BTC/USD had a week of consolidation amid negative news. The ongoing US government shutdown puts a Bitcoin ETF approval on ice. The technical picture is balanced for Bitcoin. Cryptocurrencies suffered a mini “flash crash” early in the week. The move sent BTC/USD to a low point of $3,433 but the granddaddy of digital coins bounced … “Bitcoin ignores bad news, time to rise?”

Category: Opinions

3 reasons why the dollar is down

The US Dollar is falling with significant drops against commodity currencies. The arrest of former Trump adviser Stone and reports about the Fed’s dovishness weigh. The ongoing shutdown does not help, and there’s no end in sight. The US Dollar is falling against the recovering euro and more prominently against commodity currencies. It does not … “3 reasons why the dollar is down”

EUR: The ECB Effectively Closed The Door For Rates ‘Lift-off’ Under Draghi’s Watch – SEB

The ECB left its policy measures unchanged and acknowledged the slowdown. However, Draghi remained optimistic about wages. What’s next? Here is their view, courtesy of eFXdata: “As expected, today’s ECB (interim) meeting delivered no monetary policy changes. All policy parameters including the wording of forward guidance remained unchanged. Contrary to our expectation, however, the ECB … “EUR: The ECB Effectively Closed The Door For Rates ‘Lift-off’ Under Draghi’s Watch – SEB”

EUR/USD enjoys Draghi’s balance, but could fall in March

The ECB’s message is finely balanced between risks and confidence. EUR/USD buys this relative confidence, at least for now. The door is open to a dovish shift in March. The European Central Bank left its policy and messages unchanged. The interest rate may still rise in September despite growing signs of a slowdown. President Mario Draghi balanced … “EUR/USD enjoys Draghi’s balance, but could fall in March”

USD: ‘A Peak Is One Thing, Depreciation Is Another’ – NAB

The US Dollar has been under pressure recently. Has it peaked? Where will it go next? Here is their view, courtesy of eFXdata: NAB Research discusses the USD outlook and maintains a structural bearish bias through 2019. “When we think about the USD’s medium-term trajectory, our view is conditioned by both valuation and structural considerations. In … “USD: ‘A Peak Is One Thing, Depreciation Is Another’ – NAB”

Fed Preview: Patience is priced in, but Powell’s tone could be decisive for the dollar

The Fed made a dovish shift in recent statements. Now it’s time to make it official. But how will the US Dollar react? A lot depends on Powell’s tone at the press conference. Fed decision: Wednesday: decision at 19:00, press conference at 19:30. In the final decision for 2018, the Federal Reserve raised interest rates … “Fed Preview: Patience is priced in, but Powell’s tone could be decisive for the dollar”

BOJ has new reasons not to reach its inflation target

The BOJ is set to keep interest rates unchanged in the first decision of 2019. The global slowdown provides an excuse to push back the inflation targets. The decision will not change the yen’s safe-haven status anytime soon. The Bank of Japan makes its first rate decision for the year on Wednesday, January 23rd, late … “BOJ has new reasons not to reach its inflation target”

EUR/USD: No New Signals From Next Week ECB Means EUR/USD Still At Stage 1 Of 3 – Danske

EUR/USD dropped from the highs as fears about the euro-zone grew. What’s next? The ECB is in focus. Here is their view, courtesy of eFXdata: Danske Research discusses its expectations for next week’s ECB policy meeting. “With no new policy signals expected next week, we stick to our three-stage rocket to orbit view for the … “EUR/USD: No New Signals From Next Week ECB Means EUR/USD Still At Stage 1 Of 3 – Danske”

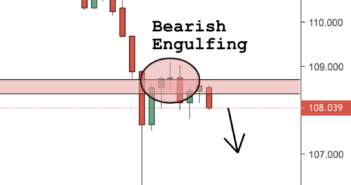

The Japanese yen is looking bearish

I am looking at the USDJPY pair. It looks like the bears are in control of price action again. After the flash crash from last week, there is some new selling enthusiasm that is developing. There are a few technical indications that tell me a continuation of the downtrend is imminent. There was a bearish … “The Japanese yen is looking bearish”

Bitcoin buying opportunity? 3 reasons

BTC/USD fell back down after rising gradually. Interest from Russia and the upcoming launch of Bakkt provide hope. The charts show that Bitcoin is balanced. The grandaddy of cryptocurrencies climbed up gently and dropped back to the bottom of the apparent range. However, it refrained from diving back to the pre-holiday season lows. Here are three … “Bitcoin buying opportunity? 3 reasons”