The Fed is due to deliver its meeting minutes later in the day. What can we expect? Here is their view, courtesy of eFXdata: Bank of America Merrill Lynch Research discusses its expectations for tomorrow’s FOMC minutes from the January meeting. “The minutes of the January FOMC meeting will be of particular interest given the … “USD: 3 Things To Look At The FOMC Minutes On Wed – BofAML”

Category: Opinions

USD: FOMC Minutes To Reveal If Hike Cycle If Complete Or Still Part Of Baseline Outlook – Barclays

The FOMC Meeting Minutes may reveal more about the next steps due by the Federal Reserve. Where will the USD go? Here is their view, courtesy of eFXdata: Barclays Research discusses its expectations for the FOMC minutes from the January meeting. “We look to the minutes of the January FOMC meeting for insights as to … “USD: FOMC Minutes To Reveal If Hike Cycle If Complete Or Still Part Of Baseline Outlook – Barclays”

3 reasons for euro/pound to rise, and where to

Bad news may be priced into the euro and not to the pound. The “Brexit cross” has room to move after a bit of stagnation. The technical levels provide guidance to the next moves of the pair. Euro/pound, aka the “Brexit cross” has been remarkably stable as Brexit nears. But such limited movement does not … “3 reasons for euro/pound to rise, and where to”

EUR/USD: Need To Close Above 1.1345 To Reinforce Support – TD

EUR/USD hit new two-month lows as the situation in Europe worsens. What’s next? Here is their view, courtesy of eFXdata: TD Research discusses EUR/USD outlook and highlights the importance of closing above the 1.1345 level to regain some support in the near-term. “The majors sit mostly in a holding pattern, as the recent sessions showed … “EUR/USD: Need To Close Above 1.1345 To Reinforce Support – TD”

USD/JPY rally may have ended and more falls could come

USD/JPY extended its advance but dropped on a risk-off atmosphere. The FOMC Meeting Minutes stand out and trade remains in the limelight. The technical picture is marginally bullish for the pair. This was the week: Talks continue, US retail sales plunge US-Chinese talks were held at top-level in Beijing between US Trade Representative Robert Lighthizer, Treasury Secretary … “USD/JPY rally may have ended and more falls could come”

USD: US CPI: Nothing In It To Sway The Fed From Doing ‘Nothing’ For Now – CIBC

Inflation is on the rise in the US and some suspect a rate hike is coming. Perhaps not so fast. Here is their view, courtesy of eFXdata: “By the magic of seasonal adjustment and methodology revisions, US CPI managed to be both a bit hotter and a bit cooler than expectations at the same time. … “USD: US CPI: Nothing In It To Sway The Fed From Doing ‘Nothing’ For Now – CIBC”

Bitcoin, Ethereum, Ripple face clear caps that once broken, may set them loose

Cryptocurrencies continue consolidating as the next moves are awaited. All three have clear caps they must cross in order to move higher. Here are the levels to watch according to the Confluence Detector, our proprietary tool. Not much has changed in the world of cryptocurrencies in the past 24 hours. Prices have been stable and … “Bitcoin, Ethereum, Ripple face clear caps that once broken, may set them loose”

Crypto confluences point to losses, at least in the short term

is After bottoming out, cryptocurrencies consolidated in range. They now seem to face significant resistance and may fall before resuming the rises. Here are the levels to watch according to the Confluence Detector, our proprietary tool. Ethereum led the rise of cryptocurrencies from the lows, Ripple enjoyed it as well, and Bitcoin also moved a … “Crypto confluences point to losses, at least in the short term”

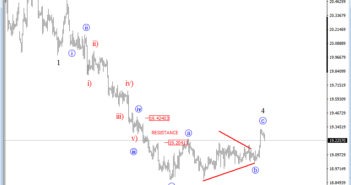

Elliott wave Analysis: USDMXN and CADJPY Update

USDMXN is still trading in a correction of wave 4 despite that bigger wave »c« recovery. The most important thing is that we have a triangle in wave »b« and we know that triangles cannot occur in wave 2, so it must be a correction! Anyhow, we remain bearish here for wave 5 towards new … “Elliott wave Analysis: USDMXN and CADJPY Update”

Global gloom: 5 worries and signs of relief to look for

Markets have stabilized but remain worried about quite a few issues going on in the world. Here is a quick update on the five things on investors’ minds and the signs of relief that could lift the gloom, the mood, and stocks. Trade talks China and the US are working to get a trade deal … “Global gloom: 5 worries and signs of relief to look for”