The euro today fell against the US dollar as investors took profits following its blistering rally and the weak euro area GDP data did not help the single currency. The EUR/USD currency pair fell from the early European market as investors took profits on their positions to end a very profitable month for traders who … “Euro Falls on Weak Euro Area Macro Prints, Retail Sales, GDP and CPI”

Canadian Dollar Rallies Against US Peer on Positive GDP Data

The Canadian dollar today posted slights gains against its US peer after the release of upbeat Canadian May GDP data in the American session. The USD/CAD currency pair was trading sideways with minimal losses for most of today’s session as global crude oil prices remained sidelined. The USD/CAD currency pair today traded in a range … “Canadian Dollar Rallies Against US Peer on Positive GDP Data”

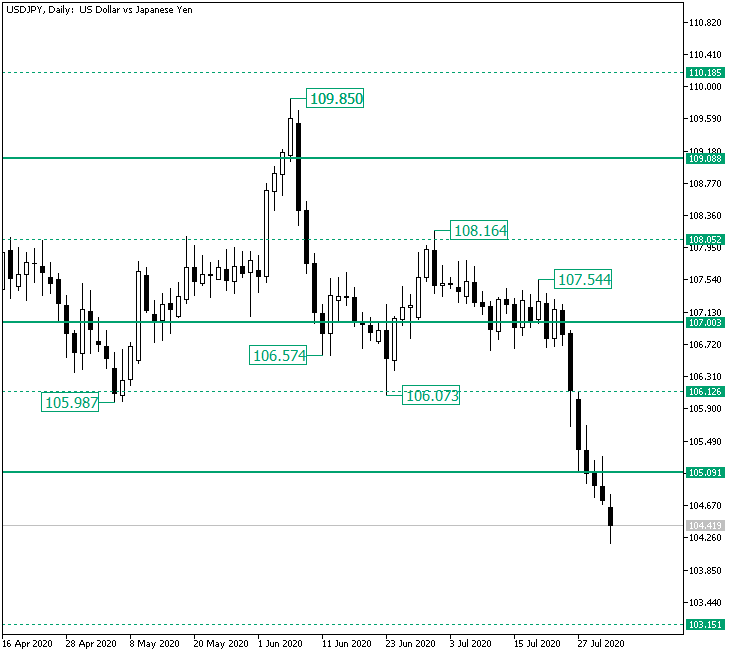

USD/JPY Beneath the Important Support of 105.09

The US dollar versus the Japanese yen currency pair slipped under the important 105.09 level. Can the bulls deliver a surprise comeback? Long-term perspective After the depreciation from the 109.85 high, the bulls were only able to make ill recoveries, their best efforts printing the 108.16 high. The last high — a lower high — was 107.54 which, given the context, offered the bears the required confidence to push the price lower. As a result, the sellers … “USD/JPY Beneath the Important Support of 105.09”

Euro Rallies to 2-Year Highs Against the Dollar on Weak US GDP

The euro today rallied to new 2-year highs against the US dollar driven by positive releases from across the eurozone combined with weak US GDP data. The EUR/USD currency pair today was boosted by upbeat German unemployment data as opposed to the rising jobless claims in the US, which dragged the greenback lower. The EUR/USD … “Euro Rallies to 2-Year Highs Against the Dollar on Weak US GDP”

US GDP: Could have been worse, but will not improve, winners and losers in markets

The US economy shrank by a historic 32.9%, better than expected. Coronavirus continues raging in America in the third quarter, setting the stage for a prolonged recession. The US dollar has room to resume its falls, while the stock market rally seems vulnerable. Better than expected – the green on the screen masks a devastating … “US GDP: Could have been worse, but will not improve, winners and losers in markets”

US Dollar Strengthens As Economy Enters Recession

The US dollar has snapped its losing streak and is making gains against its G10 currency rivals on Thursday. The greenback is finding support on the US government reporting better-than-expected initial jobless claims and GDP data in the second quarter. The buck, which has been on a downward trend over the last three months, is looking to reverse its losses as traders seek refuge in a safe-haven asset. According to the Department of Labor, the number … “US Dollar Strengthens As Economy Enters Recession”

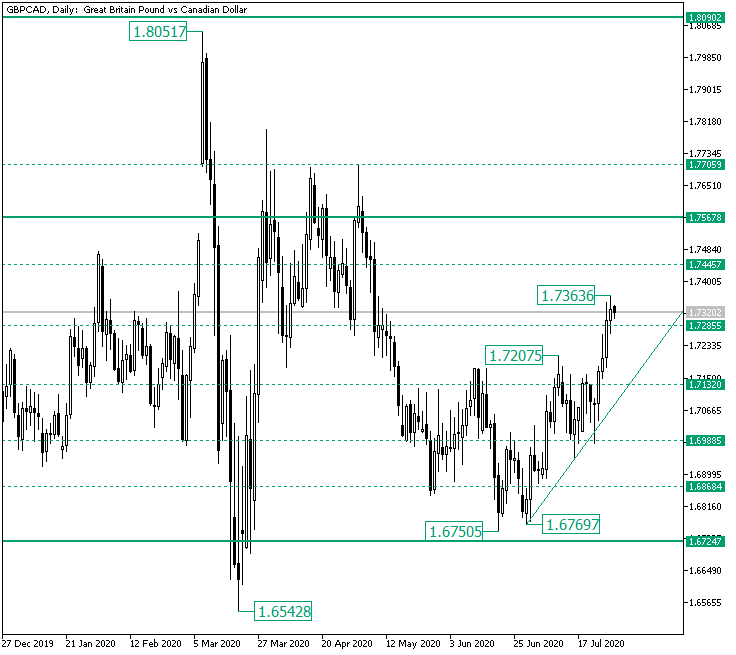

Bullish Determination Sent GBP/CAD Above 1.7285

The Great Britain pound versus the Canadian dollar currency pair printed a strong rally. Could the bears invalidate it? Long-term perspective After the three failed attempts to conquer the strict 1.7567 resistance level, the bulls let the bears do what they know best. As a result, the price got brought around the 1.6724 major support level, where the first bullish opposition towards the continuation of the fall noted the 1.6750 low. Even if … “Bullish Determination Sent GBP/CAD Above 1.7285”

Sterling Inches Higher Against the Dollar on Sentiment, Fed Decision

The Sterling pound today inched higher against the US dollar for the ninth consecutive session as investors remained worried about the rising coronavirus cases in the US. The GBP/USD currency pair today broke out of an initial trading range during the Asian session and headed higher boosted by positive UK releases. The GBP/USD currency pair … “Sterling Inches Higher Against the Dollar on Sentiment, Fed Decision”

US Dollar Falls As Federal Reserve Leaves Interest Rates Unchanged

The US dollar is sliding against many of its most traded currency rivals midweek after the US central bank left its key interest rates unchanged. The greenback has been steadily declining since the market meltdown in March, and analysts are warning that the buck could fall even further amid inflation fears. With the Federal Reserve maintaining its dovish stance, how much more could the dollar … “US Dollar Falls As Federal Reserve Leaves Interest Rates Unchanged”

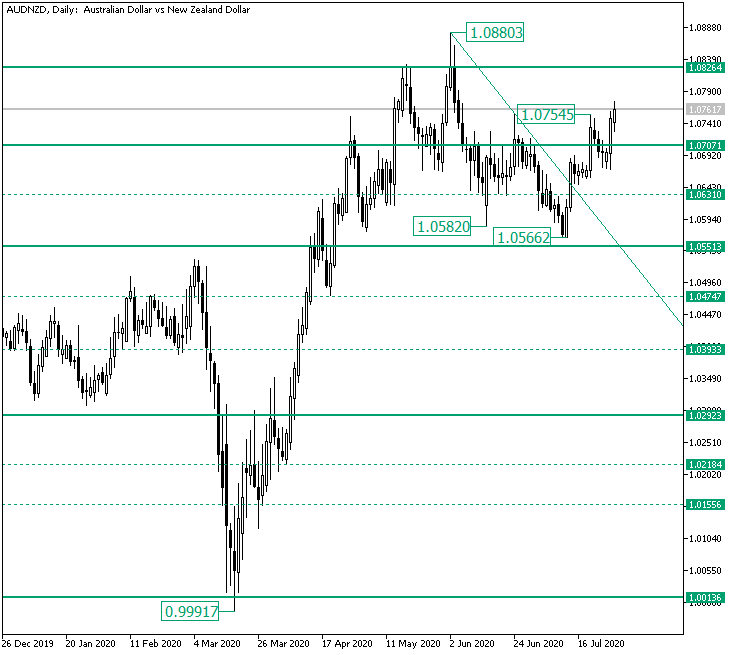

AUD/NZD Back Above 1.0707

The Australian versus the New Zealand dollar currency pair seems to have the bulls on its side. But is it really so? Long-term perspective The rally that started from the 0.9991 low extended to as high as 1.0880. This peak acted as a false piercing of the firm 1.0826 resistance level, and as a consequence, the bears took the opportunity to send the price lower. As a result, the next major support, 1.0707, was passed, leading to the piercing of the 1.0631 intermediary … “AUD/NZD Back Above 1.0707”