The euro today traded sideways against the US dollar as the selling pressure abated as investors reacted to the calming of tensions between the US and Iran. The EUR/USD currency pair today attempted to rally unsuccessfully and was mostly stuck in slightly negative territory for most of today’s session despite upbeat German industrial data. The … “Euro Range-Bound as Selling Pressure Abates Despite USD Strength”

Category: Forex news

Great Britain Pound Soft After BoE Governor Hints at Interest Rate Cut

The Great Britain pound dropped today, though by now it has managed to trim losses against some of its rivals. The main reason for the decline were comments from Bank of England Governor Mark Carney that suggested a possible interest rate cut. Continuing Brexit uncertainty was also hurting the currency. BoE chief Mark Carney delivered a speech today. While it had optimistic remarks, traders focused on negative ones. … “Great Britain Pound Soft After BoE Governor Hints at Interest Rate Cut”

Japanese Yen Weakens As Household Confidence, Foreign Investment Wanes

The Japanese yen is weakening against most of its currency rivals on Thursday as consumer confidence tumbled in December and recent investment numbers turned heads in Tokyo. The yen had rallied in the wake of the escalation in the US-Iran conflict, but with Middle East tensions abating investors resuscitated their risk appetites. A new Bank of Japan (BoJ) survey discovered that householdsâ confidence in the national economy slumped to its lowest level in five years … “Japanese Yen Weakens As Household Confidence, Foreign Investment Wanes”

Australian Dollar Mixed After Positive Australian Data, Disappointing Chinese Reports

The Australian dollar gained on other commodity currencies but was mixed against other most-traded peers today. The market sentiment was calm and domestic macroeconomic data was helpful to the Aussie. But economic reports in China, Australia’s biggest trading partner, were not particularly impressive, weighing on the Aussie a bit. The Australian Bureau of Statistics reported that the seasonally adjusted trade balance surplus widened to A$5.8 billion in November from A$4.08 … “Australian Dollar Mixed After Positive Australian Data, Disappointing Chinese Reports”

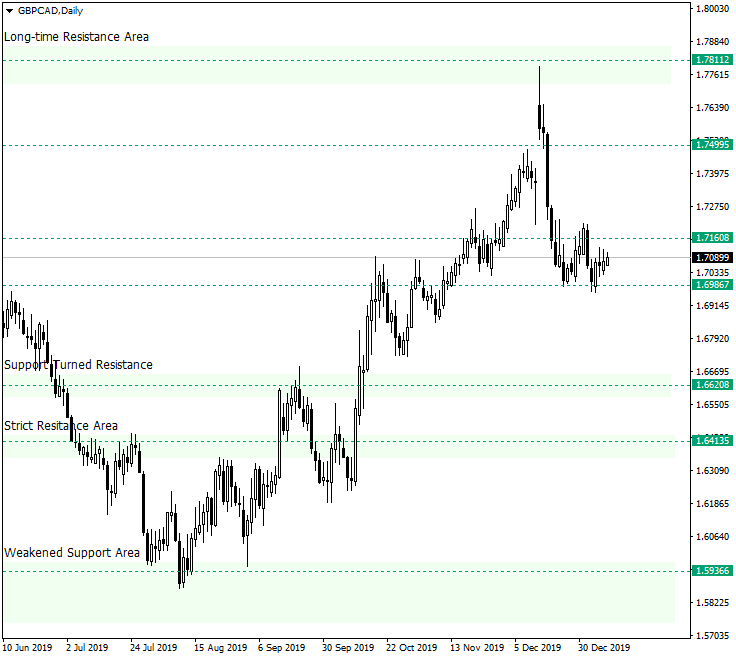

GBP/CAD Could Prepare for 1.7811

The Great Britain pound versus the Canadian dollar currency pair seems to have limited the bearish attempts to further induce a depreciation. Long-term perspective After confirming the support area of 1.5936, the price commenced an upwards pointing trend, one that extended until the long-time resistance area of 1.7811. From there, a strong retracement took place, so strong that it was able to cross two levels with ease: 1.7499 and 1.7160. … “GBP/CAD Could Prepare for 1.7811”

Canadian Dollar Weakens on Falling Crude Prices, Disappointing Exports

The Canadian dollar is weakening against multiple currency rivals midweek as energy prices are hitting the loonie. President Donald Trump confirmed that Iran is âstanding downâ in the intense Middle East conflict, sending futures plunging. The loonie was also impacted by disappointing export data. Despite being one of the top-performing G20 currencies, the Canadian dollar has had a rough start to 2020. Speaking at the White House on Wednesday, President … “Canadian Dollar Weakens on Falling Crude Prices, Disappointing Exports”

Euro Falls to 7-Day Lows on Depressed Market Risk Sentiment

The euro today fell to new weekly lows against the US dollar as the risk-off market sentiment persisted after Iran attacked US bases in Iraq. The EUR/USD currency pair’s decline was accelerated further by the release of weak data from the euro area earlier today. The EUR/USD currency pair today fell from an Asian session … “Euro Falls to 7-Day Lows on Depressed Market Risk Sentiment”

Australian Dollar Rebounds as Market Sentiment Calms Down

The Australian dollar fell intraday amid risk aversion caused by Iran’s missile attack on US military bases. But by now, the Aussie has managed to recover as investors continued to hope that the conflict will not result in a full-blown war. Currently, the Australian currency is trading about flat against most of its peers, though managed to gain on the euro and the Japanese yen. Domestic macroeconomic data was mixed, but building permits, … “Australian Dollar Rebounds as Market Sentiment Calms Down”

Yen Loses Gains Caused by Iran’s Attack on US Military Bases

The Japanese yen surged intraday on the news that Iran attacked US military bases in Iraq. But the resulting risk aversion waned quickly as investors continued to hope that the United States and Iran will avoid war. Reacting to such hopes, the yen reversed its gains and is now trading below the opening level. Domestic macroeconomic data was not helpful either as reports were not particularly good, and some of them … “Yen Loses Gains Caused by Iran’s Attack on US Military Bases”

Bubbles in 2020: The five potential bursts to watch and dollar impact

Five financial bubbles are looming and may burst in 2020. Each one may have a different impact on the US dollar. The direction of travel depends on the magnitude. The highest market volatility happens when bubbles burst – but which one will it be? The froth in the housing market that led to the Great Recession is unlikely to … “Bubbles in 2020: The five potential bursts to watch and dollar impact”