The New Zealand dollar rallied today, though it has trimmed gains against some of its rivals by now. The catalyst for the rally was the release of surprisingly good domestic employment data. Statistics New Zealand reported that the number of employed people decreased by 0.4% in the June quarter. While not a good figure by itself, the drop was nowhere near 2.0% predicted by specialists. On top of that, the previous quarter’s increase got a positive … “NZ Dollar Rises After Employment Report Surprises Positively”

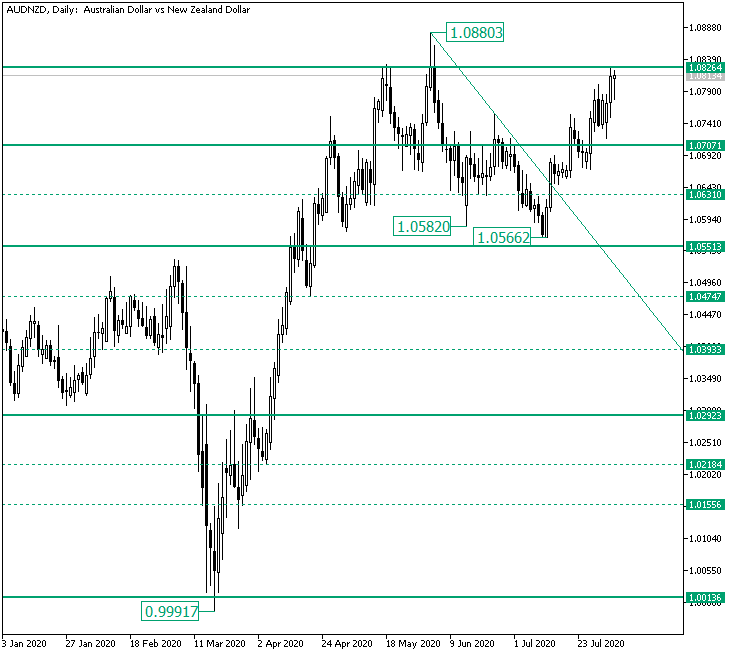

Bulls on AUD/NZD Determined to Conquer 1.0826

The Australian versus the New Zealand dollar currency pair is in a steady appreciation. Will this be enough to pass the important 1.0826 resistance level? Long-term perspective The rally that started at the 0.9991 low extended to the 1.0880 high. From there, a consolidation phase came into being, one that unvalidated the 1.0707 support level and sent the price very close to the firm 1.0551 level — see the 1.0582 and 1.0566 lows. However, the bulls … “Bulls on AUD/NZD Determined to Conquer 1.0826”

Euro Rallies Then Falls Against the US Dollar to Trade Flat for the Day

The euro today fell against the US dollar early in the European session despite the release of upbeat euro area producer price index data as the bears controlled the price action. The EUR/USD currency pair later rallied during the American session as the dollar retreated against its peers amid falling US Treasury yields to trade … “Euro Rallies Then Falls Against the US Dollar to Trade Flat for the Day”

South Korean Won Weakens on Exports, Manufacturing Data

The South Korean won is weakening against some of its major currency competitors on Tuesday as macroeconomic data came into focus. The won has had a disappointing year so far, slumping in the aftermath of the coronavirus pandemic and disappointing economic figures. Is a rebound in sight amid its first recession in nearly 20 years? For the seventh consecutive month, the IHS Markit manufacturing purchasing managersâ index (PMI) contracted, although it jumped … “South Korean Won Weakens on Exports, Manufacturing Data”

EUR/USD: Non-Farm Payrolls may trigger much-needed (temporary) correction

EUR/USD has hit the highest since 2018 amid dollar weakness stemming from several factors. US fiscal stimulus, COVID-19 figures, EU retail sales, and a full NFP buildup are eyed. Early August’s daily chart is pointing to mild overbought conditions. The FX Poll is pointing to a downward correction. Europe’s coronavirus advantage over the US has … “EUR/USD: Non-Farm Payrolls may trigger much-needed (temporary) correction”

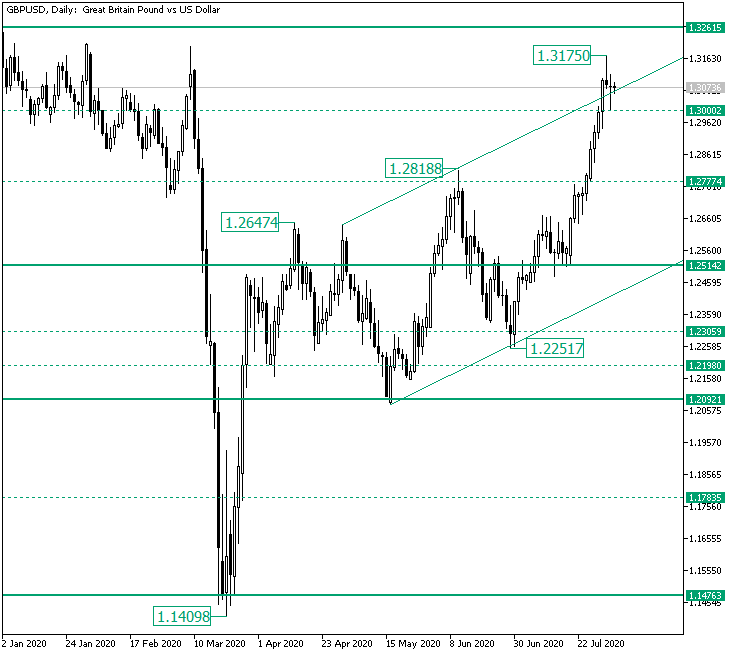

Will the 1.3000 Support on GBP/USD Hold?

The Great Britain pound versus the US dollar currency pair seems to be in a mixed-mode. But is it really so? Long-term perspective After the rally that started from the 1.1409 low and the setback that limited further advancement beyond 1.2514, the price began an ascending trend which managed to print the 1.3175 high. It is important to be noted that the high finds itself beyond the resistance trendline of the ascending channel. … “Will the 1.3000 Support on GBP/USD Hold?”

GBP/USD Weekly Forecast: Will Bailey bail out the bears? BOE, buildup to NFP set to rock rising cable

GBP/USD has hit the highest since March amid a massive dollar sell-off. The BOE’s decision and a full buildup to the Non-Farm Payrolls stand out in the upcoming week. Early August’s daily chart is showing overbought conditions. The FX Poll showing falls in all timeframes. Benefiting from the misery of others – there was nothing … “GBP/USD Weekly Forecast: Will Bailey bail out the bears? BOE, buildup to NFP set to rock rising cable”

USD/CNY Trends in 6.9 Range Amid Strong PMI Readings

The Chinese yuan is weakening slightly against the US dollar to kick off the trading week, despite strong economic data. The yuan had been finding support on a better-than-expected rebound, as well as confidence in the broader financial markets. Whatever happens, it appears that the yuan on track for further appreciation in the second half of 2020, which is what some analysts had forecast. According to the National Bureau of Statistics (NBS), the manufacturing purchasing managersâ … “USD/CNY Trends in 6.9 Range Amid Strong PMI Readings”

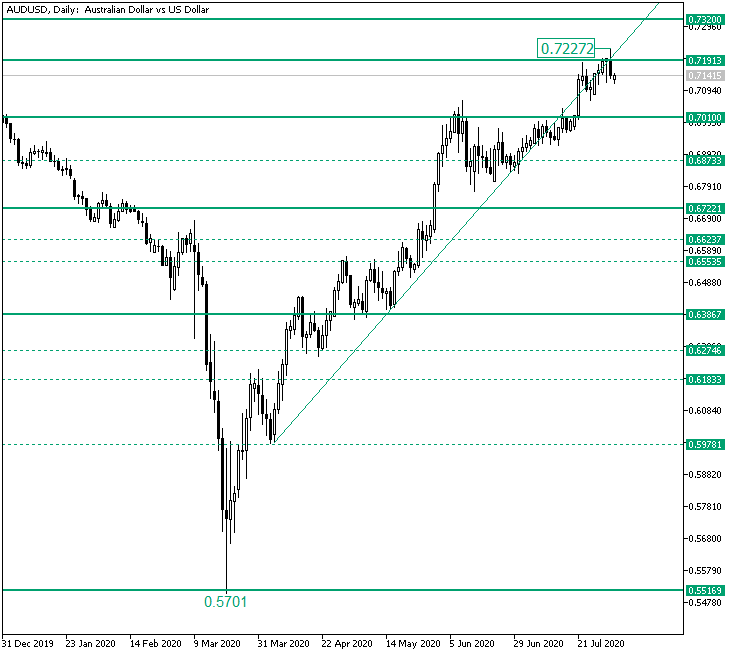

Bulls Looking Tired at 0.7191 on AUD/USD

The Australian versus the US dollar currency pair failed to conquer the 0.7191 resistance level. Is this a sign of the bears getting stronger? Long-term perspective The rise that came about after the retracement from the rooted 0.5516 support level extended all the way to the 0.7227 high. What draws attention is that the 0.7227 high — as of writing — is part of the false piercing which formed above the 0.7191 firm area. In itself the relevance … “Bulls Looking Tired at 0.7191 on AUD/USD”

USD/CHF Tests 0.91 As SNB Posts Huge Q2 Profits

The Swiss franc continues to strengthen against many of its major currency rivals. At the end of the trading week, the franc is looking to touch levels against the US dollar unseen in seven years, despite the Swiss National Bank (SNB)‘s myriad of foreign exchange interventions. How much more can the franc appreciate this year? On Friday, the SNB announced that it recorded a $41.6 billion profit during the second quarter, as well as a $37.6 … “USD/CHF Tests 0.91 As SNB Posts Huge Q2 Profits”