The Japanese yen was trading either flat or lower against most other currencies, though it managed to gain on the US dollar. Japanese macroeconomic data released on Friday was mixed. The big news today was the fact that Japan and the United Kingdom formally signed a trade deal that has been agreed in principle back in September. It is the first post-Brexit trade deal the UK signed. Yet many economists … “Japanese Yen Soft After Economic Data, Japan-UK Trade Agreement”

Category: Forex news

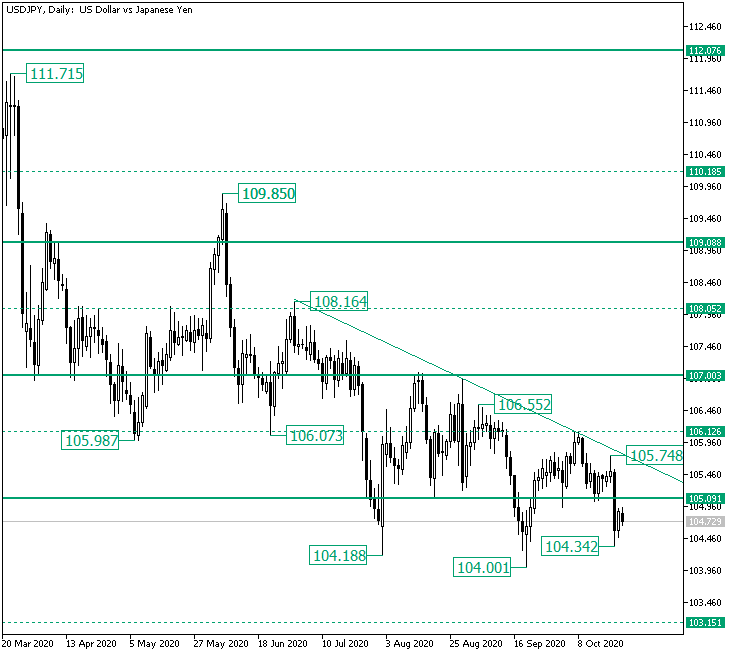

104.34 Low on USD/JPY a Double-Edged Sword?

The United States dollar versus the Japanese yen currency pair, at this moment, may very well be treasured by both bulls and bears. However, only one party is to be right. Long-term perspective The fall from the 111.71 high extended — in a first phase — until the 105.98 low, from where a new appreciation crystalized, pinning the 109.85 high. The fall from 109.85 continued the endeavor of the first one thus — after defining … “104.34 Low on USD/JPY a Double-Edged Sword?”

US Dollar Struggles for Direction As New Jobless Claims Fall Below 800k

The US dollar is looking for direction on Thursday as initial jobless claims and the Congress unable to strike a coronavirus stimulus and relief deal. The greenback has been trending downward this month following a rally in September, driven primarily by confidence in the broader financial market and optimism over the on-again, off-again stimulus negotiations. According to the Department of Labor, the number of Americans filing for unemployment benefits clocked in at 787,000 for the week ending October 17, down from the previous … “US Dollar Struggles for Direction As New Jobless Claims Fall Below 800k”

German Consumer Climate Deteriorates, Euro Weaker as Traders Expect Fiscal Stimulus in USA

The euro fell against the US dollar and was trading flat or lower versus other most-traded rivals. Market analysts thought that the euro’s weakness was mostly a result of the dollar’s strength as speculators continue to bet that US politicians will approve fiscal stimulus before the presidential election at the beginning of November. German macroeconomic data was worse than expected but did not have a material impact on the euro, though it … “German Consumer Climate Deteriorates, Euro Weaker as Traders Expect Fiscal Stimulus in USA”

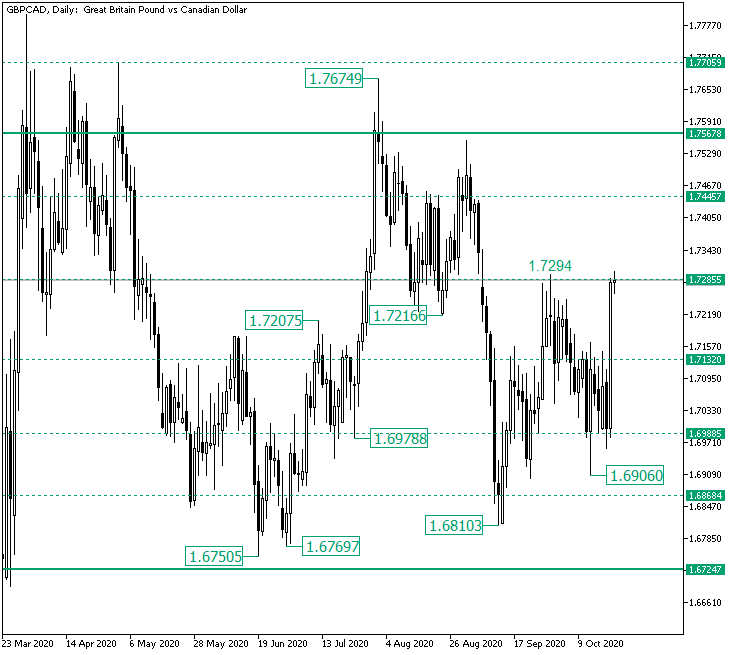

Chances for Bulls to Validate 1.7285 as Support on GBP/CAD?

After the rally to 1.7285, would the level cede in front of the bullish momentum or serve as the perfect spot for the bears to short the market at a very good price? Long-term perspective After the price validated the major level of 1.6724 as support, it managed to rise until the important 1.7567 area. But as the intermediary level of 1.7705 limited further bullish advancement, the result was a decline well under 1.7567. As a result, the price almost retouched the 1.6724 level. However, … “Chances for Bulls to Validate 1.7285 as Support on GBP/CAD?”

Turkish Lira Strengthens to Two-Week High as Markets Bet on Rate Hike

The Turkish lira is strengthening to its best level in two weeks against the US dollar. The lira, which recently crashed to a fresh all-time low, is finding support on widespread expectations that the central bank will raise interest rates to prevent further currency depreciation and to support the economy. On Thursday, central bank officials will hold their October policy meeting. Analysts believe that Ankara will vote to continue tightening … “Turkish Lira Strengthens to Two-Week High as Markets Bet on Rate Hike”

2020 Elections: Trump is is showing signs of a comeback, will the dollar follow?

National polls have been showing that President Trump has narrowed his deficit. Surveys in the critical battleground states of Pennsylvania and Florida are also tentatively showing Biden has peaked. The chances of a contested election are rising and could lead to a stock sell-off and a dollar rise. “It ain’t over till the fat lady … “2020 Elections: Trump is is showing signs of a comeback, will the dollar follow?”

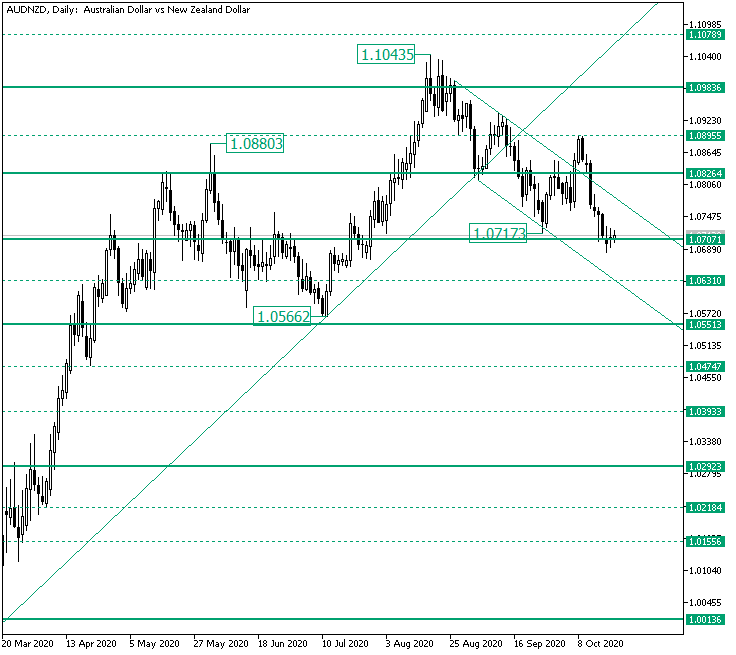

Bulls Searching for Support at 1.0707 on AUD/NZD?

The Australian versus New Zealand dollar currency pair retraced until the 1.0707 level. Are the bulls able to pull off another rise? Long-term perspective After validating 1.0013 as support, the price printed a rally that extended until the 1.0880 high. From the 1.0880 high, which is part of the false piercing of the 1.0826 firm resistance area, the price passed 1.0707 — also a steady level — only to stop near the next one, … “Bulls Searching for Support at 1.0707 on AUD/NZD?”

US Dollar Erases Gains As Nancy Pelosi Says Stimulus Deal Possible by Dayâs End

The US dollar erased its gains on Tuesday and deepened into negative territory after House Speaker Nancy Pelosi revealed that a coronavirus stimulus and relief package could be done by the dayâs end. This sent stocks and other asset classes rallying as investors were confident that the White House and the Democratic leadership could reach an agreement over a $2 trillion bill. One day after telling President Donald Trump … “US Dollar Erases Gains As Nancy Pelosi Says Stimulus Deal Possible by Dayâs End”

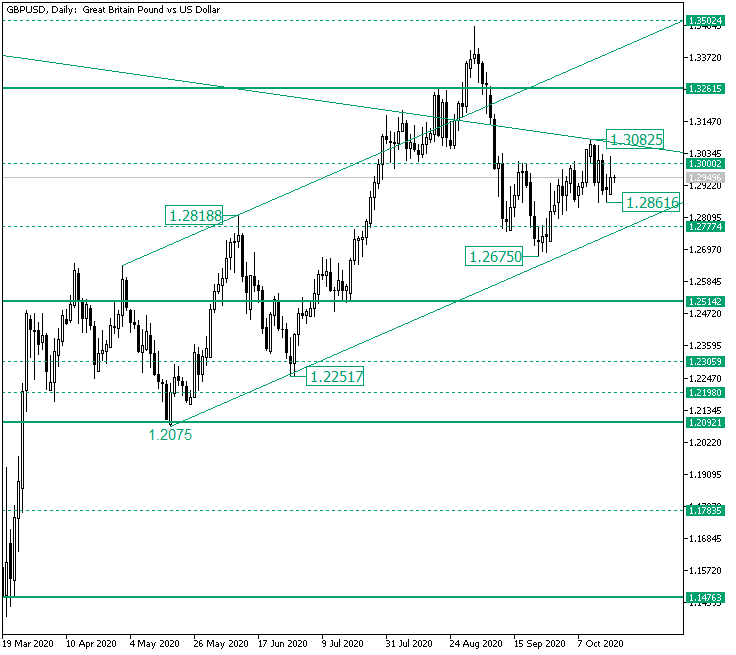

GBP/USD Encountering Bearish Resistance at 1.3000?

The Great Britain pound versus the United States dollar currency pair seems to limit the bullish efforts. Are the bulls out of steam? Long-term perspective The rally that started from the 1.1476 firm support level extended above 1.2092 but was stopped by 1.2514, leading to a consolidative phase. This phase printed the low of 1.2075 before validating 1.2092 as support and thrusting to the 1.2818 high. The retracement that came about from 1.2818, … “GBP/USD Encountering Bearish Resistance at 1.3000?”