The Canadian dollar was firm today, though fell against other commodity currencies. The loonie rallied even after the Bank of Canada signaled that it plans to keep monetary policy accommodative for a long time. Domestic housing data was favorable but hardly had any impact on the Canadian currency. The BoC held a monetary policy meeting on Wednesday. Surprising no one, the central bank kept its key interest rate … “Canadian Dollar Firm After BoC Policy Meeting”

ECB Preview: Three things for EUR/USD traders to watch out for

The ECB is set to leave rates unchanged but comments on the exchange rate are set to rock the euro. New forecasts are likely to show a minor upgrade to economic forecasts. ECB President’s Lagarde words on using the full extent of the stimulus package is also of importance. Glass half-full or half-empty? The European … “ECB Preview: Three things for EUR/USD traders to watch out for”

Chinese Yuan Renews Gains on Market Rally, Positive Data

The Chinese yuan is looking to start another winning streak after the currency suspended its momentum against the US dollar. The yuan has been on a tear in recent months, testing 6.8 against the greenback, primarily due to favorable domestic economic data and a weakening buck. But escalating US-China tensions and the plunge in equities in recent sessions could limit the yuanâs gains â for now. According to the National Bureau of Statistics, the annualized inflation slipped … “Chinese Yuan Renews Gains on Market Rally, Positive Data”

2020 Elections: Biden widens gap against Trump, why that may trigger a market bounce

A batch of polls conducted after the dust settled from party conventions show Biden enlarging his lead. President Trump may push for a larger fiscal package to increase his chances. Markets have room to rise after the recent downward correction. “It’s the economy stupid” – that comment around Clinton’s 1992 election campaign is where President … “2020 Elections: Biden widens gap against Trump, why that may trigger a market bounce”

NZ Dollar Refuses to Fall in Face of Negative Economic Data

Both domestic macroeconomic data and the general negative market sentiment were detrimental to the New Zealand dollar. But that did not prevent the currency from holding its ground today, rising at least a bit against all other most-traded peers, except for the Australian dollar. Statistics New Zealand reported that manufacturing sales dropped by 11.9% in the June quarter after showing no change in the previous three months. Business statistics … “NZ Dollar Refuses to Fall in Face of Negative Economic Data”

Australian Dollar Holds Ground Despite Risk Aversion

The Australian dollar rose a bit today, gaining against all other most-traded rivals, despite risk aversion prevailing on markets. Domestic macroeconomic data was good but is unlikely to provide the currency substantial support. Markets were in a risk-off mode in part due to the sell-off of tech stocks. Another reason for worry was the news that drug producer AstraZeneca had to pause COVID-19 vaccine tests after one of the test subjects … “Australian Dollar Holds Ground Despite Risk Aversion”

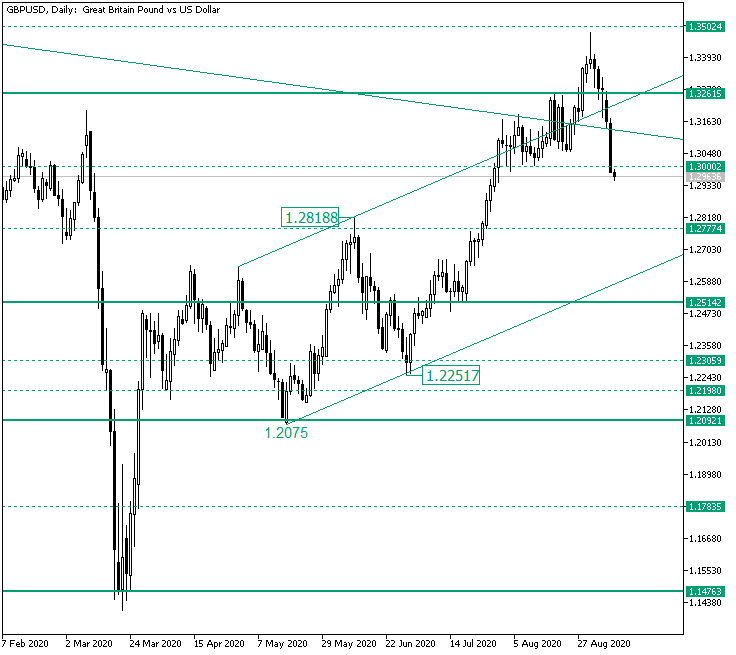

GBP/USD Pullback from 1.3502 Follow-up

The Great Britain pound versus the US dollar currency pair sharply depreciated. Are the bears strong enough to continue? Long-term perspective After printing the 1.2075 low and validating the firm 1.2092 support, the price began an ascending movement. The movement topped at 1.2818 before retracing to the 1.2251 low, from where another appreciation commenced. This laid the foundation for an ascending trend, one which has defined an impulsive swing so strong that … “GBP/USD Pullback from 1.3502 Follow-up”

Euro Falls Against US Dollar Extending Its 6-Day Losing Streak

The euro today fell against the US dollar for the sixth consecutive session despite the release of positive data from across the euro area. The risk-off investor sentiment drove the EUR/USD currency pair’s decline amid rising China-US tensions and the global equity markets selloff. The EUR/USD currency pair today fell from a high of 1.1827 … “Euro Falls Against US Dollar Extending Its 6-Day Losing Streak”

Japanese Yen Rallies Against US Dollar on Upbeat GDP Data

The Japanese yen today traded sideways against the US dollar during the Asian session despite the release of upbeat Japanese GDP data. The USD/JPY currency pair later fell as the yen rallied against the much weaker greenback during the American session. The USD/JPY currency pair today fell from a high of 106.38 in the London … “Japanese Yen Rallies Against US Dollar on Upbeat GDP Data”

Canadian Dollar Slumps to Two-Week Low As 8% Oil Crash Impacts Loonie

The Canadian dollar is slumping to its lowest level in two weeks against the US dollar on Tuesday. The loonie is plummeting primarily on crude oil crashing as much as 9%, joining the broader market selloff. It is going to be relatively quiet on the data front this week, which means the loonie will find direction on energy prices and the central bankâs midweek policy meeting. October West Texas Intermediate (WTI) crude … “Canadian Dollar Slumps to Two-Week Low As 8% Oil Crash Impacts Loonie”