The US dollar is trading modestly lower on Tuesday as Federal Reserve Chair Jerome Powell testified in front of lawmakers. The greenback is also heading lower on mixed economic data that showed a tightening labor market but growing business optimism. Despite the greenback taking a breather, the buck is still enjoying a strong start to 2020. During his semi-annual appearance in front of the House Financial Services Committee, Powell stated some … “US Dollar Slips on Jerome Powell Testimony, Labor Conditions”

Category: Forex news

Euro Recovers From Fresh 2020 Lows on ECB Chief Lagardeâs Testimony

The euro today traded sideways against the US dollar before falling to its daily lows in the mid-European session driven by the prevailing risk-off market sentiment. The EUR/USD currency pair recovered and rallied higher in the early American session following the release of the ECB Governor Christine Lagarde‘s testimony. The EUR/USD currency pair today fell … “Euro Recovers From Fresh 2020 Lows on ECB Chief Lagardeâs Testimony”

Dollar may rise and fall now that Trump’s approval rating hits multi-year highs

President Trump’s approval rating is near the levels seen just after his inauguration. The Senate acquittal, messy Democratic Party primaries, and a strong economy are behind the rise. The US dollar has room to rise for a limited time, with Trump potentially sending it lower. Making the dollar great again? Paraphrasing President Donald Trump’s 2016 election … “Dollar may rise and fall now that Trump’s approval rating hits multi-year highs”

Great Britain Pound Stable After GDP, Other Economic Indicators

The Great Britain pound was about flat against other major currencies and trimmed losses versus commodity currencies today after the release of a bunch of macroeconomic indicators in Britain. The data was not extremely positive, but apparently, markets considered it to be good enough to support the sterling. Britain’s Office for National Statistics reported that according to the preliminary estimate gross domestic product was flat in the fourth quarter of 2019 compared … “Great Britain Pound Stable After GDP, Other Economic Indicators”

Australian Dollar Extends Rise After Business Confidence Improves

The Australian dollar continued to rise today after the business confidence improved. Other commodity currencies were trying to recover as well even though investors remained cautious as the deadly coronavirus continued to spread across China. National Australia Bank reported that business confidence improved slightly from -2 in December to -1 in January. Business conditions remained unchanged at +3. Alan Oster, NAB Group Chief Economist, commented on the results: The survey … “Australian Dollar Extends Rise After Business Confidence Improves”

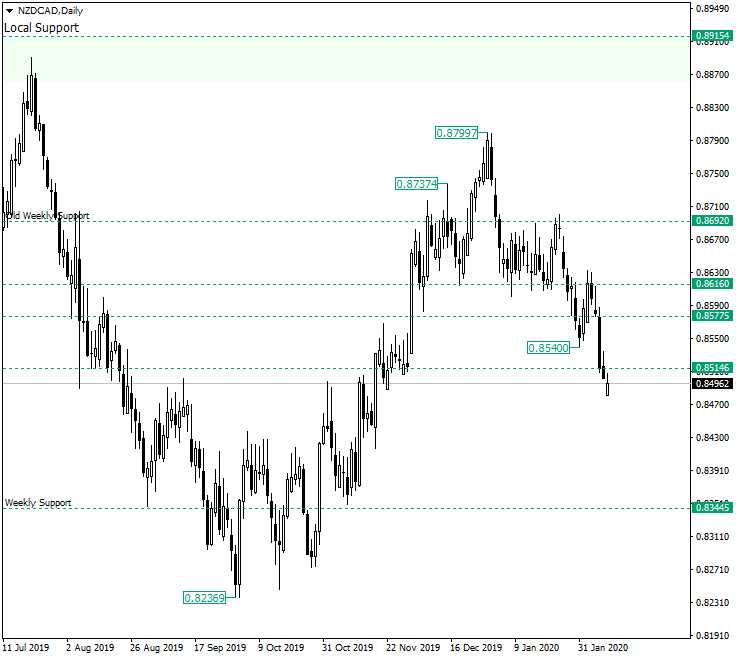

NZD/CAD Made It to 0.8514. Where Now?

The New Zealand dollar versus the Canadian dollar currency pair reached the 0.8514 level. Is this only a met target or is the depreciation about to continue? Long-term perspective The depreciation that started from the peak of 0.8799, which is a part of the head and shoulders pattern with the left-side shoulder marked by 0.8737, extended to 0.8540, retraced, confirmed the level of 0.8616 — which is also the neck-line of the aforementioned chart pattern — as resistance, and continued towards … “NZD/CAD Made It to 0.8514. Where Now?”

Euro Falls on Coronavirus News and US-EU Economic Divergence

The euro today fell to new 2020 lows against the much stronger US amid a risk-off market environment dominated by headlines of new coronavirus infections. The EUR/USD currency pair’s decline was accelerated by Friday’s positive US non-farm payrolls report, which showed diverging performance between the two economies. The EUR/USD currency pair today fell from an Asian session high of 1.0958 to a low of 1.0909 in the American session and was near these … “Euro Falls on Coronavirus News and US-EU Economic Divergence”

Canadian Dollar Mixed As Housing, Jobs Data Unable to Trigger Momentum

The Canadian dollar is trading mixed against multiple currency rivals to kick off the trading week, despite bullish housing and jobs data that should have buoyed the loonie. The paucity of momentum will be more pronounced as the Canadian dollar may trade sideways ahead of the central bankâs policy announcement later this week. Will the currency reverse its downward trend? According to the Canada Mortgage and Housing Corporation (CMHC), seasonally … “Canadian Dollar Mixed As Housing, Jobs Data Unable to Trigger Momentum”

Australian Dollar Trades Higher After China’s CPI Beats Expectations

The Australian dollar rose today after China’s consumer inflation accelerated more than was expected by markets. The market sentiment was still cautious as the Wuhan coronavirus continued to spread across China. According to data from the National Bureau of Statistics of China, the Consumer Price Index climbed by 5.4% in January, year-on-year. That is compared with the median forecast of a 4.9% increase and a 4.5% gain registered in the prior month. The Producer Price Index … “Australian Dollar Trades Higher After China’s CPI Beats Expectations”

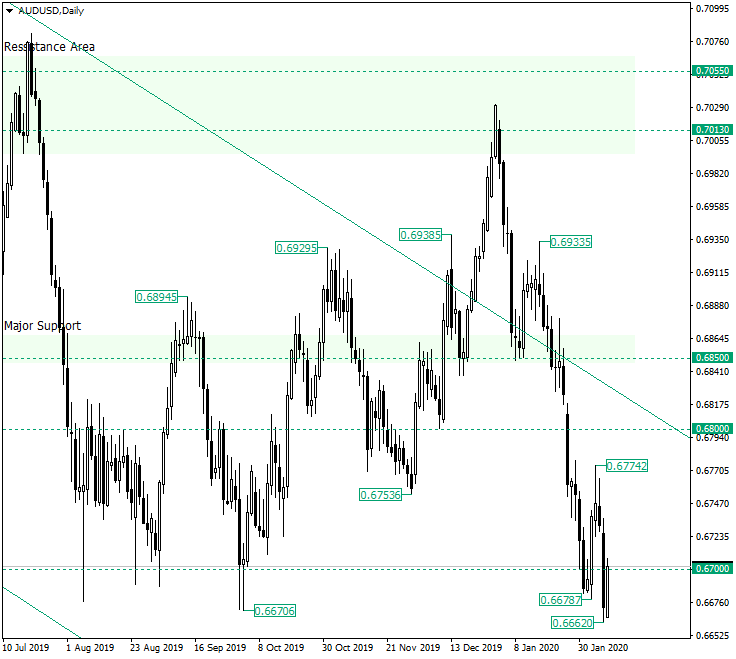

AUD/USD Might Be Ready for 0.6500

The Australian dollar versus the US dollar currency pair, although it may be still receiving some bullish support, seems to be in bearish hands. Long-term perspective The decline that followed the head and shoulders pattern — shoulders market by the peaks of 0.6938 and 0.6933, respectively — reached the area of the 0.6700 psychological level. From there, after bottoming at 0.6678, the price climbed at 0.6774. Further appreciation was halted as the price confirmed the area corresponding … “AUD/USD Might Be Ready for 0.6500”