The FED hiked interest rates as expected and also lifted expectations for 2017 from two to three rate hikes. Here is the quick response from CIBC: Here is their view, courtesy of eFXnews: Forgive someone for yawning about the Fed’s unanimous decision to raise rates a quarter point today, which was well telegraphed in advance. Nor … “Dec FOMC: No More Hawkish Than Needed; Market To Reprice”

Category: Opinions

FED Preview: Three scenarios, only one USD-positive

The Federal Reserve is set to raise the interest rate for the second time after the financial crisis, one year after the first, historic hike. That will not be a surprise and it is already baked into prices. The big question is what’s next? Traders will try to assess the FED’s path in 2017 in beyond. … “FED Preview: Three scenarios, only one USD-positive”

Trading FOMC: 5 FX Observations From Dec 2015 Hike – SEB

In our FED preview, we laid out three scenarios, only one USD positive. Here is the view from SEB, which compares today’s event to the moves seen last year: With Fed widely anticipated to hike policy rate Wednesday Dec 14 we have looked at G10 currency reactions following the hike Dec 16, 2015 as well as … “Trading FOMC: 5 FX Observations From Dec 2015 Hike – SEB”

AUD/USD: Trading the Australian Employment Change

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian Employment Change”

A Fed’s Hike This Week + 2 More Hikes In

The Federal Reserve is set to raise rates, in a move which will not be a surprise. But what’s next afterwards? Here is the view from Nomura: Here is their view, courtesy of eFXnews: We expect the FOMC to raise its targets for short-term interest rates by 25bp at its meeting this week. Recent public statements by … “A Fed’s Hike This Week + 2 More Hikes In”

GBP/USD: Trading the UK Claimant Count Change

The UK Claimant Count Change measures the change in the number of people claiming unemployment benefits. Along with the unemployment rate, which is released at the same time, it provides a snapshot of the UK employment situation and could affect the direction of GDP/USD. Here are the details and 5 possible outcomes for GBP/USD. Published on Wednesday … “GBP/USD: Trading the UK Claimant Count Change”

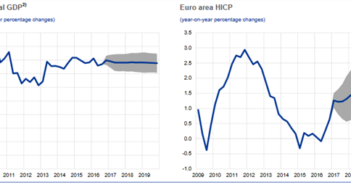

Euro falls on ECB’s QE extension, but declines are

The European Central Bank’s monthly monetary policy meeting which concluded on Thursday, November 8, showed that the central bank had extended its bond purchases from March 2017 to the end of 2017. The decision to extend QE takes the central bank’s total size of QE purchases above EUR 2.2 trillion. The central bank chief, Mario … “Euro falls on ECB’s QE extension, but declines are”

EUR/USD: Trading the German ZEW Economic Sentiment

German ZEW Economic Sentiment is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Tuesday at 10:00 GMT. Indicator Background … “EUR/USD: Trading the German ZEW Economic Sentiment”

The Counterintuitive EUR Reaction; The Market Is Wrong –

The euro sold off after Draghi presented his dovishness. Is this justified? Here is their view, courtesy of eFXnews: Whatever it takes” seems to be trumped by politics now Since 2011 Mario Draghi had brought iron-clad consistency to the ECB: it would err on the side of caution, would go as far as possible to … “The Counterintuitive EUR Reaction; The Market Is Wrong –”

EUR/USD: Risk-Reward To The Downside Post-ECB; Sell Rallies –

More responses come after the ECB’s big QE extension move. What’s next? Here is their view, courtesy of eFXnews: The ECB extended its QE purchases by nine months to December 2017, but reduced the monthly purchases to EUR60bn from EUR80bn. The lower pace of purchases followed, according to the ECB, as the risk of deflation has … “EUR/USD: Risk-Reward To The Downside Post-ECB; Sell Rallies –”