The Dutch go to the polls on March 15th to elect a new parliament. While The Netherlands is not one of the big countries in the euro-zone, it is often seen as “the canary in coal mine” or a trendsetter. The outcome of the elections in Holland can reflect and/or influence elections elsewhere, more specifically in … “Dutch elections preview – all about who comes out first”

Category: Opinions

EUR/USD: Asymmetric Risk But Short Preferable Into French Elections

The euro has many forces moving it. The big political risk is the French Presidential Election. What can we expect for EUR/USD? Here is their view, courtesy of eFXnews: EUR/USD downside risks remains ahead of the French Elections, says Bank of America Merrill Lynch FX Strategy. In that regard, BofAML’s baseline does not include a Le Pen … “EUR/USD: Asymmetric Risk But Short Preferable Into French Elections”

GBP/USD: Trading the UK Claimant Count Change

The UK Claimant Count Change measures the change in the number of people claiming unemployment benefits. It provides a snapshot of the UK employment situation and could affect the direction of GDP/USD. Here are the details and 5 possible outcomes for GBP/USD Published on Wednesday at 9:30 GMT. Indicator Background UK Claimant Count Change is closely monitored, … “GBP/USD: Trading the UK Claimant Count Change”

GBP/USD: as politics get messy, reality could begin biting

The fall of cable is not solely the outcome of the hawkish Fed. The back and forth on the Brexit Bill as well as some worrying signs about consumption. Is the weak pound taking its toll? If so, we are seeing a vicious cycle. After explaining the reasons for the fall, we move to discussing … “GBP/USD: as politics get messy, reality could begin biting”

ECB’s hawkish twist – what’s next for EUR? – 3 opinions

EUR/USD managed to gain some ground after Draghi removed some urgency. What does this mean for the euro? Here are three opinions: Here is their view, courtesy of eFXnews: EUR: Here Is The Next Step From The ECB After the ‘Hawkish Twist’ – Danske The ECB kept all policy measures unchanged at today’s meeting, and … “ECB’s hawkish twist – what’s next for EUR? – 3 opinions”

EUR/USD: Trading the US Nonfarm Payrolls March 2017

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 13:30 GMT. Indicator Background Job … “EUR/USD: Trading the US Nonfarm Payrolls March 2017”

ECB Preview: a short-lived blow to the euro? [Video]

The European Central Bank is unlikely to change its policy. Nevertheless, this is an important meeting as new forecasts are released and as inflation lifts its head. Mario Draghi will have to play a fine balancing act between acknowledging the improving reality and expressing a need and desire for more stimulus. His magic could work … “ECB Preview: a short-lived blow to the euro? [Video]”

ECB Preview: acknowledging reality or playing it down?

The European Central Bank not only makes its decision (where no change is expected) but also releases new staff forecasts for growth and inflation. This makes the March 9th decision an important one. With the latest inflation figures for February already out, it’s time to analyze the big event that will hopefully move the euro out of … “ECB Preview: acknowledging reality or playing it down?”

EUR: ECB To Keep A Dovish Stance This Week – Danske

EUR/USD is awaiting the ECB decision with the updated forecasts. What can we expect? Here is their view, courtesy of eFXnews: We expect the ECB to maintain its dovish stance at the meeting this week although inflation has reached the 2% target. The reason why we do not expect the ECB to react to the stronger … “EUR: ECB To Keep A Dovish Stance This Week – Danske”

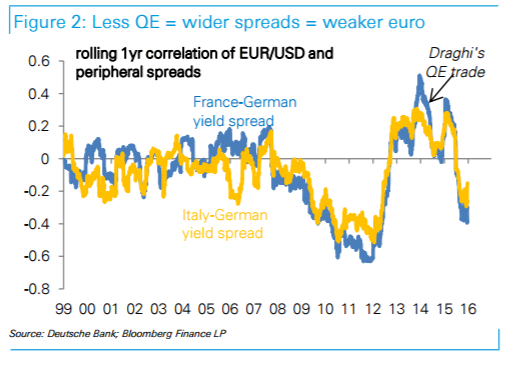

3 Reasons Why ECB Tapering Won’t Prevent Further EUR/USD

The European Central Bank is pondering over its next steps regarding the QE program. The team at Deutsche Bank sees weakness in any case: Here is their view, courtesy of eFXnews: One of the pushbacks we get to our weaker euro view is that the ECB will signal tapering this year preventing EUR/USD weakness. We … “3 Reasons Why ECB Tapering Won’t Prevent Further EUR/USD”

![ECB Preview: a short-lived blow to the euro? [Video]](https://investinearth.org/wp-content/uploads/2017/03/Fotolia_77768687_S-351x185-1.jpg)