The final read for UK Q4 GDP is expected to confirm the previous figures. A revision of the yearly growth figure and investment could trigger short-term action. Brexit remains left, right, and center for GBP/USD movements. The UK publishes its final Gross Domestic Product report for the fourth quarter of 2018 on Friday, March 29th, … “UK GDP could provide a temporary relief from Brexit headlines for GBP/USD”

Category: Opinions

USD/JPY: How low can it go? Many factors in play

USD/JPY dropped as the Fed went dovish but never went too far. US GDP, housing figures, and more events could rock the boat. The technical picture is bearish for the pair. Experts are bearish in the short term. This was the week: Dovish Fed, Brexit drama The Federal Reserve took another dovish twist. After pledging … “USD/JPY: How low can it go? Many factors in play”

3 ways Brexit can go and the potential GBP/USD reactions

GBP/USD is back down, failing to take advantage of the Brexit chaos weighs. Eight days to go, there are three scenarios left. The technical picture is worsening for the pair which is nearing oversold territory. GBP/USD is trading back below 1.3200 as the Brexit uncertainty continues. The state of Brexit On Wednesday, UK PM Theresa May … “3 ways Brexit can go and the potential GBP/USD reactions”

Buying opportunity on GBP/USD? This anarchy could turn positive

GBP/USD dropped on May’s request for a short extension. The EU’s cold response added additional pressure. Things can turn around quite quickly and may provide a buying opportunity on cable. Under pressure from Brexit-supporting ministers, UK PM Theresa May asked for a short extension to Article 50: only up to June 30th. The embattled PM would … “Buying opportunity on GBP/USD? This anarchy could turn positive”

BOE could impact GBP/USD despite Brexit, in two different ways

The BOE is set to leave its policy unchanged amid high Brexit uncertainty. Upbeat economic data make a case for a rate hike after we get Brexit certainty. Comments in the meeting minutes can impact the pound in the short term and affect the future moves. The Bank of England makes its rate decision on Thursday, March … “BOE could impact GBP/USD despite Brexit, in two different ways”

GBP/USD will have another reason to rise once Brexit is resolved

The UK jobs report came out significantly better than expected. This adds to the BOE’s reasons to raise rates and will push the pound higher. But nothing will move until Brexit is resolved. The UK published its labor market report around 12 minutes earlier than expected. Are UK authorities keen to show they are up-to-speed … “GBP/USD will have another reason to rise once Brexit is resolved”

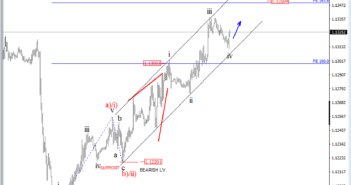

Elliott wave Analysis: EURUSD and USDCHF In Negative Correlation

Hello traders, and welcome to our intra-day updates. Let’s start the day with EURUSD. On EURUSD we are tracking a bigger three-wave recovery in play, which we labeled as wave a)/i), b)/2) and now c) or iii). That being said, at the moment we see price nicely unraveling a five-wave rally within wave c)/iii) with … “Elliott wave Analysis: EURUSD and USDCHF In Negative Correlation”

Yen enjoys safe haven flows on doom and gloom, more to come?

USD/JPY dropped sharply as worries about the economy grew A big bulk of US figures will give a clearer picture of the situation. The technical picture remains mostly bullish for the pair. Experts see a bullish move in the short and medium terms and a drop afterward. This was the week: Worries, worries, worries The … “Yen enjoys safe haven flows on doom and gloom, more to come?”

CAD saved by the jobs reports after the BOC hits it hard

USD/CAD shot higher on the BOC’s dovishness but the jobs report stabilized it. A light calendar leaves the focus on oil and global developments. The technical picture is bullish for USD/CAD while experts are bullish only in the short-term. This was the week: BOC changes its mind, oil, jobs The Bank of Canada all but removed its … “CAD saved by the jobs reports after the BOC hits it hard”

5 reasons to buy the NFP Dollar Dip

The US gained only 20K jobs in February and the US Dollar dropped. The acceleration in wages and the effect of the government shutdown should allay fears. The US Dollar has room to rise, especially as the other currencies have their issues. The American economy gained a meager 20K positions in February, far worse than … “5 reasons to buy the NFP Dollar Dip”