The ECB is set to leave rates unchanged but hint of additional stimulus due to the virus. Forward-looking indicators are already pointing to a significant slowdown. Recent inflation figures paint a worrying picture for the bank. All eyes are on Europe again – and for the wrong reason. COVID-19 cases are surging in the old continent … “ECB Preview: Three charts show why Lagarde could send EUR/USD tumbling”

Category: Forex news

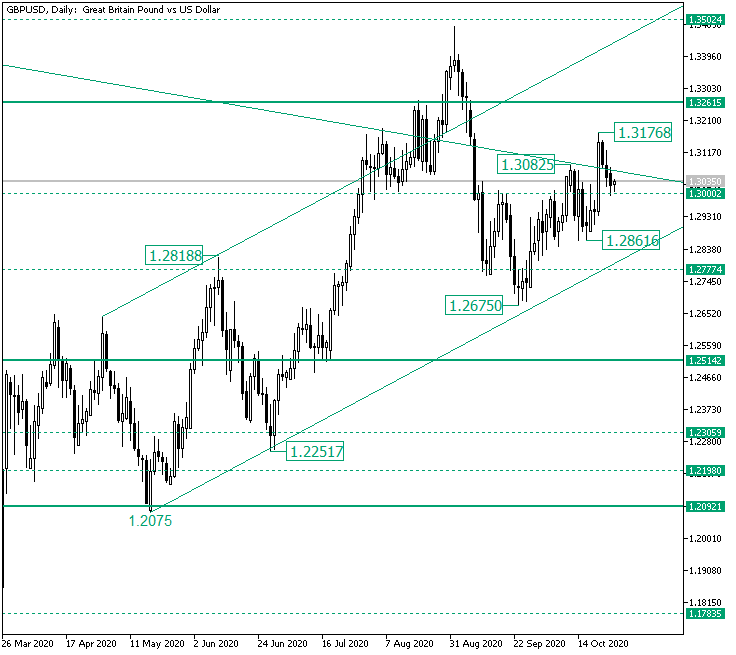

Bears Testing the 1.3000 Level on GBP/USD

The Great Britain pound versus the United States dollar currency pair has to make a decision: above or beneath 1.3000? Long-term perspective After validating the firm level of 1.2092 as support, the price started an ascending trend, one that came very close to the 1.3502 intermediary level. However, reaching 1.3502 meant passing a triple resistance area made up of the 1.3261 level, the upper line of the ascending channel, and the descending line. But as the retracement … “Bears Testing the 1.3000 Level on GBP/USD”

Euro Falls on Rising Eurozone COVID-19 Cases, Risk-Off Sentiment

The euro today fell against the US dollar as investors sold the single currency amid rising coronavirus cases within the euro area dampening investor sentiment. The EUR/USD currency pair’s decline was further fueled by the stalemate in the US stimulus talks ahead of next week’s Presidential election as equity markets sold off. The EUR/USD currency … “Euro Falls on Rising Eurozone COVID-19 Cases, Risk-Off Sentiment”

BOC Preview: Covid concerns set to outweigh recovery optimism and crush CAD

The Bank of Canada is set to leave rates unchanged in its October meeting. Governor Macklem will likely stress growing uncertainty due to coronavirus. Canada’s recent upbeat performance may remain a side story. Winter comes early in Canada – the mercury drops rapidly in the northern country and COVID-19 cases are rising. As the same phenomenon is … “BOC Preview: Covid concerns set to outweigh recovery optimism and crush CAD”

Chinese Yuan Retreats From 27-Month High as Officials Tolerate Currencyâs Appreciation

The Chinese yuan is retreating from its highest level against the US dollar in 27 months, despite officials revealing they will tolerate the currencyâs appreciation against the greenback â for now. The acceptance of the yuanâs enormous climb has signaled that policymakers are prepared to potentially alter the currencyâs strategy in the global economy, fueling its aspirations to make the yuan a global reserve currency that rivals the buck and other counterparts. Wang … “Chinese Yuan Retreats From 27-Month High as Officials Tolerate Currencyâs Appreciation”

Japanese Yen Mixed During Monday’s Quiet Trading

The Japanese yen was mixed today, rising against some peers and falling against others. Generally, though, the yen did not move far as trading was rather quiet on Monday. The Bank of Japan will hold a monetary policy meeting on Thursday. The general consensus among analysts is that the central bank will leave its monetary policy unchanged, though some of them speculate that the bank may downgrade its … “Japanese Yen Mixed During Monday’s Quiet Trading”

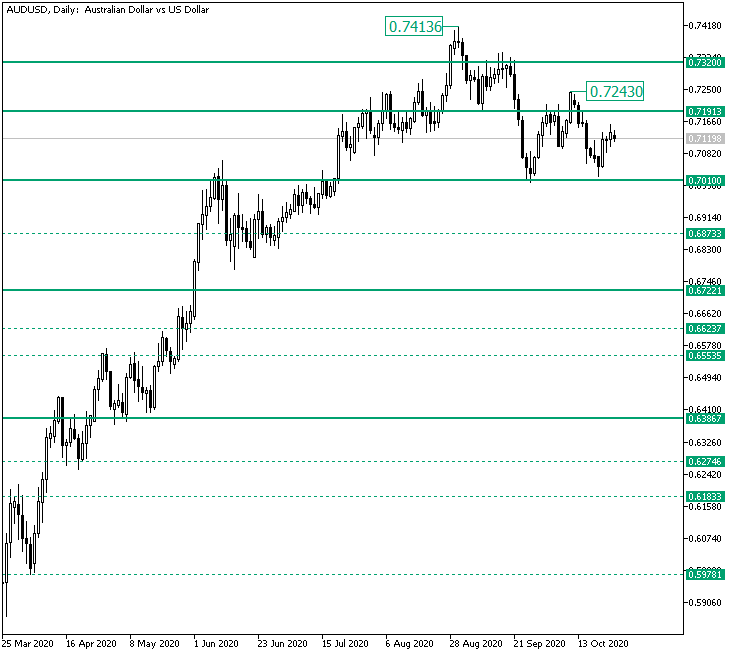

For How Long Are the Bulls Going to Wait for 0.7320 on AUD/USD?

The Australian versus the United States dollar currency pair is making lower highs, but the bulls may be just around the corner. Long-term perspective The rise in which the Australian dollar finds itself since the middle of March extended until the 07413 high. As can be seen, from the 0.6873 intermediary level, the appreciation lost part of its steam. Nevertheless, two important levels were conquered: 0.7010 and 0.7191. However, the next … “For How Long Are the Bulls Going to Wait for 0.7320 on AUD/USD?”

Gold (mostly) hinges on Trump´s electoral chances

Gold has been battling the $1,900 level amid fiscal stimulus speculation. Pre-election polls and US GDP stand out in the upcoming week. Late October’s daily chart is showing a triangle pattern. The FX Poll is painting a decisively bullish picture. “Putting pen to paper” – such commentary from Washington about a fiscal stimulus deal has … “Gold (mostly) hinges on Trump´s electoral chances”

EUR/USD Ends Week Higher

EUR/USD ended the week with solid gains. The US dollar was the weakest major currency on the Forex market during the week. The euro, on the other hand, was one of the strongest, ending trading either flat or higher against its most-traded rivals. Market analysts explained the weakness of the dollar and the resulting strength of the euro for the most part by hopes for fiscal stimulus in the United States. But most analysts express strong doubts about the ability of US … “EUR/USD Ends Week Higher”

Turkish Lira Tests Fresh Record Low of 7.9 As Central Bank Leaves Rates Unchanged

The Turkish lira tested a fresh record low of 7.9 to close out the trading week, one day after the central bank surprised analysts and left interest rates unchanged. The lira has repeatedly been cratering to new all-time lows throughout 2020, driven by declining foreign exchange reserves and geopolitical tensions. Could the lira break 8.0 against the US dollar in the coming weeks? On Thursday, the central bank announced that it would … “Turkish Lira Tests Fresh Record Low of 7.9 As Central Bank Leaves Rates Unchanged”