The Bank of England is set to hold its rates but publish new projections on “Super Thursday.” The darkening clouds around the global economy and Brexit may cause a rethink. There are five scenarios for the decision and pound reaction. The disconnect between the Bank of England’s upbeat assessment and markets’ dim views is unlikely … “5 scenarios for GBP/USD on the BOE’s Super Thursday”

Category: Forex news

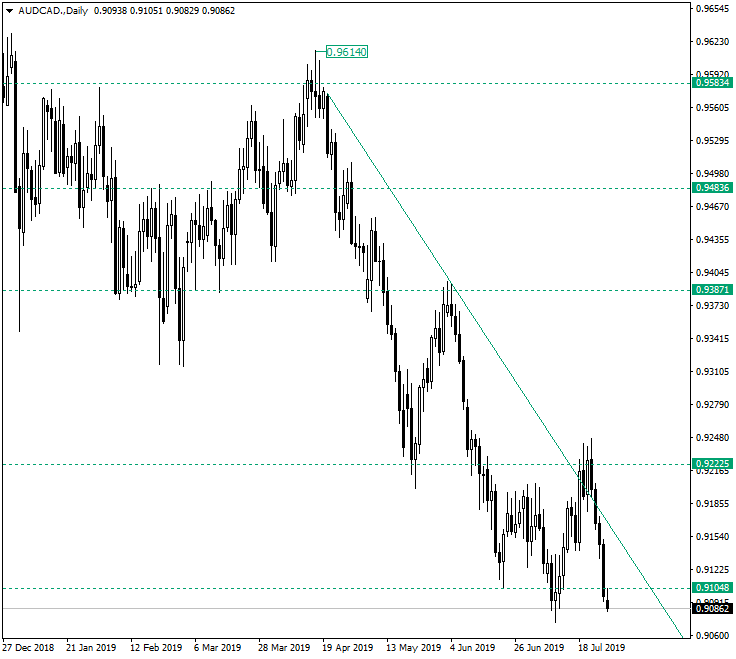

AUD/CAD Looking for 0.9000

The Australian dollar versus the Canadian dollar currency pair is under bearish dominance and the support of the 0.9100 psychological level seems to give way. Long-term perspective From the 0.9614 high the price entered a descending move which confirmed rigorously key resistance areas — like 0.9483, 0.9387, and 0.9225. In such a bearish driven environment the last support, 0.9104, seems to have little to do in order to withstand the downwards pressure. If the previous low … “AUD/CAD Looking for 0.9000”

After the plunge, these GBP/USD levels are eyed

GBP/USD has hit 1.2247 – the lowest in two years on fears of a hard Brexit. PM Boris Johnson has rejected the claim that the government is assuming no-deal. GBP/USD may challenge levels last seen in late 2016 / early 2017. How low can the pound go? The pound’s plummet has turned into an avalanche as the new … “After the plunge, these GBP/USD levels are eyed”

Japanese Yen Mixed as Traders Wait for Fed, Other Events

The Japanese yen was mixed today amid mild risk aversion on the Forex market. Traders were reluctant to open new positions at the start of the week full of important events. There will be many important macroeconomic releases this week, including US nonfarm payrolls. But the highlight of the week should be the monetary policy meeting of the Federal Reserve, which is expected to result in an interest rate cut. Market participants will … “Japanese Yen Mixed as Traders Wait for Fed, Other Events”

US Dollar Ends Week Strongest Despite Outlook for Fed Easing

The US dollar was surprisingly strong during the past trading week, rising against all other most-traded currencies. That is despite the outlook for monetary easing from the Federal Reserve next week. The greenback got a boost by the end of the week from a better-than-expected GDP print. But that did not change the outlook for a 100% chance of an interest rate cut from the Fed next week. It is possible that the cut … “US Dollar Ends Week Strongest Despite Outlook for Fed Easing”

Pound Hits Multi-Year Lows on Brexit Clash Between the UK and EU

The Sterling pound today fell against the US dollar as UK and European Union leaders exchanged words regarding the reopening of Brexit talks. The GBP/USD currency pair was on a losing trend from most of today’s session as markets reacted to the heightened possibility of a no-deal Brexit. The GBP/USD currency pair today fell from an opening high of … “Pound Hits Multi-Year Lows on Brexit Clash Between the UK and EU”

USD/JPY set to rock on the explosive mix of the Fed and the NFP

USD/JPY has been rising as upbeat data supported the greenback. The Fed’s first rate cut since the crisis and the US jobs report stand out. Late July’s technical chart paints a mixed picture. The FX Poll shows short-term rises followed by declines later on. What just happened: Mixed data, fresh trade talks The US and … “USD/JPY set to rock on the explosive mix of the Fed and the NFP”

GBP/USD bracing for the BOE after Boris

GBP/USD has been suffering from the Brexit impasse and USD strength. The Bank of England’s “Super Thursday” stands out. Late July’s daily chart points to further falls. Experts are neutral in the short term and bullish afterward. What just happened: PM Boris Johnson meets reality Boris Johnson, PM – a headline that many had waited … “GBP/USD bracing for the BOE after Boris”

US Dollar Rallies on Better-Than-Expected Q2 GDP

The US dollar is rallying against a basket of currencies to close out the trading week, driven by a better-than-expected but slower than usual second-quarter economic report. The gross domestic product cooled down in the April-to-June period, but there were some bright spots in the overall report, including a surge in consumer spending. According to the Bureau of Economic Analysis (BEA), the gross domestic product advanced a 2.1% annual clip in the second quarter, down from … “US Dollar Rallies on Better-Than-Expected Q2 GDP”

US GDP should encourage the Fed – and the dollar

US GDP has come out at 2.1%, above expectations. The Federal Reserve is watching the data very closely. The USD has room to rise ahead of the central bank’s decision. The US economy is alive and kicking – hardly justifying the planned Fed rate cut next week – and certainly not a pre-announcement about a … “US GDP should encourage the Fed – and the dollar”