The Great Britain pound was extremely weak today, falling against all other major currencies, even the Australian and New Zealand dollars, which were recovering after the losses they have posted earlier this week. Analysts say, though, that the gains of the Australian and New Zealand currencies were just a result of a short-covering rally, which is not likely to last long. As for the sterling, it performed poorly this week, … “The Great Britain Pound Drops Despite Positive News Headlines”

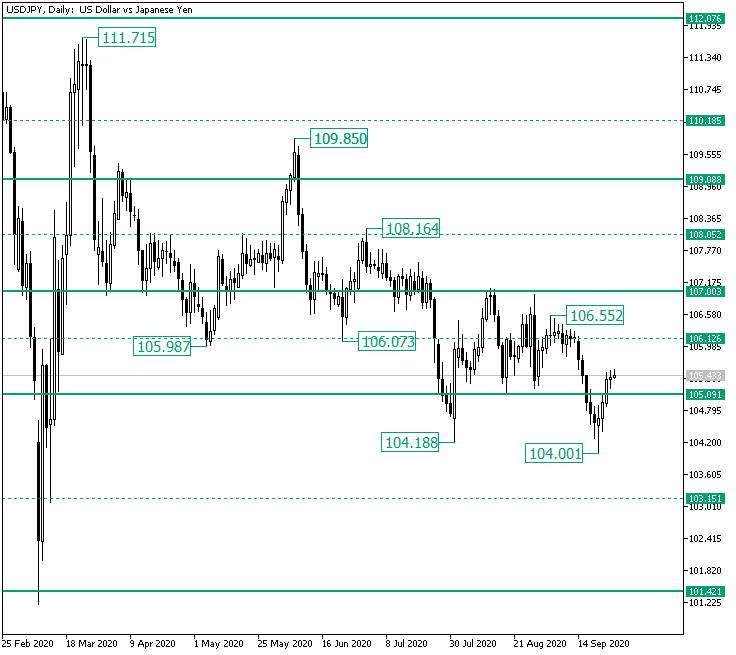

Bulls Back on Track on USD/JPY from 104.00?

The US dollar versus the Japanese yen currency pair seems to have recovered, as it oscillates above the 105.09 level. Should the bulls buy it!? Long-term perspective Tha fall from the 111.71 high had given the bears a good opportunity, as the series of lower highs and lower lows suggests. So, they had taken their chance and, driven by conviction, crafted the 104.00 low. This is their second attempt to establish … “Bulls Back on Track on USD/JPY from 104.00?”

Norges Bank Won’t Hike Interest Rates for Years, Krone Flat

Norway’s central bank signaled today that it is planning to keep interest rates at the current record low levels for at least a couple more years. The Norwegian krone weakened as a result of the announcement but has rebounded afterward and is now heading to end the session about flat. As was widely expected, the Norges Bank kept the policy rate (its key interest rate) at zero, saying that “he policy rate will … “Norges Bank Won’t Hike Interest Rates for Years, Krone Flat”

Turkish Lira Gains After Surprise Interest Rate Hike

The Turkish central bank surprised markets today, performing an unexpected interest rate hike. The Turkish lira rallied as a result. The Central Bank of the Republic of Turkey raised its policy rate (one-week repo auction rate) from 8.25% to 10.25%. That was a total surprise to analysts as most of them were expecting the central bank to keep rates unchanged. And even those, who believed that a hike is possible, did not anticipate … “Turkish Lira Gains After Surprise Interest Rate Hike”

SNB Keeps Monetary Policy Unchanged, Swiss Franc Weak

The Swiss National Bank made a monetary policy announcement today but markets paid little attention to it. Currently, the Swiss franc is the weakest currency on the Forex market, even losing its earlier gains versus the Australian and New Zealand dollars, which themselves were very weak. It looks like traders continue to prefer the US dollar as a refuge, ignoring other safe currencies, like the franc and the Japanese yen. As was … “SNB Keeps Monetary Policy Unchanged, Swiss Franc Weak”

Euro Falls Against US Dollar on Risk-Off Mood, Later Recovers

The euro today fell against the US dollar driven by the risk-off investor sentiment, which has been persistent this week triggering a selloff in riskier assets. The EUR/USD currency pair’s decline was also fueled by the weak German IFO survey data released earlier today combined with the greenback’s overall strength. The EUR/USD currency pair today … “Euro Falls Against US Dollar on Risk-Off Mood, Later Recovers”

US Dollar Finds Safe-Haven Support on Worse-Than-Expected Jobless Claims

The US dollar is finding support from investors who are seeking shelter following a worse-than-expected jobless claims report. The greenback has been climbing in recent weeks amid a return of volatility in the broader financial markets. With growing uncertainty in the economy surrounding the coronavirus and the upcoming cold and flu season, the buck might pare much of its losses by yearâs end. According to the Department of Labor, the number of Americans filing for first-time unemployment benefits … “US Dollar Finds Safe-Haven Support on Worse-Than-Expected Jobless Claims”

NZ Dollar Drops on Monetary Easing Outlook

The New Zealand dollar together with its Australian counterpart remained the weakest among most-traded currencies on the Forex market during today’s trading. The reason for such a poor performance was the outlook for monetary easing from the central banks of New Zealand and Australia. The Reserve Bank of New Zealand signaled yesterday that it continues to prepare for implementing negative interest rates and other measures to stimulate the struggling New Zealand economy, which got … “NZ Dollar Drops on Monetary Easing Outlook”

Japanese Yen Remains Soft Despite Pessimistic Mood

The market sentiment remained pessimistic, encouraging investors to stick to safer assets. But that did not help the Japanese yen, which was one of the weakest currencies on the Forex market during Thursday’s trading. Today, the Bank of Japan released minutes of its July monetary policy meeting. The bank talked in the notes about recovery in the global economy: Overseas economies had been depressed significantly, reflecting the impact of the COVID-19 pandemic, although they … “Japanese Yen Remains Soft Despite Pessimistic Mood”

Bears Taking Control on AUD/NZD from 1.0856?

The Australian versus the New Zealand dollar currency pair slipped under the ascending trendline. Is this the end of the bullish dominance? Long-term perspective The rally that started from the 0.9991 low and which validated 1.0013 as support, extended, firstly, until the 1.0880 high. From there, a correction phase came into being, one that drew a retracement until the 1.0566 low. After validating the 1.0551 level as support and also etching the second … “Bears Taking Control on AUD/NZD from 1.0856?”