EUR/USD has had a stubborn 2019. Where will it go in 2020? Here is their view, courtesy of eFXdata: Danske Research discusses its EUR/USD outlook and adopts a constructive bias over the coming year. “Risks are broadly skewed on the downside for USD, as risk sentiment stays supported by a lenient Fed amid a brightening cyclical … “EUR/USD: Difficult To Edge Firmly Below 1.10; Looking For A Gradual Rise Through 1.15 In 2020 – Danske”

Category: Forex news

Chinese Yuan Mixed As Industrial Profits Rebound

The Chinese yuan is mixed at the end of the trading week as final data of 2019 and outlook for 2020 drive the currencyâs trading performance. With industrial profits rebounding in November, analysts are holding out hope that next year could be an improvement now that there is some certainty on the trade file. According to the National Bureau of Statistics (NBS), the largest industrial companies saw their profits tumble by 2.1% in the first 11 … “Chinese Yuan Mixed As Industrial Profits Rebound”

Japanese Yen Stuck Trading Sideways Against the Weak US Dollar

The Japanese yen today traded in a tight range against the US dollar despite the greenback’s overall weakness against other major currencies. The USD/JPY traded sideways even as the Nikkei 225 equity index closed lower for the day despite the risk-on market sentiment. The USD/JPY currency pair today traded between a high of 109.55 and a low of … “Japanese Yen Stuck Trading Sideways Against the Weak US Dollar”

Pound Hits 7-Day High on Santa Claus Rally and USD Weakness

The Sterling pound today rallied against the US dollar as the Santa Claus rally kicked into full effect in the absence of any significant fundamental releases. The GBP/USD rallied to new 7-day highs as the greenback fell against most of its peers as investor risk appetite soared. The GBP/USD currency pair today rallied from an Asian session low of 1.2968 to a high of … “Pound Hits 7-Day High on Santa Claus Rally and USD Weakness”

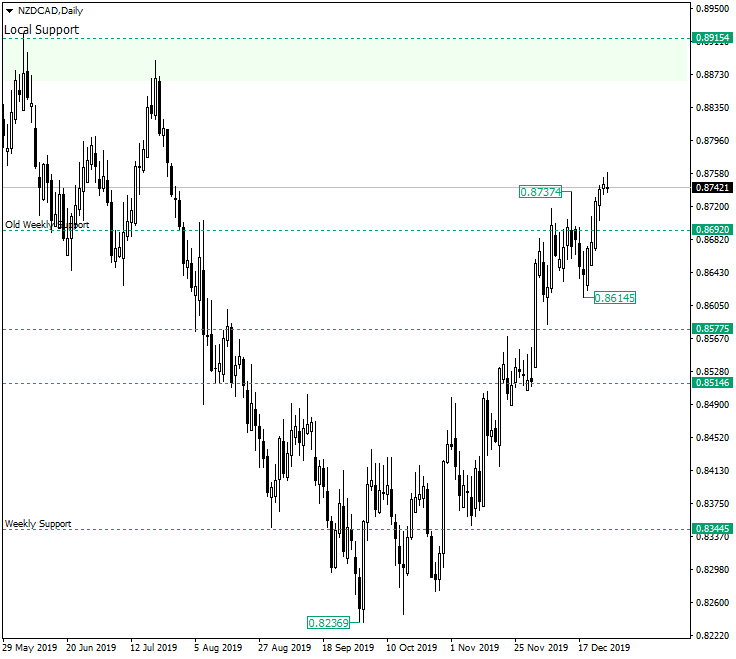

Will NZD/CAD Correct on Its Way to 0.8915?

The New Zealand dollar versus the Canadian dollar currency pair managed to conquer the 0.8692 level. The continuation towards 0.8915 might come after a corrective phase. Long-term perspective The low at 0.8236 started an ascending movement that did not allow any bearish victory. In its ascension, the price won important levels, the last one being 0.8692, an old but important weekly support. The current swing, which started at 0.8614, took … “Will NZD/CAD Correct on Its Way to 0.8915?”

G10: Macro Story Looks Good In AUD, CAD, NZD And Poor In SEK, JPY, CHF – TD

2019 draws to a close and 2020 is about to begin. Where next for currencies? Here is their view, courtesy of eFXdata: TD Research discusses G10 outlook from a macro perspective over the coming year. TD maintains a long AUD/NZD* position targeting a move towards 1.14 in 2020. “A less synchronized slowdown could reinforce broader … “G10: Macro Story Looks Good In AUD, CAD, NZD And Poor In SEK, JPY, CHF – TD”

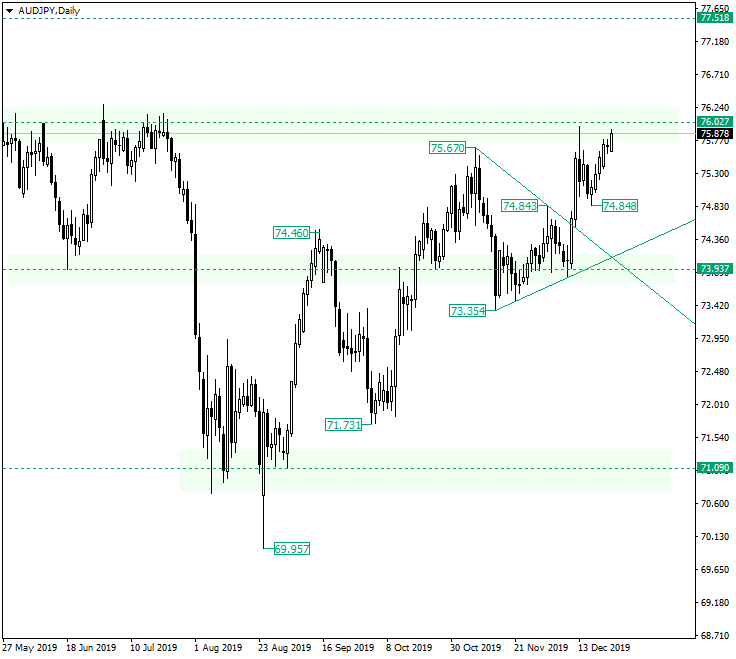

AUD/JPY Taking Decisions at 76.02

The Australian dollar versus the Japanese yen currency pair seems determined to challenge the 76.02 resistance. Will it make it? Long-term perspective The price is contained within the ascending trend that started after the confirmation of 71.09 as support, and there are reasons for the bulls to have no worries with regards to a possible change. The reasons for such an expectation are sustained by the very structure that the bulls beat into shape. For a first instance, … “AUD/JPY Taking Decisions at 76.02”

Euro Falls Then Attempts to Rally on Christmas Eve

The euro today fell against the US dollar amid thin holiday trading conditions ahead of tomorrow’s Christmas holiday celebrations. The EUR/USD currency pair’s performance was not influenced by any significant fundamental news but was primarily driven by investor sentiment. The EUR/USD currency pair today fell from an opening high of 1.1093 in the Asian session … “Euro Falls Then Attempts to Rally on Christmas Eve”

Japanese Yen Flat As Data Elevates Recession Talk

The Japanese yen is trading relatively flat against some of the most-traded currencies in the market as a string of disappointing data has elevated recession talk. After some reprieve from bearish data, it looks like the worldâs third-largest economy is still unable to rejuvenate growth, despite the governmentâs planned $120 billion stimulus. The question that is now dominating global financial markets is: Whatâs next? The Ministry of Economy, Trade, … “Japanese Yen Flat As Data Elevates Recession Talk”

PPE must haves for any workplace

Providing a workplace with appropriate PPE will help protect employees from a variety of potential health and safety risks. All workplaces should endeavour to provide clear procedures, training and adequate supervision to improve levels of safety, but there are often still risks or hazards which require a range of PPE. When considering which items of … “PPE must haves for any workplace”