The euro today fell against the US dollar after hitting highs last seen in September 2018 yesterday as the greenback sold off. The EUR/USD currency pair was stuck trading in a sideways range slightly lower from its opening price driven by the non-volatile market environment. The EUR/USD currency pair today traded at a high of … “Euro Trades Sideways Above 1.17 As Investors Await Fed Decision”

Brazilian Real Weakens Despite Rise in Foreign Direct Investment, Soybean Exports

The Brazilian real is weakening against the US dollar and several other major currency counterparts on Tuesday, despite positive domestic economic data. The real has rebounded since hitting a record low against the greenback in May, but jitters in global financial markets may be hitting the pause button on emerging market currencies. According to central bank data, foreign direct investment increased for the third consecutive month in June to $4.75 billion, … “Brazilian Real Weakens Despite Rise in Foreign Direct Investment, Soybean Exports”

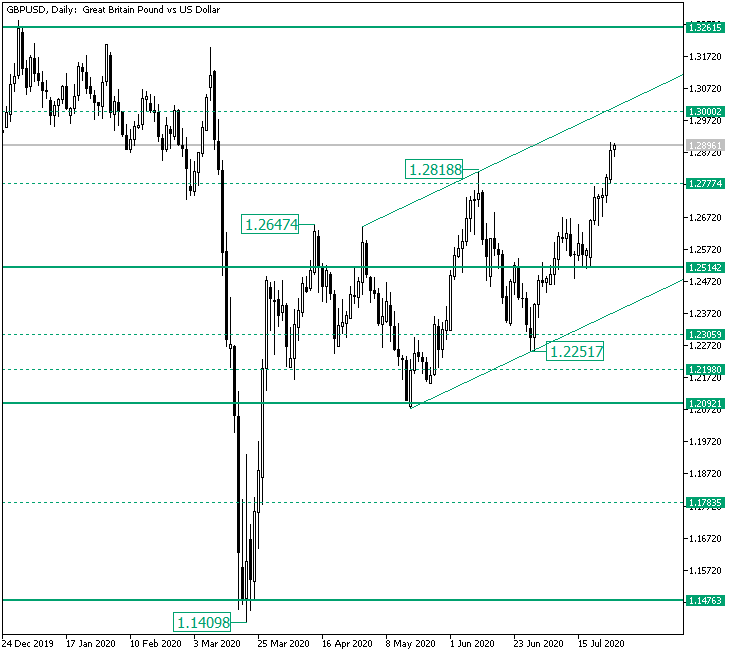

GBP/USD Passes 1.2818 High and on Its Way to 1.3000

The Great Britain pound versus the United States dollar currency pair continues the movement towards the north. Are the bears anywhere near? Long-term perspective The rejection from the 1.4376 dominant support, which printed the 1.1409 low, extended — in the first run — until the 1.2647 high. After the price retraced to confirm the important level of 1.2092 as support, the bulls were able to print a rally that noted a new higher high — 1.2818 — and also start … “GBP/USD Passes 1.2818 High and on Its Way to 1.3000”

Chinese Yuan Strengthens on PBoC Easing Reports, Industrial Profits Gains

The Chinese yuan gained against some of its key currency manipulators to kick off the trading week. The yuan is looking to break below the seven mark against the US dollar on news that the central bank is reportedly keeping its monetary stimulus unchanged due to a stronger-than-expected economic recovery. The yuan is also looking to extend its momentum on additional data on Monday. On Friday, Reuters published a report that suggested the Peopleâs … “Chinese Yuan Strengthens on PBoC Easing Reports, Industrial Profits Gains”

Fed Preview: Warming up to controlling the yield curve, nudging lawmakers, keeping markets happy

The Federal Reserve is set to leave its policy unchanged but may show openness to controlling the yield curve. Fed Chair Powell may gently call on lawmakers to act as negotiations come to the wire. While stock markets may seem rich, the Fed is unlikely to express concern. “Not even thinking about thinking about raising … “Fed Preview: Warming up to controlling the yield curve, nudging lawmakers, keeping markets happy”

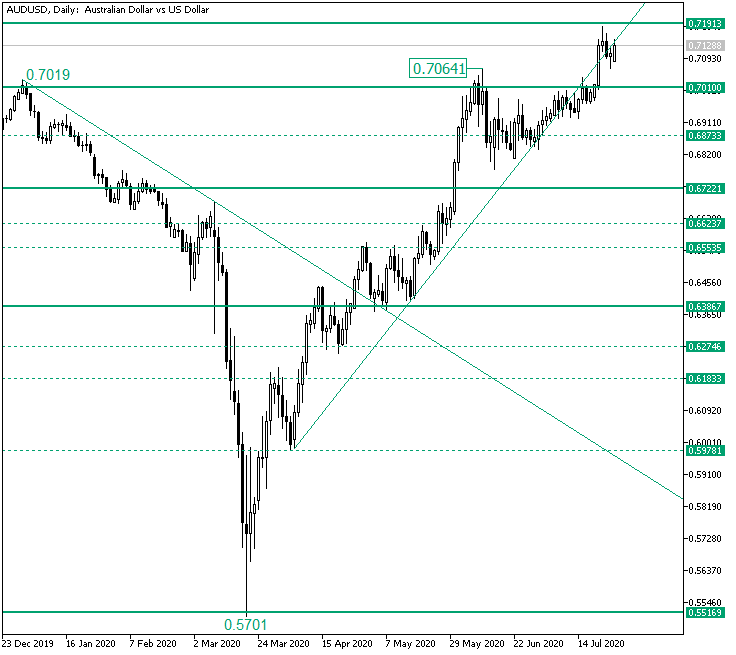

AUD/USD Above 0.7000. Whatâs Next?

The Australian dollar versus the United States dollar currency pair conquered the 0.7000 psychological level. But is this truly a bullish victory? Long-term perspective The retracement from the solid support of 0.5516 managed to stabilize above the double resistance area defined by the 0.6306 level and the descending trendline that starts from the 0.7019 high. After this, the bulls headed for their next target, 0.7000, an old but important area, and also a psychological … “AUD/USD Above 0.7000. Whatâs Next?”

USD/CHF Tests 0.92 As UBS Warns US Will Label SNB a Currency Manipulator

The Swiss franc is extending its gains against many of its G10 currency competitors to finish the trading week. With the US dollar weakening and global economic uncertainty amid the coronavirus pandemic, investors continue to pour into the franc, much to the chagrin of a central bank doing everything it can to place a cap on its ascent. As the Swiss National Bank (SNB) defends its aggressive foreign exchange interventions to limit the currencyâs appreciation, … “USD/CHF Tests 0.92 As UBS Warns US Will Label SNB a Currency Manipulator”

Euro Trades Sideways Despite Upbeat Euro Area Flash PMI Prints

The euro today traded sideways against the US dollar as the market sentiment remained subdued despite the release of multiple PMI prints from the euro area by Markit Economics. The EUR/USD currency pair did not react to the US PMI releases as well amid a lack of volatility in the markets as the week comes … “Euro Trades Sideways Despite Upbeat Euro Area Flash PMI Prints”

Sterling Range-Bound Despite Upbeat UK Retail Sales and PMI Data

The Sterling pound today traded sideways against the US dollar despite the release of multiple positive macro prints from the UK docket in the London session. The GBP/USD currency pair traded in a tight range as investors worried about the prospect of a no-deal Brexit and the high chance of the second wave of coronavirus … “Sterling Range-Bound Despite Upbeat UK Retail Sales and PMI Data”

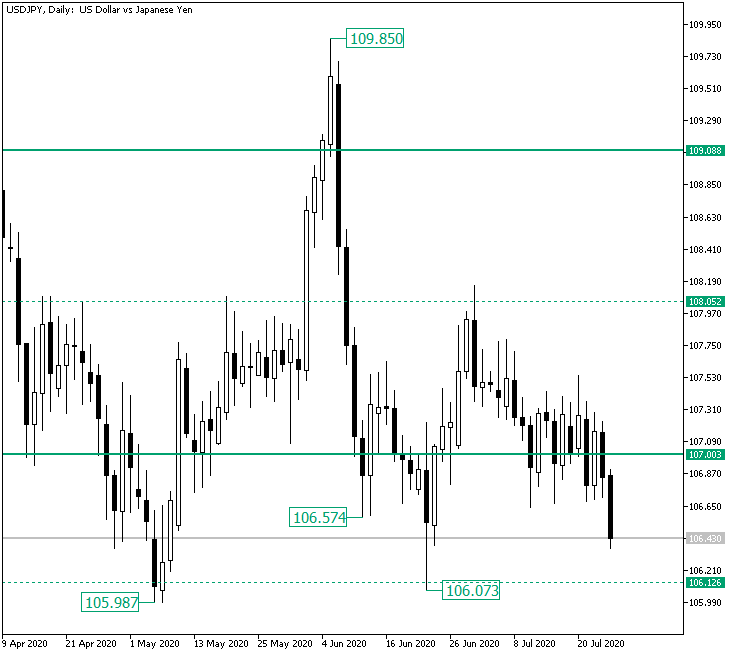

USD/JPY About to Test the 106.12 Level

The United States dollar versus the Japanese yen currency pair seems to have been taken over by the bears. Do the bulls stand a chance at 106.12? Long-term perspective The fall from the 109.85 high extended, in a first instance, until the 106.57 low. From there, the bulls tried to recover, but, even if they were able to close a candle above the level, the bears had the power to send the price to 106.12, printing the 106.07 low. … “USD/JPY About to Test the 106.12 Level”