EUR/USD managed to bounce very nicely from the Italian referendum result and looks further away from parity. What’s next? Here is their view, courtesy of eFXnews: The Italians voted ‘No’ in the constitutional reform referendum, and do so in resounding fashion, with a 59-41 outcome estimated. The polls had indicated a ‘No’ win but the scale … “EUR/USD: No Major Downside This Month; En-Route To Parity”

Category: Opinions

EUR/USD: Trading The Italian Referendum – Credit Suisse

Italians are currenty voting in the Renzirendum and traders are highly anticipating the results, which are due when markets open. How should you trade it? Here is the view from Credit Suisse: Here is their view, courtesy of eFXnews: On Sunday 4 December Italians will vote in a constitutional reform referendum, which includes provisions to transform the Senate … “EUR/USD: Trading The Italian Referendum – Credit Suisse”

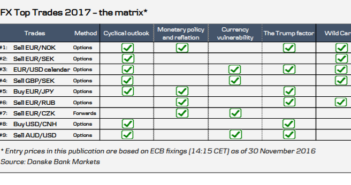

Position For 2017: 4 Themes, 9 Trades, 1 Wild-Card –

As December begins, many are already eying the next year: 2017. The team at Dankse has you ready with 4 themes, 9 trades and 1 wild card: Here is their view, courtesy of eFXnews: We present our year-end FX Top Trades for the coming year. We base the 2017 publication on four themes we think will drive … “Position For 2017: 4 Themes, 9 Trades, 1 Wild-Card –”

EUR/USD: Trading the US Non-Farm Payrolls

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 13:30 GMT. Indicator Background … “EUR/USD: Trading the US Non-Farm Payrolls”

After OPEC: new oil targets from two banks

After OPEC reached an ambitious deal, oil prices held up to their previous gains and could now continue higher. But where to? Here are two opinions? Here is their view, courtesy of eFXnews: OPEC Deal: First Reaction On Targets For WTI Oil Prices – CIBC It appeared that Saudi Arabia was taking a different tact … “After OPEC: new oil targets from two banks”

AUD, NZD: Fade Rallies As Risk Aversion Likely To Pickup

The Australian and New Zealand dollars struggled during the month of November and could continue enduring pressure in the last month of 2016: Here is their view, courtesy of eFXnews: The chart below shows our proxy for macro hedge fund positioning. It suggests that macro funds are short oil currencies but long high-beta currencies like AUD … “AUD, NZD: Fade Rallies As Risk Aversion Likely To Pickup”

CAD: ‘Rates Trump Oil’; Where To Target? – BofA Merrill

USD/CAD is stuck between Donald and oil. Which factor will win? The team at Bank of America Merrill Lynch assesses the situation: Here is their view, courtesy of eFXnews: Themes: rates trump oil. We pushed up our USD-CAD forecast sizably, and now expect 1.43 at end-2017. The shift in view reflects several developments: First, Donald Trump’s election increases … “CAD: ‘Rates Trump Oil’; Where To Target? – BofA Merrill”

EUR/USD En-Route To 0.95; Parallels With The Reagan Era

Euro/dollar reached a double-bottom at 1.0520 but has bounced nicely since then. What’s next? The team at ABN AMRO is very bearish: Here is their view, courtesy of eFXnews: Since the US presidential elections the US dollar has firmed against most currencies. While it has risen by more than 5% against the yen and 3.5% against the … “EUR/USD En-Route To 0.95; Parallels With The Reagan Era”

AUD/USD: Trading the Chinese Caixin Manufacturing PMI

Chinese Caixin Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in China. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible … “AUD/USD: Trading the Chinese Caixin Manufacturing PMI”

Top 10 FX Trades For 2017 – Morgan Stanley

The US dollar has a strong run to end 2016. What’s up for 2017? The team at Morgan Stanley lists the Top 10 trades for the upcoming year: Here is their view, courtesy of eFXnews: USD has entered its last leg within a secular bull market. We expect USD to be driven by widening rate and investment … “Top 10 FX Trades For 2017 – Morgan Stanley”