The Chinese yuan reversed its recent downward trend against the US dollar to kick off the trading week, breaking below 6.7 on positive economic data. The latest figures show that the post-coronavirus recovery is doing well, from growth to retail sales. This has Beijing anticipating that the worldâs second-largest economy will be one of the few Asian countries to report growth in 2020. How will this benefit the currency? … “Chinese Yuan Strengthens Against USD on Upbeat GDP, Retail Sales”

Category: Forex news

2020 Elections: Seven reasons why this is not 2016, time to focus on the Senate

President Trump is trailing Biden by a wide margin but skeptics point to 2016. There are seven reasons why this time is different. The Senate race is much closer and could be more consequential for markets. Polls dismissed then-candidate Donald Trump in 2016, and are off the mark also in 2020 – that is the … “2020 Elections: Seven reasons why this is not 2016, time to focus on the Senate”

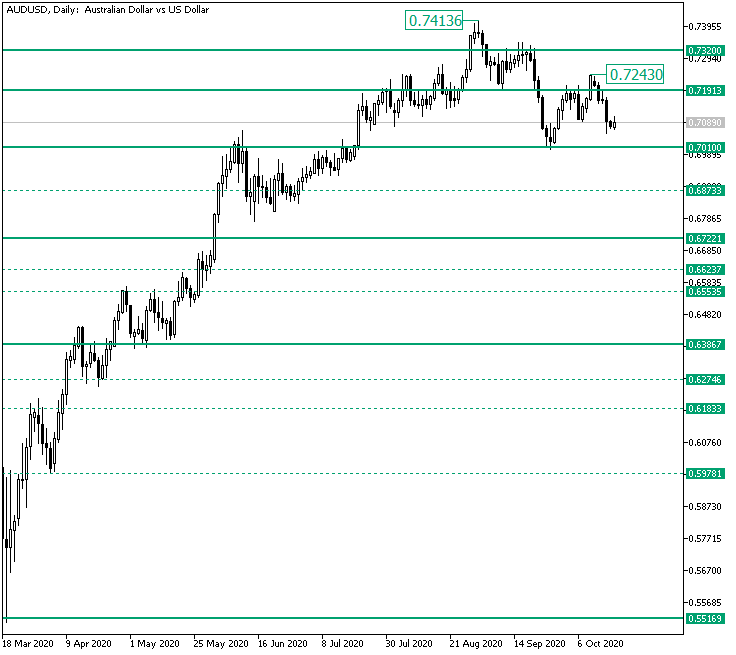

Safety Net at 0.7010 on AUD/USD for the Pressured Bulls?

The Australian versus the US dollar currency pair seems to have a hard time resuming the upward movement. It is the trend approaching the end of its evolution? Long-term perspective After the rise that started following the validation as support of the 0.5516 firm area, the price started an ascending trend. The first part of this unfolding was under strict bullish control, as they conquered 0.6386 fairly quickly. Their next objective, 0.7010, required … “Safety Net at 0.7010 on AUD/USD for the Pressured Bulls?”

USD/CHF Flat on Inflation, Investors Weigh SNB Comments

The Swiss franc is trading relatively flat against the US dollar to finish the trading week. The safe-haven asset, which has been one of the top-performing currencies in this yearâs chaotic financial market, was struggling to find direction amid the latest producer and import prices and the central bankâs lack of enthusiasm over negative interest rates. Despite a bombardment of foreign exchange interventions, the franc continues to appreciate, frustrating policymakers. According to the Swiss Federal … “USD/CHF Flat on Inflation, Investors Weigh SNB Comments”

Great Britain Pound Flat Despite Worrying Brexit News

The Great Britain pound was mostly flat today despite concerning Brexit news headlines. While the sterling was trading either near the opening level or slightly higher against most of its rivals, it fell versus the Canadian dollar. The European Union and the United Kingdom decided yesterday to prolong Brexit talks beyond the October 15 deadline. But it seems that UK Prime Minister Boris Johnson wants to walk … “Great Britain Pound Flat Despite Worrying Brexit News”

GBP/USD: Sterling set for rock on Trump’s last chance, after Boris’ Brexit move

GBP/USD has struggled to advance amid minimal progress in Brexit and US fiscal stimulus talks. The US presidential debate and the UK’s handling of coronavirus, stand out in the upcoming week. Mid-October’s daily chart is painting a mixed picture. The FX Poll is pointing to falls in the short term. Two steps forward, one step back … “GBP/USD: Sterling set for rock on Trump’s last chance, after Boris’ Brexit move”

Canadian Dollar Rallies Against US Peer Driven by Dollar Dynamics

The Canadian dollar today rallied against its US peer benefitting heavily from the latter’s decline as investors remained cautiously optimistic about the global economy. The USD/CAD currency pair fell as the loonie rallied driven by the upbeat investor sentiment as Canada insists that it will not open its borders to Americans given the surge in … “Canadian Dollar Rallies Against US Peer Driven by Dollar Dynamics”

Euro Rallies on ECB Comments and In-Line Eurozone Inflation Data

The euro today inched higher against the dollar as rising eurozone coronavirus cases continued to weigh on the single currency amid mixed inflation reports. The EUR/USD currency pair was trading sideways earlier today before surging higher boosted by positive comments from European Central Bank policymakers. The EUR/USD currency pair today rallied from a low of … “Euro Rallies on ECB Comments and In-Line Eurozone Inflation Data”

NZ Dollar Mixed After Economic Data, Ahead of Election

The New Zealand dollar was mixed today, though it largely did not go far from the opening level against its major rivals. The notable exceptions were the Great Britain pound and the Australian dollar, with the former one demonstrating a decent gain and the latter one showing a decline versus the kiwi. The BusinessNZ Performance of Manufacturing Index climbed to 54.0 in September from 51.0 in August. While the reading was undoubtedly good, … “NZ Dollar Mixed After Economic Data, Ahead of Election”

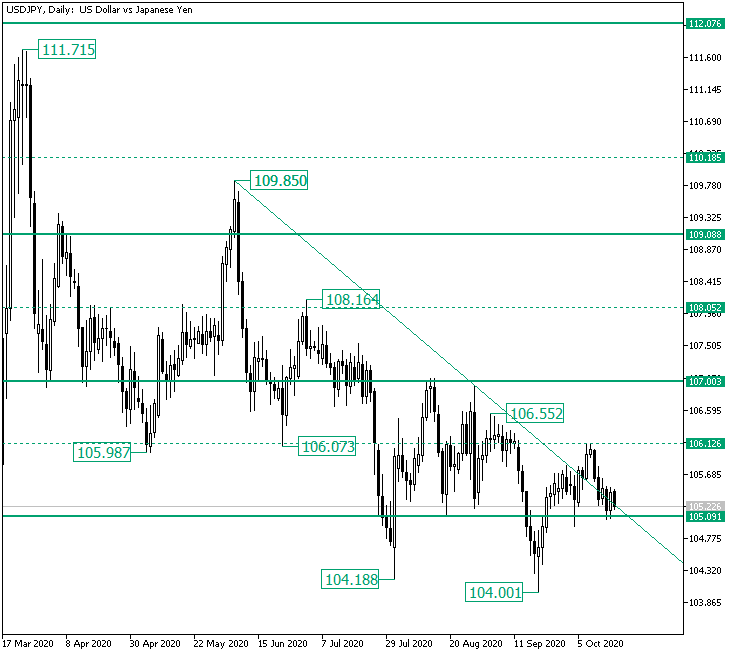

USD/JPY Respecting the 105.09 Support?

The United States dollar versus the Japanese yen currency pair seems to be under bullish control. Long-term perspective From the 111.71 high, the price started a decline that, for the time being, coined the low at 104.00. Along this path, the market crystallized two unfoldings that are trying to emulate ranges. The first one is limited by the 109.08 and 107.00 firm resistance and support, respectively. The second is lined up by 107.00 as resistance … “USD/JPY Respecting the 105.09 Support?”