The US dollar is holding steady against a basket of currencies on Thursday after the federal government released the latest jobs numbers in the economic fallout of the coronavirus. In total, about 30 million Americans have lost their positions in just six weeks, and based on what the Federal Reserve stated on Wednesday, more economic pain is coming in the next couple of months. According to the Department of Labor, the initial jobless claims reading was 3.839 million … “US Dollar Holds Steady As 30 Million Jobs Lost in Six Weeks”

Category: Forex news

Euro Trades Sideways on Mixed Macro Prints and ECB Rate Decision

The euro today alternated between gains and losses against the US dollar amid a raft of releases from across the euro area that kept the pair trading in a wide range. The EUR/USD currency pair reacted differently to the mixed European announcements such as Germany’s retail sales data among others as it struggled to find … “Euro Trades Sideways on Mixed Macro Prints and ECB Rate Decision”

Japanese Yen Flat After Economic Data, Falls vs. Franc & Sterling

The Japanese yen traded largely sideways today, though it slid against the Great Britain pound a bit and dropped versus the Swiss franc. The market sentiment was swinging between optimism and pessimism, making it hard for currencies to find a clear direction. Japanese macroeconomic data looked rather dire but not all reports turned out to be as bad as analysts were expecting. Japan’s Ministry of Economy, Trade, and Industry reported … “Japanese Yen Flat After Economic Data, Falls vs. Franc & Sterling”

Pound Rallies on Bullish Sentiment Despite Rising UK COVID-19 Cases

The Sterling pound today rallied higher against the US dollar despite the current lockdown in the UK amid rising coronavirus cases as opposed to other European countries. The GBP/USD currency pair today rallied higher as the dollar retreated driven by the risk-on market sentiment as Boris Johnson prepares to host a cabinet meeting today. The … “Pound Rallies on Bullish Sentiment Despite Rising UK COVID-19 Cases”

Australian Dollar Soft as Market Sentiment Worsens

The Australian dollar traded lower for the most part today as traders’ optimism was evaporating. The relatively positive Chinese macroeconomic data was unable to provide the Aussie a boost. Economic indicators in Australia itself were mixed. The Australian Bureau of Statistics reported that import prices fell in the March quarter by 1.0% instead of rising at the same rate as analysts had predicted. Year-on-year, though, the prices increased by 0.9%. The main contributors to the quarterly decline were … “Australian Dollar Soft as Market Sentiment Worsens”

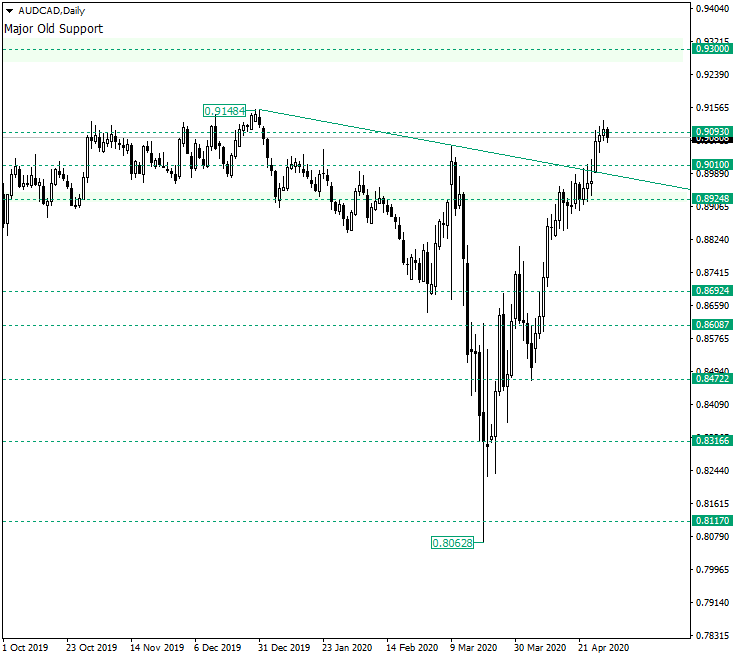

AUD/CAD Back at 0.9093

The Australian dollar versus the Canadian dollar currency pair is testing the important area of 0.9093. Where could the market go to? Long-term perspective The firm retracement that etched the low of 0.8062 caused a series of upward pointing legs, each of them confirming significant levels. The last of them, 0.8472, facilitated a rally that managed to pierce not only the level of 0.8924 but also the double resistance drawn by the level of 0.9010 and the trendline … “AUD/CAD Back at 0.9093”

NZ Dollar Flat-to-Higher After Domestic, Chinese Data

The New Zealand dollar was trading either flat or slightly higher against other currencies, including its commodity-related counterparts. The kiwi got a boost from positive macroeconomic data released in both China, New Zealand’s biggest trading partner, and New Zealand itself. The optimistic market sentiment was helping the currency too. The ANZ business confidence stood at — 66.6 at the end of April, up from -73.1 in the preliminary report released … “NZ Dollar Flat-to-Higher After Domestic, Chinese Data”

US Dollar Plunges As Federal Reserve Warns of More Economic Pain in Q2

The US dollar is maintaining its downward trend from late last week as the greenback slumped on new economic data and a bearish Federal Reserve. Despite being one of the bright spots in chaotic global financial markets, the central bank has tried to pour cold water on the greenback, and it is finding success in suppressing its ascent in the international economy. On Wednesday, the Federal Open Market Committee (FOMC) agreed to leave the target range … “US Dollar Plunges As Federal Reserve Warns of More Economic Pain in Q2”

Euro Hits Daily Highs on Fed Rate Decision and Mixed Eurozone Data

The euro today rallied to new daily highs against the US dollar following the FOMC rate decision, which was in line with analysts consensus estimates. The EUR/USD currency pair today alternated between gains and losses driven by mixed fundamental releases from across the eurozone. The EUR/USD currency pair today rallied from an opening low of … “Euro Hits Daily Highs on Fed Rate Decision and Mixed Eurozone Data”

Canadian Dollar Continues April Comeback As Crude Rally Lifts Loonie

The Canadian dollar is staging its late-April comeback against several of its G10 currency rivals. The loonie, which has been battered throughout much of the year, continued its rally midweek as the double-digit gains in crude oil prices lifted the currency. Could the Canadian dollar continue its upward trend next month? Canada has endured a two-pronged financial crisis that has paralyzed the Great White North: the coronavirus pandemic … “Canadian Dollar Continues April Comeback As Crude Rally Lifts Loonie”