The Japanese yen was mixed today despite the relatively negative sentiment amid investors. Usually, the yen rallied amid risk aversion due to its status as a safe haven. But today, the currency was struggling to rise. Some analysts explained that by the rally of the stock market. Domestic economic indicators were not favorable to the currency of Japan either. European stocks rallied, with all major indices logging gains. That alleviated … “Japanese Yen Mixed amid Signs of Economic Slowdown”

US Dollar Among Strongest on Coronavirus Fears

The US dollar was firm today, battling with the Great Britain pound for the title of the strongest currency during Wednesday’s trading. Market analysts explained the strong performance by risk aversion on markets. Investors are worried about the impact of the coronavirus pandemic and measures to contain it. While many countries were easing restrictions, the surge of new cases around the world is likely to force governments to reinstall lockdown measures. Even without the second … “US Dollar Among Strongest on Coronavirus Fears”

Euro Rallies Against Dollar, Later Falls on Dovish Sentiment

The euro today extended its losing trend against the much stronger US dollar driven by the release of mostly negative euro area PMI prints by Markit Economics. The EUR/USD currency pair today fell driven by the massive demand for the greenback amid fears that the rising coronavirus cases would derail the global economy. The EUR/USD currency pair … “Euro Rallies Against Dollar, Later Falls on Dovish Sentiment”

Australian Dollar Weak on Interest Rate Cut Outlook

The Australian dollar was one of the weakest currencies on the Forex market during Wednesday’s trading. The Aussie fell even against its New Zealand counterpart, which itself was extremely soft, though by now the AUD/USD pair has almost erased its losses. Market analysts thought that the main reason for the currency’s weakness was the outlook for an interest rate cut in the near future. Yesterday, Guy Debelle, Reserve Bank of Australia Deputy … “Australian Dollar Weak on Interest Rate Cut Outlook”

USD/INR Slumps to One-Month Low As Economy Forecast to Crash in 2020

The Indian rupee is slumping to a one-month low against the US dollar, driven by a bleak forecast for the developing countryâs economy in 2020. But while market observers are anticipating an economic contraction, officials are looking ahead and expecting improvements across the nation. But could the rupee threaten its gains over the last few months? The United Nations Conference on Trade and Development (UNCTAD) published a new Trade and Development Report for 2020. It … “USD/INR Slumps to One-Month Low As Economy Forecast to Crash in 2020”

NZ Dollar Drops After RBNZ Hints at Additional Monetary Easing

The New Zealand dollar dropped today, falling against some of its rivals, like the US dollar, for the third consecutive day. The currency declined following the monetary policy announcement from the nation’s central bank. The Reserve Bank of New Zealand confirmed that it continues to prepare additional measures to stimulate the New Zealand economy. The RBNZ left its monetary policy unchanged, with the key interest rate staying at 0.25% and the Large Scale … “NZ Dollar Drops After RBNZ Hints at Additional Monetary Easing”

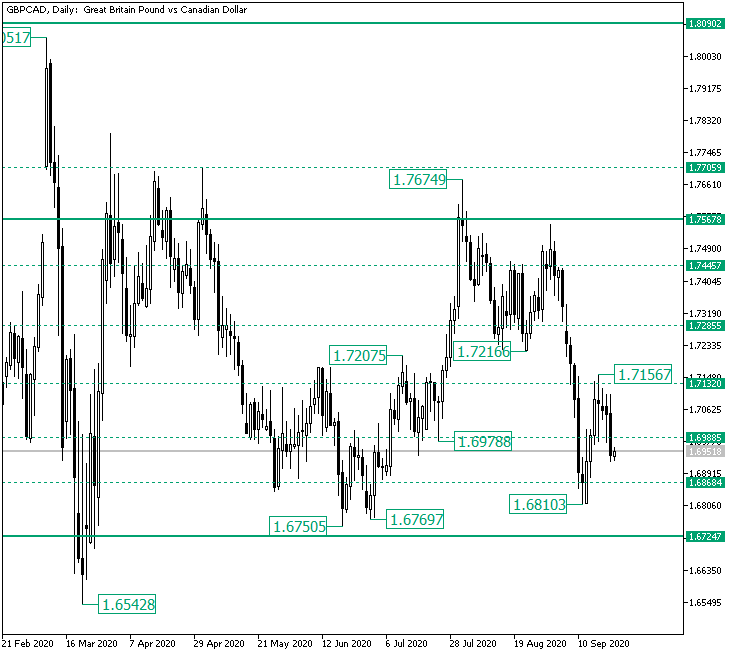

Rise on GBP/CAD Halted at 1.7156?

The Great Britain pound versus the Canadian dollar currency pair seems to have ceased the appreciation phase. Is this only a small correction? Long-term perspective The appreciation that started after the double bottom — defined by the 1.6750 and 1.6769 lows, respectively — played its role, ended after the 1.7567 level interrupted the movement twice — first by rendering the 1.7674 high as a false piercing and then by stopping the advance that started from 1.7216. After … “Rise on GBP/CAD Halted at 1.7156?”

Pound Falls Against Dollar on Brexit and New UK COVID-19 Rules

The Sterling pound today fell against the US dollar as investors remained wary of the current state of post-Brexit trade talks with the rising chances of a no-deal scenario. The GBP/USD currency pair’s decline was also fueled by the increasing coronavirus cases in the UK, which saw the government impose new restrictions to curb its … “Pound Falls Against Dollar on Brexit and New UK COVID-19 Rules”

Chinese Yuan Tests 6.7 As PBoC Leaves LPR Unchanged, Injects More Liquidity

The Chinese yuan is continuing to make gains against the US dollar on Tuesday ahead of the manufacturing and non-manufacturing purchasing managersâ index (PMI) readings. The yuan, which had cratered to as low as 7.17 against the greenback, has been one of the top-performing Asian currencies this year, advancing nearly 3% year-to-date. Could the yuan defy market expectations even more? On Monday, the Peopleâs Bank of China (PBoC) left its benchmark lending rate … “Chinese Yuan Tests 6.7 As PBoC Leaves LPR Unchanged, Injects More Liquidity”

NZ Dollar Forecast for Week of September 21-25

The New Zealand dollar rallied strongly since the last year, though it was moving sideways since the summer months of this year. Last week was very good for the currency despite the sharp decline of New Zealand’s economy as the kiwi rivaled the Japanese yen for the title of the strongest currency on the Forex market. But what this week holds for the New Zealand dollar? Last week’s macroeconomic data was somewhat inconclusive. While … “NZ Dollar Forecast for Week of September 21-25”