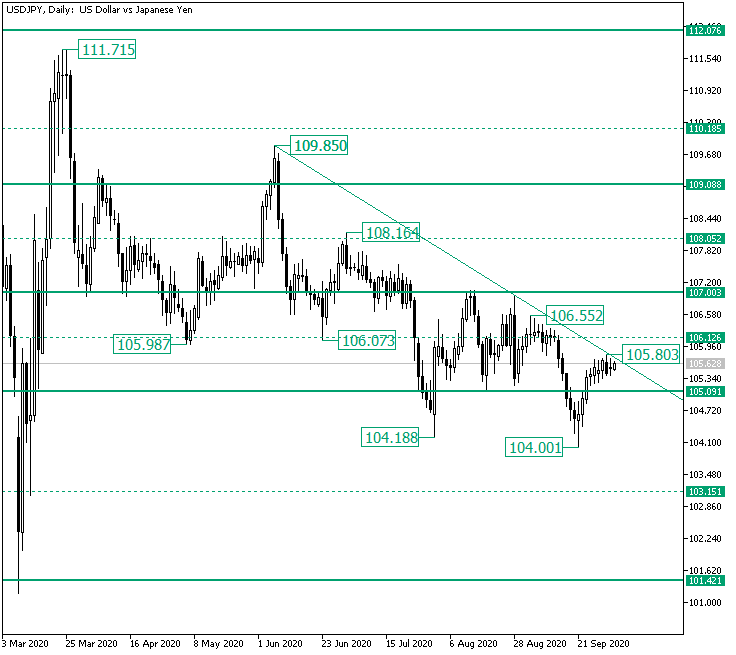

The US dollar versus the Japanese yen currency pair seems to be lacking traction to reach 106.12. Are the bears just around the corner? Long-term perspective The depreciation from the 111.71 high lead to a more or less sideways movement which, from the 109.85 lower high, ebbed and crafted the low of 104.18. From the 104.18 low, a new side sideways movement started, one contained by the 107.00 and 105.09 levels, respectively. After the support was … “Possible Leg Down on USD/JPY from the 105.80 High?”

Euro Rallies Against Dollar on Elevated Sentiment, Falls Then Rises

The euro today rallied against the US dollar twice followed by quick retracements despite the upbeat investor risk appetite that boosted risk assets. The EUR/USD currency pair today rallied then gave up all its gains before rallying again as the bulls and bears fought for control amid mixed euro area macro prints. The EUR/USD currency … “Euro Rallies Against Dollar on Elevated Sentiment, Falls Then Rises”

US Dollar Weakens As Jobless Claims Slide to Six-Month Low, Consumer Spending Jumps

The US dollar is kicking off October lower as the number of Americans filing for first-time unemployment benefits fell to a six-month low and consumers continued to show some signs of life in August. Still, the greenback is poised for a noteworthy weekly gain against many of its major currency rivals, buoyed by uncertainty in the broader financial markets. According to the Department of Labor, initial jobless claims increased by 837,000 in the week ending September 26, coming in below … “US Dollar Weakens As Jobless Claims Slide to Six-Month Low, Consumer Spending Jumps”

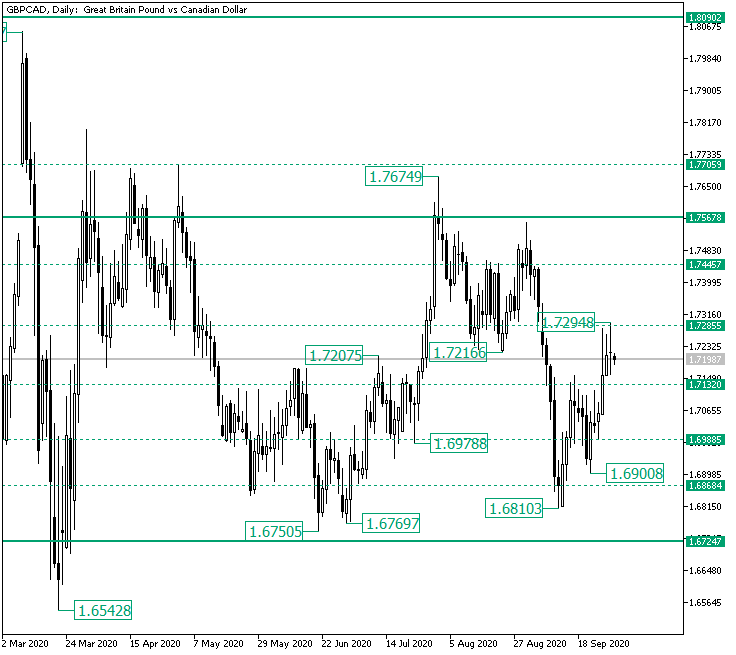

GBP/CAD Peaking at 1.7294?

The Great Britain pound versus the Canadian dollar currency pair seems to be having a hard time while attempting to conquer 1.7285. Long-term perspective The appreciation that came into being after the double bottom defined by the 1.6705 and 1.6769 lows, respectively, played its part was limited by the 1.6567 firm resistance area, which encouraged the bears to start a fall that would later stop at the zone of the mentioned lows, printing the 1.6810 … “GBP/CAD Peaking at 1.7294?”

Sterling Rallies Against Dollar on Brexit Optimism and UK GDP

The Sterling pound today rallied against the weak dollar ignoring the uncertainty surrounding the Brexit talks as investor sentiment remained decidedly bullish. The GBP/USD currency pair today extended its rally for the third consecutive day driven by the greenback’s overall weakness and positive UK macro reports. The GBP/USD currency pair today rose from a low … “Sterling Rallies Against Dollar on Brexit Optimism and UK GDP”

Canadian Dollar Rises as GDP Continues to Grow, Oil Prices Rise

Commodity currencies were the clear winners today, and the Canadian dollar was among them. It was trading on par with its Australian and New Zealand counterparts but gained against major rivals. Market analysts speculated that such behavior was a result of month-end flows, which drove the US dollar down, though the Canadian currency has its own factors to support it. Statistics Canada reported that gross … “Canadian Dollar Rises as GDP Continues to Grow, Oil Prices Rise”

US Dollar Mixed As GDP Beats Estimates, Fiscal Stimulus Hopes Rise

The US dollar is trading mixed against several currency counterparts midweek as investors focus more on economic data and fiscal stimulus instead of the first 2020 presidential debate between President Donald Trump and former Vice President Joe Biden. With growing confidence in the broader financial market, the greenback could face pressure in October, but electoral uncertainty might cap its decline. According to the US Bureau of Economic Analysis (BEA), … “US Dollar Mixed As GDP Beats Estimates, Fiscal Stimulus Hopes Rise”

Chinese Yuan Jumps on Better-Than-Expected Manufacturing Activity

The Chinese yuan is looking to extend its modest winning streak this week, buoyed by better-than-expected manufacturing and non-manufacturing data. Global financial markets have been waiting for these figures to see how the worldâs second-largest economy is faring in the aftermath of the coronavirus pandemic. While the numbers are positive, they still suggest sluggishness in China. According to the National Bureau of Statistics (NBS), the manufacturing purchasing managersâ index (PMI) climbed to 51.5 … “Chinese Yuan Jumps on Better-Than-Expected Manufacturing Activity”

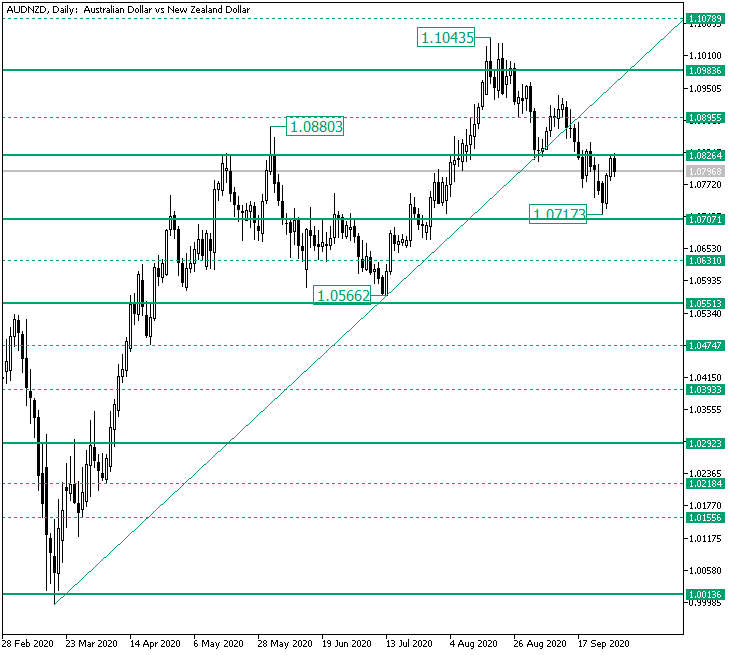

Bulls Attempting Recovery on AUD/NZD from 1.0717?

The Australian versus the New Zealand dollar currency pair seems to be unwilling to go any lower. It’s the bulls behind all this, or a new depreciation is just around the corner? Long-term perspective After the rally that started from the 1.0013 support area and the correction that extends from the 1.0880 high to the 1.0566 low, the price continued until the 1.1043 peak. But as the peak formed above the major 1.0983 level and the following … “Bulls Attempting Recovery on AUD/NZD from 1.0717?”

Euro Rallies to 1-Week Highs Driven by Investor Risk Appetite

The euro today rallied against the US dollar despite the release of mixed macro prints from across the euro area driven by the resurgent investor risk appetite. The EUR/USD currency pair’s rally was also boosted by the greenback’s selloff, which started yesterday amid hopes of a US coronavirus stimulus package. The EUR/USD currency pair today … “Euro Rallies to 1-Week Highs Driven by Investor Risk Appetite”