GBP/USD has been rising amid Powell-powered dollar weakness. Brexit headlines, coronavirus news, BOE speeches, and Non-Farm Payrolls are set to move the currency pair. Early September’s daily chart is pointing to near overbought conditions. The FX Poll is pointing to falls in the short, medium and long terms. Fed-fueled dollar weakness has been overshadowing everything … “GBP/USD: Time to take profits? Why sterling may suffer in back-tos-school week”

Euro Rallies Against the Dollar on Upbeat Euro Area Macro Prints

The euro today rallied higher against the US dollar capitalising on the greenback’s overall weakness since yesterday’s speech by the Fed Chair. The EUR/USD currency pair also benefitted from the upbeat macro releases from across the euro area, which lent support to the single currency today. The EUR/USD currency pair today rallied from a low … “Euro Rallies Against the Dollar on Upbeat Euro Area Macro Prints”

Japanese Yen Strengthens As Abe Resigns, Economic Activity Rebounds

The Japanese yen is strengthening against its currency rivals to finish the trading week. The yen has found support on Prime Minister Shinzo Abe stepping down and renewed economic activity in the worldâs third-largest economy. The yen has been performing well in 2020 as investors continue to seek traditional safe-haven assets in the fallout of COVID-19. On Friday, Japanâs prime minister announced that he would be resigning from his post as head … “Japanese Yen Strengthens As Abe Resigns, Economic Activity Rebounds”

Franc Weak Despite Near-Record Jump of KOF Economic Barometer

The Swiss franc fell against almost all of the most-traded currencies today despite the near-record jump of the KOF Economic Barometer. The Swissie managed to gain only against the currencies that were weak themselves, like the US dollar, dragged down by yesterday’s speech of Federal Reserve Chairman Jerome Powell, and the Canadian dollar, which suffered from a sharp economic downturn in Canada. The KOF Business Barometer jumped from the revised July reading of 86.0 … “Franc Weak Despite Near-Record Jump of KOF Economic Barometer”

Canadian Dollar Surges Against US Peer, Later falls on GDP Data

The Canadian dollar today surged against its US peer as the latter eas reeling from yesterday’s speech by the Fed Chair Jerome Powell, which unveiled a new inflation policy. The USD/CAD currency pair today fell for the fourth consecutive session to lows last seen in January as the greenback remained under intense selling pressure. The … “Canadian Dollar Surges Against US Peer, Later falls on GDP Data”

Abe’s Departure Analysis: USD/JPY buying opportunity? Abenomics is here to stay

Japanese Prime Minister Shinzo Abe is set to step down after nearly eight years in office. The safe-haven yen reacted with a rise amid uncertainty about the succession. Economic policy is set to remain on course under any replacement, leaving room to recover. The end of an era – that is how several media outlets … “Abe’s Departure Analysis: USD/JPY buying opportunity? Abenomics is here to stay”

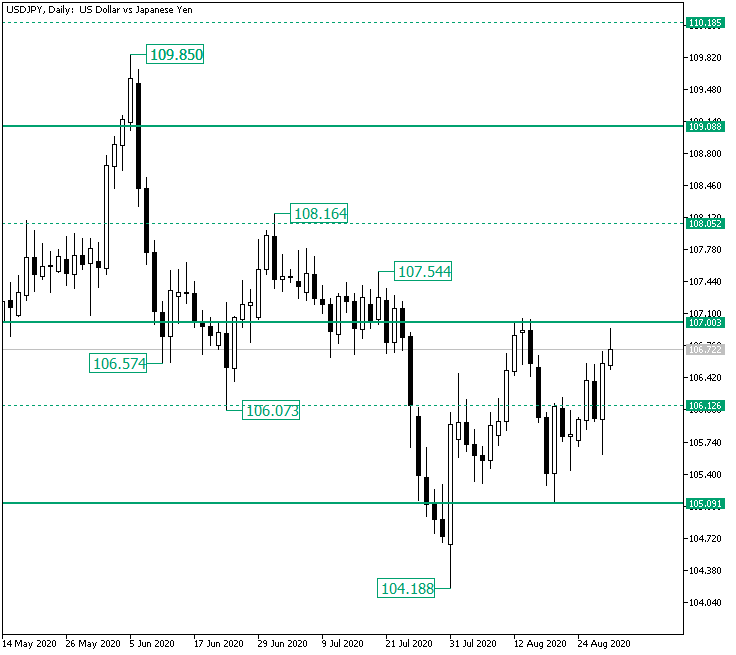

USD/JPY Confronting the 107.00 Resistance Level

The US dollar versus the Japanese yen currency pair seems to be willing to pass the 107.00 level. Will the bears defend it? Long-term perspective The fall from the 109.85 high extended until the 104.18 low. The high is part of a bullish overextension above the firm 109.00 level, while the low an overextension by the bears in relation to the major 105.09 level. The decline from the peak to the bottom passed yet another area of interest, the psychological level … “USD/JPY Confronting the 107.00 Resistance Level”

Euro Swings Between Gains and Losses on Powellâs Speech

The euro today alternated between gains and losses against the US dollar swinging wildly between gains and losses ahead of Jerome Powell speech. The EUR/USD currency pair spiked higher and then crashed lower during the Fed Chair’s speech creating uncertain trading conditions for most traders. The EUR/USD currency pair today spiked to a high of … “Euro Swings Between Gains and Losses on Powellâs Speech”

Powell Quick Analysis: Fed fires on all cylinders, three factors fueling gold stocks, downing dollar

Fed Chair Powell has introduced a new policy framework, allowing for average inflation targeting as expected. Details are lacking, opening the door to inflation running hot. The bank will also prioritize employment over price rises. The Powell Put is alive and kicking – Jerome Powell, Chairman of the Federal Reserve, announced a major dovish paradigm … “Powell Quick Analysis: Fed fires on all cylinders, three factors fueling gold stocks, downing dollar”

US Dollar Slumps As Federal Reserve Announces New Inflation Approach

The US dollar is slumping toward the end of the trading week after the Federal Reserve announced a new approach to inflation that would keep interest rates lower for longer. The greenback is also in the red after initial jobless claims topped one million for the second consecutive week. With inflation almost certain for the next few years, does this spell bad news for the buck? Fed Chair Jerome Powell announced a major … “US Dollar Slumps As Federal Reserve Announces New Inflation Approach”