The US dollar is looking to continue its winning streak on Thursday after the federal government reported that the number of Americans filing for first-time unemployment benefits plunged to a new COVID-19 pandemic low. Although the number remains historically high, the trends suggest the labor market is extending its rebound. But while the greenback has cratered in recent months, is the string of gains a signal that the currency is triggering a rally? According … “USD/CAD Rises As Initial Jobless Claims Fall to New Pandemic Low”

Australian Dollar Weak After Trade Balance Shrinks

The Australian dollar was weak today, falling against almost all other most-traded currencies. Some market analysts blamed the decline on the disappointing trade data released in Australia during the trading session, while others thought that it might be just a corrective sell-off after the incredibly good performance last month. The Australian Bureau of Statistics reported that the trade balance surplus shrank to A$4.61 billion in July from A$8.15 … “Australian Dollar Weak After Trade Balance Shrinks”

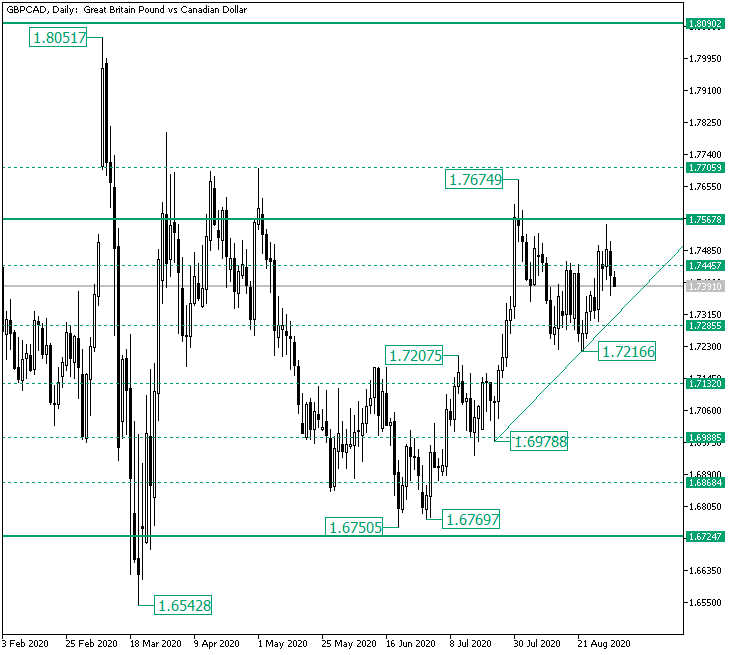

GBP/CAD Ebbs from the Major 1.7567 Resistance

The Great Britain pound versus the Canadian dollar currency pair rotated and began a depreciation. Is this a small correction, or the bears truly took over? Long-term perspective After the double bottom chart pattern etched by the 1.6750 and 1.6769 lows, respectively, the price started an appreciation that reached the firm 1.7567 resistance level. Upon arrival, the bulls attempted to conquer the level but were only able to print the 1.7674 high before the price … “GBP/CAD Ebbs from the Major 1.7567 Resistance”

Turkish Lira Weakens As Investors Weigh Monetary Policy, Poor Economic Data

The Turkish lira is continuing its downward trend against the US dollar midweek as investors start to weigh the central bankâs policies. The lira faced additional pressure on weakening economic data, including the second-quarter gross domestic product and manufacturing numbers. According to the Istanbul Chamber of Industry Turkey, the manufacturing purchasing managersâ index (PMI) fell to 54.3 in August, down from 56.9 in July â anything above 50 indicates expansion. Despite … “Turkish Lira Weakens As Investors Weigh Monetary Policy, Poor Economic Data”

Sterling Pound Falls Against the Dollar on Dovish BoE Speeches

The Sterling pound today fell against the US dollar following dovish speeches from Bank of England policymakers regarding the British economy and monetary policy. The GBP/USD currency pair kept falling despite the release of weak US jobs data as markets interpreted the BoE’s willingness to take extra easing measures negatively. The GBP/USD currency pair today … “Sterling Pound Falls Against the Dollar on Dovish BoE Speeches”

US Dollar Strong Despite Huge Miss of ADP Employment

The US dollar was very strong today despite disappointing employment data. Market analysts suggested various possible reasons for such behavior. Some speculated that the greenback continued to get support from Monday’s positive US manufacturing data. Others argued that it was just a bounce in an oversold market. Automatic Data Processing reported today that US employers added 428,000 jobs in August after adding 212,000 … “US Dollar Strong Despite Huge Miss of ADP Employment”

South Korean Won Mixed As Inflation, Manufacturing PMI Drive Currency

The South Korean won is mixed in the middle of the trading week as inflation and manufacturing data drive one of the worst-performing Asian currencies this year. Although the won has recovered against the greenback since June, the currency has come under a lot of pressure based on the recession and a coronavirus resurgence. Could the won retest 1,200 by the yearâs end? According to Statistics Korea, the consumer price index (CPI) rose 0.6% in August, up from the 0% … “South Korean Won Mixed As Inflation, Manufacturing PMI Drive Currency”

ISM Non-Manufacturing PMI Preview: Low bar opens door to (temporary) dollar bounce

The US ISM Non-Manufacturing PMI and its employment component are set to fall in August. Low expectations and upbeat manufacturing gauge point to a potential upside surprise. The dollar has room to bounce, yet headwinds from the Fed would make it short-lived. Under-promising and over-delivering – something that politicians rarely do – is what may … “ISM Non-Manufacturing PMI Preview: Low bar opens door to (temporary) dollar bounce”

New Zealand Dollar Strongest Despite Outlook for Monetary Easing

The New Zealand dollar was the strongest among the most-traded currencies on the Forex market today despite the outlook for additional monetary easing from New Zealand’s central bank. Domestic macroeconomic data was favorable but seems to provide no noticeable boost to the currency. Adrian Orr, Reserve Bank of New Zealand Governor, delivered a surprise unscheduled speech at the Victoria University of Wellington School of Government today. He signaled that the central bank … “New Zealand Dollar Strongest Despite Outlook for Monetary Easing”

Aussie Soft After Economy Enters First Recession in Almost 30 Years

The Australian dollar was soft today after data confirmed that Australia’s economy has entered a recession. The losses were limited, though, and the Aussie managed to remain flat against a range of peers. The currency had a muted reaction to yesterday’s monetary policy announcement from the Australian central bank. The Australian Bureau of Statistics reported that gross domestic product shrank by 7.0% in the June quarter of this year on a seasonally adjusted basis. Not … “Aussie Soft After Economy Enters First Recession in Almost 30 Years”