The South Korean won is trading sideways against the US dollar on Tuesday as the national economy failed to improve in August as the effects of COVID-19 continue to linger in one of Asia’s biggest economies. With the coronavirus pandemic diminishing in Seoul, could one of Asiaâs worst-performing currencies turn things around in the final quarter of 2020? Industrial output fell 0.7% in August, down from the 1.9% increase in July. The annualized rate dropped 3%, worse than … “USD/KRW Unchanged As Data Disappoints Struggling South Korean Economy”

Presidential Debate Preview: Trump may lose due to his own buildup, market implications

The first presidential debate is set to shake up the elections campaign. President Trump’s playing down of challenger Biden’s skills may turn into a double-edged sword. Markets will move on implications for a new fiscal relief package. “Sleepy Joe” is what President Donald Trump calls his opponent and former Vice-President Joe Biden. Mocking a political … “Presidential Debate Preview: Trump may lose due to his own buildup, market implications”

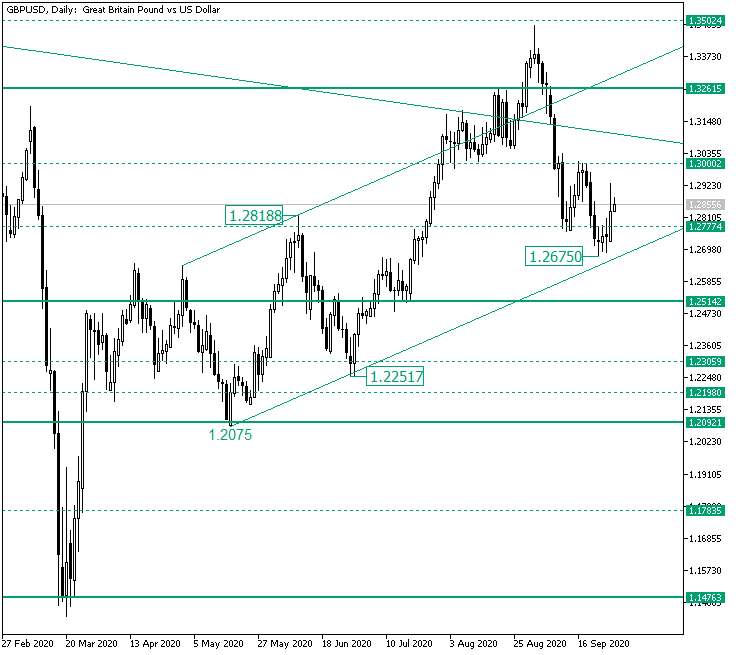

Bulls Back on GBP/USD from 1.2675?

The Great Britain pound versus the US dollar currency pair seems to have shifted the course. Is this the real thing, or it’s just the bears preparing a new depreciation? Long-term perspective After the rally started by the confirmation of 1.1476 as support, the price sprang an ascending movement that stopped near the 1.3502 intermediary level. However, shortly after, the price dropped under the area it had just conquered, an area defined by the 1.3261 level, … “Bulls Back on GBP/USD from 1.2675?”

Australian Dollar Gains on Improving Sentiment, Changing Outlook for Interest Rate Cut

The Australian dollar was extremely strong on Monday, second only to the Great Britain pound. There were two likely reasons for that. The first one was the positive general market sentiment, which was favoring riskier assets. The second one was the changing outlook for the timing of an interest rate cut from the Reserve Bank of Australia. Investors were in a positive mood at the start of the week as the rally in the stock market that has started on Friday … “Australian Dollar Gains on Improving Sentiment, Changing Outlook for Interest Rate Cut”

Sterling Firms on Brexit Optimism, Monetary Policy Outlook

The Great Britain pound was the strongest among the major currencies on the Forex market today thanks to comments from a central bank official and hopes for a trade deal between the United Kingdom and the European Union. While the sterling has trimmed its gains by now, it is still trading above the opening level at the time of writing. Bank of England Deputy Governor Dave Ramsden said that he thinks the BoE does not need … “Sterling Firms on Brexit Optimism, Monetary Policy Outlook”

Chinese Yuan Looks to Test 52-Week High as PBoC Pumps More Liquidity

The Chinese yuan paused its rally last week after touching a 52-week high of 6.75 against the US dollar. The yuan is looking to restart its push against the greenback to kick off the trading week, driven by additional liquidity in the banking system and a recovering economy. Can the yuan maintain its upward trajectory? On Monday, the People’s Bank of China (PBoC) announced that it would inject $5.86 billion into the Chinese market … “Chinese Yuan Looks to Test 52-Week High as PBoC Pumps More Liquidity”

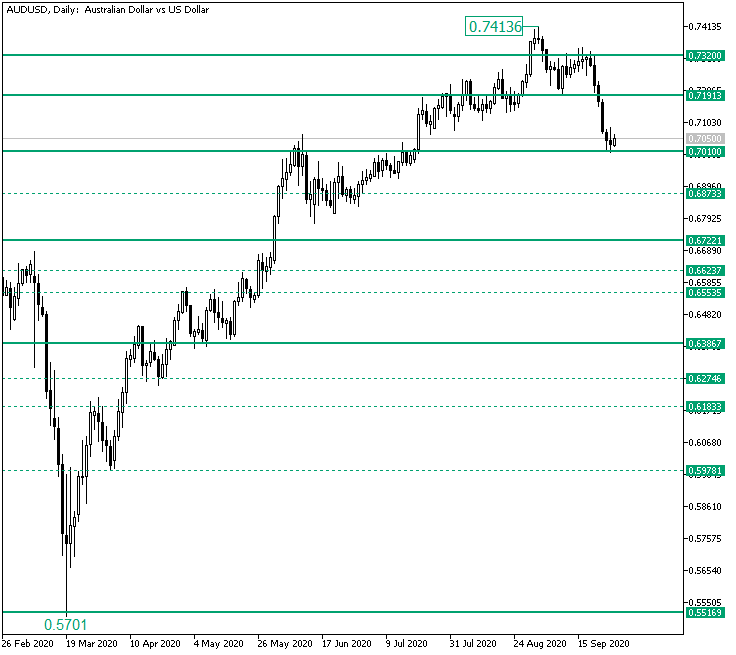

AUD/USD Touched 0.7010. Are the Bears Done?

The Australian versus the US dollar currency pair seems to be in bearish hands. Are the bulls anywhere near? Long-term perspective The appreciation from the 0.5701 low climbed to as high as 0.7413. From there, it retraced under the 0.7320 firm resistance area, which rendered the price-action as a false break. On September 9, a bullish engulfing was printed after the price was repelled by 0.7191. However, the facts that the pattern materialized after a false … “AUD/USD Touched 0.7010. Are the Bears Done?”

Risk Aversion Helped Greenback End Week Strongest

The US dollar ended the trading week as the strongest currency on the Forex market thanks to risk aversion. The Australian and New Zealand dollars were the weakest due to the outlook for monetary easing from their respective central banks. The greenback started the week strong due to risk aversions caused by the rising number of new COVID-19 cases around the world, concerns about the global economic recovery, political uncertainty associated with the upcoming presidential election in the United … “Risk Aversion Helped Greenback End Week Strongest”

Euro Falls to 2-Month Lows As Investors Remain Risk Averse

The euro today fell to 2-month lows against the US dollar driven by negative investor sentiment as coronavirus cases in Europe and across the world continue to rise. The greenback’s rally also fueled the EUR/USD currency pair’s decline as investors piled into the world’s only reserve currency despite the looming US elections. The EUR/USD currency pair today fell from a high of 1.1684 in the early Frankfurt session to a low of 1.1612 in the American market and was slightly … “Euro Falls to 2-Month Lows As Investors Remain Risk Averse”

USD/MXN Rises As Mexican Central Bank Cuts Interest Rates Again

The Mexican peso is struggling to find support against several major currency rivals after the central bank cut interest rates for the 11th consecutive month. The Mexican economy has been slumping as the country fails to contain the coronavirus pandemic, with the number of new infections rising thousands per day. Despite the peso making gains this past summer, it has been one of the worst-performing Latin American currencies this year. … “USD/MXN Rises As Mexican Central Bank Cuts Interest Rates Again”