The Japanese yen started Friday’s trading weak but managed to rebound and is now trading as the strongest currency on the Forex market. The currency gained on the US dollar as the FOMC-inspired rally of the greenback continued to fade. Today’s macroeconomic data in Japan demonstrated deflation of consumer prices, though experts were expecting that. The Statistics Bureau of Japan reported that the national core Consumer Price Index, which excludes fresh food, fell by 0.4% in August … “Japanese Yen Starts Friday Weak, Rebounds Later”

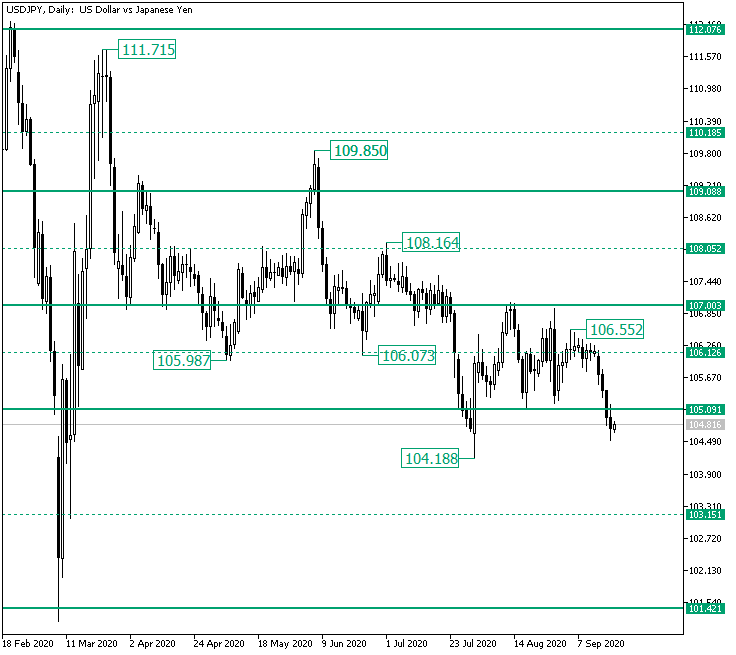

USD/JPY Under the 105.00 Handle

The US dollar versus the Japanese yen currency pair fell under the major 105.09 support area. Can the bulls still recover? Long-term perspective Starting with the 111.71 high, which came after the sharp rally that validated the 101.42 support level, the currency pair has been under constant bearish pressure. The bearish presence can be observed, first of all, by checking the lower highs and — except for 106.07 — lower … “USD/JPY Under the 105.00 Handle”

Japanese Yen Extends Winning Streak As BoJ Maintains Ultra-Loose Support

The Japanese yen is extending its winning streak against many of its most traded currency counterparts on Thursday. The yen found support in the central bank leaving interest rates in subzero territory and keeping its bond-buying program. In addition to the ultra-loose efforts of the Bank of Japan (BoJ), the institution plans to coordinate with new Prime Minister Yoshihide Suga on a wide range of policies. Governor Haruhiko Kuroda and his colleagues voted to keep its … “Japanese Yen Extends Winning Streak As BoJ Maintains Ultra-Loose Support”

US Dollar Looks for Direction As Jobless Claims Fall to Pandemic Low

The US dollar is looking for direction against many of its currency rivals on Thursday after the federal government reported that the number of Americans filing for first-time unemployment benefits declined to a pandemic low. The US central bankâs important September policy meeting continues to weigh on the buck, while uncertainty surrounding Congress’ newest stimulus package sparks concern in the broader financial markets. According to the Department of Labor, initial jobless claims came in at 860,000 … “US Dollar Looks for Direction As Jobless Claims Fall to Pandemic Low”

Sterling Tanks After BoE Talks About Negative Interest Rates

The Great Britain pound sank today, overtaking the New Zealand dollar as the weakest currency on the Forex market during Thursday’s trading. The sterling dropped after the monetary policy announcement from the Bank of England. While the central bank kept its policy unchanged, the wording of the statement led to the drop of the currency. As was widely expected, the BoE left its monetary policy unchanged, with the benchmark interest rate remaining at 0.10% and the size of the Asset Purchase … “Sterling Tanks After BoE Talks About Negative Interest Rates”

NZ Dollar Among Weakest After GDP Report

The New Zealand dollar was among the weakest currencies on the Forex market today amid the risk-negative sentiment among investors. Domestic macroeconomic data was also extremely bad, though not as bad as pessimistic forecasts. Statistics New Zealand reported that gross domestic product shrank by as much as 12.2% in the June quarter. That was the biggest decline on the record. Yet it was still not as big as the 12.5% decline predicted by economists. … “NZ Dollar Among Weakest After GDP Report”

Retail Sales Analysis: Miserable figures good for gold as fiscal help could come sooner

US Retail Sales missed by rising by only 0.1% in August. The lapse of federal support seems to be taking its toll. Growing chances of fresh relief from Washington could boost gold prices. The economic recovery cannot walk on its own – that is the conclusion from America’s retail sales figures for Aguust. Expenditure grew … “Retail Sales Analysis: Miserable figures good for gold as fiscal help could come sooner”

Fed Analysis: No news is good news for the dollar, at least until Congress moves

The Federal Reserve’s projections reiterate the message of low rates. Growth is forecast to return to pre-pandemic levels only by the end of 2021. The cautious message may boost the dollar, weigh on sensitive stocks. Focus shifts to Congress, where there is fresh hope for a deal. Read my dot-plot, no new rate hikes – … “Fed Analysis: No news is good news for the dollar, at least until Congress moves”

Bulls Taking Over on GBP/CAD from 1.6810?

The Great Britain pound versus the Canadian dollar currency pair shifted direction. Could this be a sustainable rise? Long-term perspective After the double bottom marked by the 1.6750 and 1.6769 lows, respectively, validated the firm 1.6724 support area, the price started a convincing appreciation phase. At first, the rally was limited by the 1.7132 intermediary level, thus printing the 1.7207 high. As a result, a consolidation stage — with 1.6988 as support — took shape. However, … “Bulls Taking Over on GBP/CAD from 1.6810?”

Canadian Dollar Soft Despite Surge in Crude Oil Prices

The Canadian dollar was soft today, falling or staying flat against its most-traded peers. Even the strong rally of crude oil prices was unable to aid the currency. One of the possible reasons for the loonie’s weakness was disappointing domestic inflation data. Statistics Canada reported that the Consumer Price Index fell 0.1% in August, without adjustments for seasonal factors, instead of rising at the same rate as analysts had predicted. With seasonal … “Canadian Dollar Soft Despite Surge in Crude Oil Prices”