoy the results, but it will take time. Citizens of the fourth-largest economy in the euro-zone vote in general elections on Sunday, April 28th. Voting ends at 18:00 GMT. Exit polls … “5 scenarios for Spain’s elections”

USD/JPY has room to fall on a paralyzed BOJ

The BOJ is set to leave its policy unchanged at the sixth anniversary of its QQE program. There is little maneuvering space for the central bank. The Japanese yen could strength on the inability to act. The Bank of Japan announces its rate decision and releases its Outlook for Economic Activity and Prices in the … “USD/JPY has room to fall on a paralyzed BOJ”

USD/JPY capped at the double-top, all eyes on US GDP

USD/JPY consolidates its gains at the highs amid stability in economic indicators. US retail sales stand out ahead of Easter. The technical picture is bullish for the pair. This was the week: Signs of economic recovery Chinese GDP growth beat expectations with 6.4% annualized growth in Q1. While many doubt the veracity of the data … “USD/JPY capped at the double-top, all eyes on US GDP”

EUR/USD fears another devastating German PMI

Germany, the largest economy in Europe, is suffering major hiccups. The forward-looking Manufacturing PMI is closely watched after last month’s nasty surprise. EUR/USD watches is looking for a new direction. Markit releases its forward-looking Purchasing Managers’ Indices for Germany on Thursday, April 18th, at 7:30 GMT. The 500-strong survey of around purchasing managers asks them … “EUR/USD fears another devastating German PMI”

GBP/USD could rise on an OK UK inflation report

UK inflation has likely risen in March back to the target. The BOE is still paralyzed by Brexit but will take note. With Brexit on break, a second consecutive positive number may already lift the pound. The UK publishes its inflation report on Wednesday, April 17th, at 8:30 GMT. The headline Consumer Price Index (CPI) … “GBP/USD could rise on an OK UK inflation report”