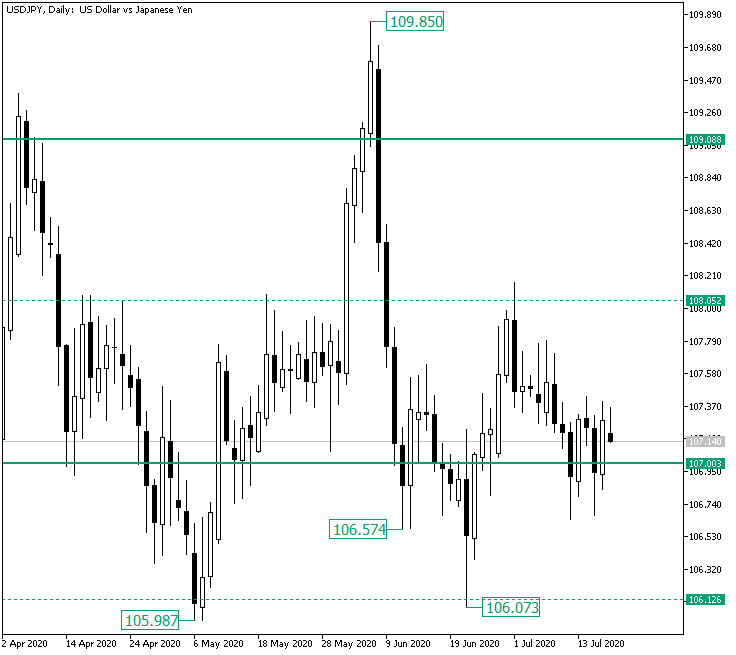

The US dollar versus the Japanese yen currency pair seems to lack the power for climbing to greater values. Long-term perspective The fall from the 109.85 high extended to as low as 106.07, after a previous bullish attempt to stall it at the 107.00 psychological level, which ended only by printing the 106.57 low. From the 106.07 low, the bulls did manage a comeback, one that not only pierced and departed from 107.00 but also stretched … “Bulls Failing on USD/JPY from 107.00?”

US Consumer Sentiment Preview: Finally an update on coronavirus resurgence damage, S&P 500 on alert

The University of Michigan’s Consumer Sentiment Index for July is projected to remain stable. US COVID-19 cases picked up only in mid-June and recent data has been unable to capture the shift. Investors seemed to shrug off June’s retail sales figures and are likely to react to this figure. The last publication of the week … “US Consumer Sentiment Preview: Finally an update on coronavirus resurgence damage, S&P 500 on alert”

Pound Swings From Losses to Gains on Shifting Market Sentiment

The Sterling pound today headed lower at the start of the session, driven by the risk-off market sentiment from yesterday as investors reacted to escalating US-China tensions. The GBP/USD currency pair later recovered and rallied higher primarily driven by the greenback’s oscillating between gains and losses as it ignored upbeat UK jobs data. The GBP/USD … “Pound Swings From Losses to Gains on Shifting Market Sentiment”

US Dollar Flat As Retail Sales Surge, Jobless Claims Disappoint

The US dollar is trading relatively flat against its currency competitors on Thursday as retail sales surged in June but weekly jobless claims disappointed. With Europe choosing to pause on expanding its relief and stimulus measures, the broader global financial market has been subdued, providing little momentum for the greenback. According to the Department of Labor, initial jobless claims came in at 1.3 million for the week ending July 11, worse than … “US Dollar Flat As Retail Sales Surge, Jobless Claims Disappoint”

The Importance of Using Fibonacci Levels for Targeting

Dear Traders, Many of you have already heard of the Fibonacci tool, but did you realize that Fibs can also be used as targets? This article reviews how traders can aim for Fibonacci targets, which offers key levels for exits. And knowing where to exit a trade is in fact just as important as knowing … “The Importance of Using Fibonacci Levels for Targeting”

Title: Decision Zones and Triggers Help Filter Your Trading Ideas

Dear Traders, Do you sometimes enter a trade in the ‘middle of nowhere’ with no clear bounce or break spot on the chart? Traders are often tempted to trade spontaneously when they price action moving quickly. But an unplanned trade often creates trouble… This guide explains how traders can plan their trade setups and entries … “Title: Decision Zones and Triggers Help Filter Your Trading Ideas”

Euro Little Changed As ECB Leaves Interest Rates, QE Program Unchanged

The euro is little changed against many of its G10 currency rivals on Thursday after the central bank adopted a wait-and-see approach to monetary policy, leaving its key interest rates and quantitative easing (QE) program unchanged. The European Central Bank (ECB) confirmed it would monitor the strength of the eurozone economy before choosing to add to its suite of stimulus and relief measures. After its July policy meeting, the ECB announced … “Euro Little Changed As ECB Leaves Interest Rates, QE Program Unchanged”

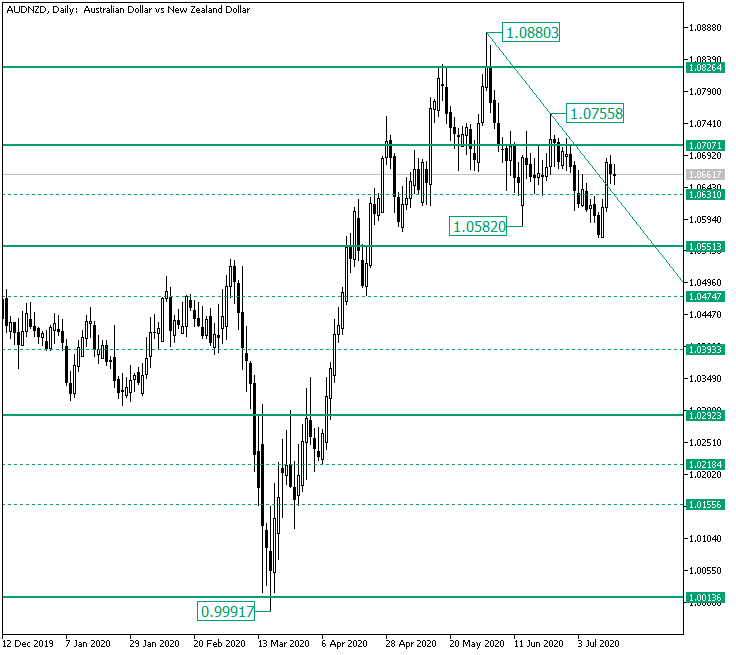

Another Chance for the Bulls on AUD/NZD from 1.0630

The Australian dollar versus the New Zealand dollar currency pair sits above an important level, one from which the bulls could spark a new appreciation. The question is: are the bears going to choose to stand aside? Long-term perspective After confirming the support level of 1.0013, the ascending movement that started from the 0.9991 low extended to as high as 1.0880. From there, the price retraced but failed to confirm as support the next important … “Another Chance for the Bulls on AUD/NZD from 1.0630”

Chinese GDP: Three uncertainties open door to surprises, volatile marketreaction

The Chinese economy most likely rebounded in the second quarter, yet government support is still needed. Factories have been keeping up, yet external demand is questionable. Consumers have been shy but their confidence has been rising, adding to the uncertainty. Comeback from coronavirus – but how much? China has surely bounced back in the second … “Chinese GDP: Three uncertainties open door to surprises, volatile marketreaction”

Chinese Yuan Strengthens After Bullish Goldman Sachs Forecast, Trade Data

The Chinese yuan is strengthening against multiple currency counterparts midweek following a bullish forecast by a Wall Street titan. Trade data also came in better than expected on Wednesday, leaving analysts to surmise that the economic rebound is running full steam ahead. The real test, however, will be later this week when several crucial numbers come out, including the gross domestic product. The Chinese yuan captured … “Chinese Yuan Strengthens After Bullish Goldman Sachs Forecast, Trade Data”