EUR/USD had another down week, reaching 5-month lows. What’s next? Here is their view, courtesy of eFXdata: Bank of America Merrill Lynch Research discusses EUR/USD outlook and maintains a tactical bearish bias, expressing that via holding a short EUR/USD position targeting a move to 1.15. “The USD rally is not done yet, in our view. We see the considerable risk … “EUR/USD: FX/CTA Pressing To Downside & Leveraged Flat; Staying Short – BofAML”

Category: Opinions

EUR/USD: Market Bias Is To Sell Bounces; Eyes Dec Low At 1.1720 – SocGen

The euro is under pressure but it managed to stabilize around 1.18. What´s next? Maybe it can go lower. Societe Generale Cross Asset Strategy Research discusses EUR/USD outlook and notes that the break of 1.1825 opens the door towards December’s lows at 1.1720, which was the springboard for the move to 1.25. Meanwhile, ScoGen thinks that BTP/Bund spread … “EUR/USD: Market Bias Is To Sell Bounces; Eyes Dec Low At 1.1720 – SocGen”

The dollar roller coaster is back

US Retail Sales mostly met expectations, but revisions were to the upside. The US Dollar was already on the move ahead of the release on higher yields The US Retail Sales report was only an excuse. The real story is the resumption of the rally in 10-year yields. US yields are above 3.05%, the highest … “The dollar roller coaster is back”

Correction or crash? US Retail Sales to set new course for the dollar

All measures of Retail Sales are expected to rise, but with a significant variation. The Control Group measure holds the key to the reaction. The US Dollar made a significant correction on the previous critical figure and awaits the verdict from this report. The US Retail Sales are published on Tuesday, May 15th, at 12:30 … “Correction or crash? US Retail Sales to set new course for the dollar”

USD: April CPI Tilts The Odds In Favor Of 2 More Fed Hikes This Year Rather Than 3 – CIBC

US Core inflation came out at 2.1%, below expectations. What does it mean for the greenback going forward? Here is their view, courtesy of eFXdata: CIBC Research discusses its reaction to today’s US CPI report for the month of April. “Slowly but surely, inflation is heating up. US consumer prices advanced 0.2% in April, leaving … “USD: April CPI Tilts The Odds In Favor Of 2 More Fed Hikes This Year Rather Than 3 – CIBC”

Aussie faces resistance and is stuck down under

The AUD/USD reached the lowest levels in 11 months and began recovering as the US Dollar finally takes a breather. However, the pair may run into massive resistance. The Technical Confluences Indicator shows that the 0.7477 level is the convergence of the Simple Moving Average 200-15m, the SMA50-1h, the Fibonacci 38.2% one-day, the one-month low, the one-week low, and the … “Aussie faces resistance and is stuck down under”

USD/CAD awaits a hopeful Canadian jobs report

Canada is expected to post a second consecutive month of upbeat job gains. The high hopes for the April are based on other positive data but may lead to disappointment. The USD/CAD is looking for a new direction, and this report may supply it. Canada publishes its jobs report on Friday, May 11th, at 12:30 … “USD/CAD awaits a hopeful Canadian jobs report”

3 ways Trump can go on Iran and what it means for currencies

Trump is set to announce his decision on the Iran deal on Tuesday at 18:00 GMT. This is the most important foreign policy move in 15 months, and the world is watching. There are three potential scenarios for his decision and the impact on oil and currency values. US President Donald Trump will tell the … “3 ways Trump can go on Iran and what it means for currencies”

Casualties of War – The Financial Toll of an All-out Proxy War in Syria

There is one thing common to all wars fought by Man since time immemorial, apart from the death and destruction—it is an opportunity to make money. War and economics march hand in hand, and nowhere is that more clearly illustrated than in the complex war in Syria, which has now been raging for almost seven … “Casualties of War – The Financial Toll of an All-out Proxy War in Syria”

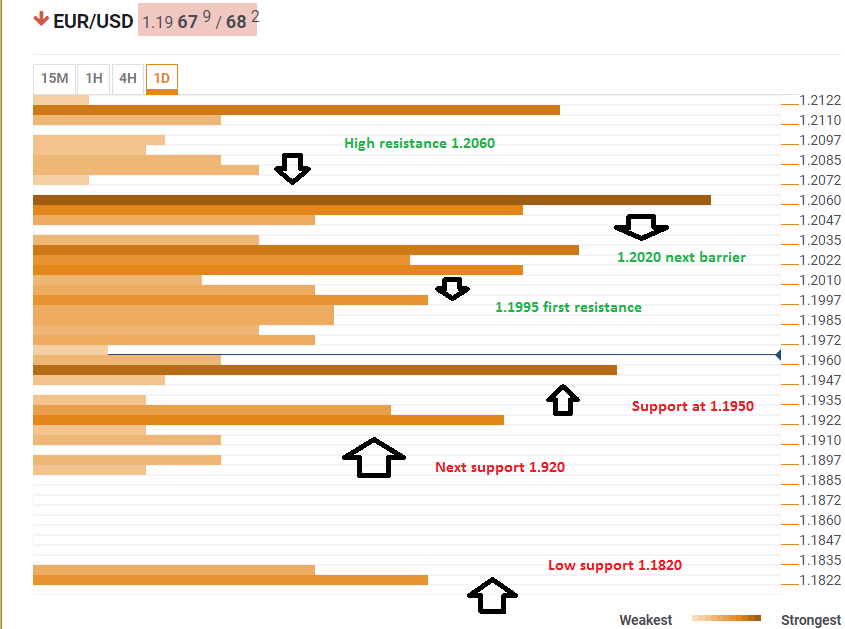

More resistance than support for the EUR/USD ahead of the NFP

The Technical Confluences Indicator shows that the battle lines are well-defined toward the all-important release of the US Non-Farm Payrolls. A congestion of support lines awaits around $1.1950 with the one-day High, the Bolinger Band one-day Lower, and the Pivot Point one-day Support 1. Further support is at $1.1920 which sees the confluence of the Pivot Point one-day S2 and … “More resistance than support for the EUR/USD ahead of the NFP”