The British parliament is moving forward with processing Article 50. What does it mean for sterling? Here is their view, courtesy of eFXnews: A positioning squeeze coupled with a broader dollar sell-off has made holding sterling shorts painful this year. We’re unconvinced the rally is sustainable. Article 50 negotiations should start badly. The likely date for talks … “GBP: ‘No Fallback Options For Hard Brexit’; We Stay Core”

Category: Opinions

USD: Time To Take Trump Literally? How To Position In

The Trump Trade is beginning to become the Donald Downfall. What’s next? Here is their view, courtesy of eFXnews: Markets are gradually getting concerned that the pre-election Trump and the postelection Trump may be the same person. One by one, President Trump seems to be carrying out his pre-election promises, some of which may not necessarily … “USD: Time To Take Trump Literally? How To Position In”

Jan NFP: ‘Market Is Trading Off Of The Wage Number’;

The NFP was mixed and caused choppy yet range-bound trading on EUR/USD. Where next for the dollar? Here is their view, courtesy of eFXnews: It’s been a happy new year for the US economy so far, with animal spirits perking up and hiring looking robust. The pace of non-farm payrolls gains accelerated to 227k in January, from … “Jan NFP: ‘Market Is Trading Off Of The Wage Number’;”

3 reasons to sell the dollar after the recent correction

The US dollar is off its lows against major currencies, with EUR/USD trading at 1.0750, USD/JPY at 113.20 and GBP/USD licking its wounds at 1.2530. Here are reasons why this could be a selling opportunity on the USD: This is only a correction: The greenback gained strength without any clear event related to the move. A … “3 reasons to sell the dollar after the recent correction”

EUR/USD: Trading the US Nonfarm Employment Payrolls

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 13:30 GMT. Indicator Background Job … “EUR/USD: Trading the US Nonfarm Employment Payrolls”

USD/CAD: The Trump-Trade Squeeze Hypothesis – TD

The Canadian dollar enjoyed the positive GDP number and the dollar fell on Trump. What’s next? Here is their view, courtesy of eFXnews: A healthy Nov GDP report underpinned CAD. The headline beat expectations coming in line with TD’s expectations of a 0.4% m/m gain. Under the hood, the goods-producing industries led the gains while services made a … “USD/CAD: The Trump-Trade Squeeze Hypothesis – TD”

EUR/USD: Jump’s ‘Excessive’ And ‘Noise’; We’re Short Into This

EUR/USD had a nice ride to the topside, enjoying the weakness of the Donald Dollar as well as positive data from the euro-zone. SocGen is short into this rally: Here is their view, courtesy of eFXnews: All the jawboning is chopping FX rates around all over the place, and I’ve been reading more and more about … “EUR/USD: Jump’s ‘Excessive’ And ‘Noise’; We’re Short Into This”

USD Into FOMC: Looking For A ‘Reprieve’ For USD? –

The Fed convenes after raising rates last time and as Trump makes his dent in the Oval Office. What can we expect? Here is their view, courtesy of eFXnews: We do not expect fireworks from the upcoming FOMC meeting. The Federal Reserve will be releasing its statement without a press conference or Summary of Economic Projections … “USD Into FOMC: Looking For A ‘Reprieve’ For USD? –”

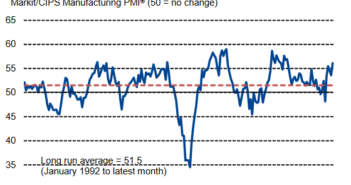

GBP/USD: Trading the UK Manufacturing PMI

The UK Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for … “GBP/USD: Trading the UK Manufacturing PMI”

CBI survey: UK manufacturers post the fastest growth in

Manufacturing firms in the UK experienced one of the fastest growth in domestic orders ever recorded in more than two years, during the three months through January, industry data showed. The uptick in domestic orders underpinned the fact that rising consumer prices did not curb demand at the turn of last year, survey data from … “CBI survey: UK manufacturers post the fastest growth in”